Page 15: of Offshore Engineer Magazine (Sep/Oct 2025)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2025 Offshore Engineer Magazine

MARKETS RIGS he initial offer was of NOK 14 per share, but in September ADES increased the cash consid- eration offered to Shelf shareholders to NOK

T 18.50 per share. In a moment of market un- certainty, contract suspensions and cost discipline, this merger appears to carry a strategic premium. This offer likely exceeds near-term standalone valuation metrics but refects a long-term vision: the creation of the largest jackup feet globally by far, a major geographic expan- sion, a more diverse client portfolio (specially IOCs) and operational synergies.

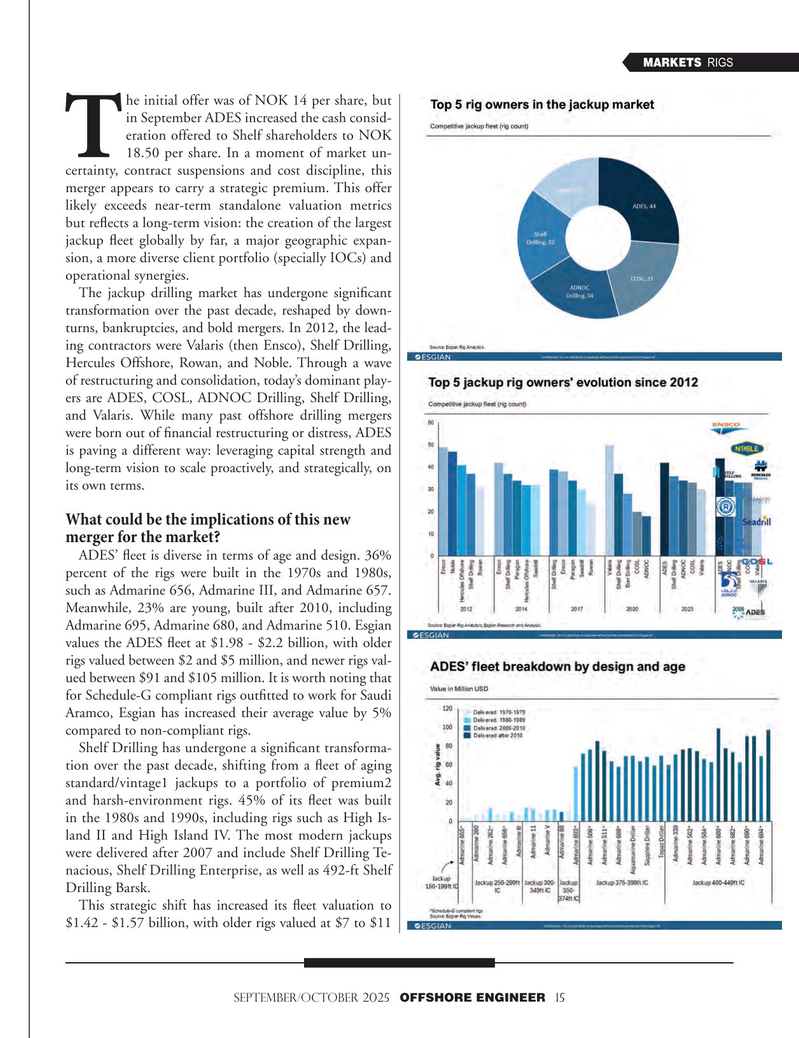

The jackup drilling market has undergone signifcant transformation over the past decade, reshaped by down- turns, bankruptcies, and bold mergers. In 2012, the lead- ing contractors were Valaris (then Ensco), Shelf Drilling,

Hercules Offshore, Rowan, and Noble. Through a wave of restructuring and consolidation, today’s dominant play- ers are ADES, COSL, ADNOC Drilling, Shelf Drilling, and Valaris. While many past offshore drilling mergers were born out of fnancial restructuring or distress, ADES is paving a different way: leveraging capital strength and long-term vision to scale proactively, and strategically, on its own terms.

What could be the implications of this new merger for the market?

ADES’ feet is diverse in terms of age and design. 36% percent of the rigs were built in the 1970s and 1980s, such as Admarine 656, Admarine III, and Admarine 657.

Meanwhile, 23% are young, built after 2010, including

Admarine 695, Admarine 680, and Admarine 510. Esgian values the ADES feet at $1.98 - $2.2 billion, with older rigs valued between $2 and $5 million, and newer rigs val- ued between $91 and $105 million. It is worth noting that for Schedule-G compliant rigs outftted to work for Saudi

Aramco, Esgian has increased their average value by 5% compared to non-compliant rigs.

Shelf Drilling has undergone a signifcant transforma- tion over the past decade, shifting from a feet of aging standard/vintage1 jackups to a portfolio of premium2 and harsh-environment rigs. 45% of its feet was built in the 1980s and 1990s, including rigs such as High Is- land II and High Island IV. The most modern jackups were delivered after 2007 and include Shelf Drilling Te- nacious, Shelf Drilling Enterprise, as well as 492-ft Shelf

Drilling Barsk.

This strategic shift has increased its feet valuation to $1.42 - $1.57 billion, with older rigs valued at $7 to $11

SEPTEMBER/OCTOBER 2025 OFFSHORE ENGINEER 15

14

14

16

16