Page 37: of Offshore Engineer Magazine (Mar/Apr 2025)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2025 Offshore Engineer Magazine

THE LIZA UNITY FPSO IS DESIGNED TO PRODUCE APPROXIMATELY 220,000 BARRELS OF OIL

PER DAY, TO HAVE ASSOCIATED GAS TREATMENT CAPACITY OF 400 MILLION CUBIC FEET

PER DAY AND WATER INJECTION CAPACITY OF 250,000 BARRELS PER DAY.

These projects are not pushed off the quayside at the earliest opportunity. We want to make sure that they’re fully commissioned and ready for operation.” – Alexander Glenn,

Chief Operating Officer of SBM Offshore

Image courtesy SBM Offshore for FPSO construction. Tremblay emphasizes that while

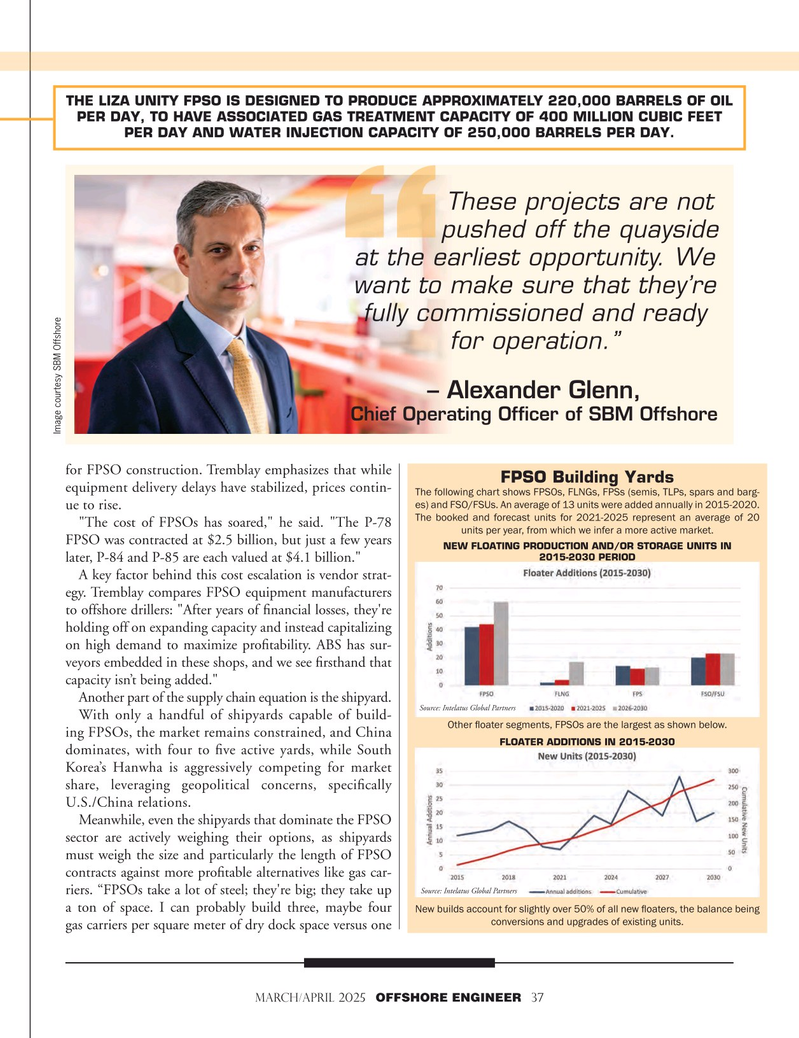

FPSO Building Yards equipment delivery delays have stabilized, prices contin-

The following chart shows FPSOs, FLNGs, FPSs (semis, TLPs, spars and barg- es) and FSO/FSUs. An average of 13 units were added annually in 2015-2020. ue to rise.

The booked and forecast units for 2021-2025 represent an average of 20 "The cost of FPSOs has soared," he said. "The P-78 units per year, from which we infer a more active market.

FPSO was contracted at $2.5 billion, but just a few years

NEW FLOATING PRODUCTION AND/OR STORAGE UNITS IN 2015-2030 PERIOD later, P-84 and P-85 are each valued at $4.1 billion."

A key factor behind this cost escalation is vendor strat- egy. Tremblay compares FPSO equipment manufacturers to offshore drillers: "After years of fnancial losses, they're holding off on expanding capacity and instead capitalizing on high demand to maximize proftability. ABS has sur- veyors embedded in these shops, and we see frsthand that capacity isn’t being added."

Another part of the supply chain equation is the shipyard.

Source: Intelatus Global Partners

With only a handful of shipyards capable of build-

Other foater segments, FPSOs are the largest as shown below.

ing FPSOs, the market remains constrained, and China

FLOATER ADDITIONS IN 2015-2030 dominates, with four to fve active yards, while South

Korea’s Hanwha is aggressively competing for market share, leveraging geopolitical concerns, specifcally

U.S./China relations.

Meanwhile, even the shipyards that dominate the FPSO sector are actively weighing their options, as shipyards must weigh the size and particularly the length of FPSO contracts against more proftable alternatives like gas car-

Source: Intelatus Global Partners riers. “FPSOs take a lot of steel; they're big; they take up a ton of space. I can probably build three, maybe four

New builds account for slightly over 50% of all new foaters, the balance being conversions and upgrades of existing units.

gas carriers per square meter of dry dock space versus one march/april 2025 OFFSHORE ENGINEER 37

36

36

38

38