Page 16: of Offshore Engineer Magazine (Sep/Oct 2025)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2025 Offshore Engineer Magazine

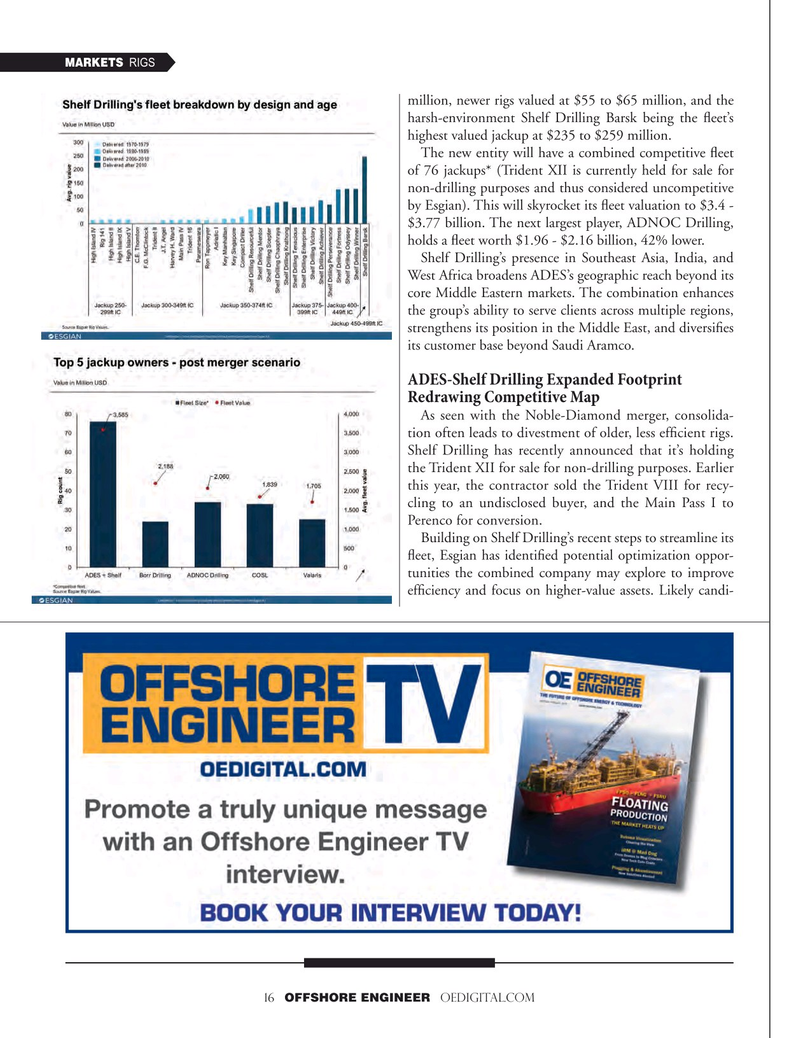

MARKETS RIGS million, newer rigs valued at $55 to $65 million, and the harsh-environment Shelf Drilling Barsk being the feet’s highest valued jackup at $235 to $259 million.

The new entity will have a combined competitive feet of 76 jackups* (Trident XII is currently held for sale for non-drilling purposes and thus considered uncompetitive by Esgian). This will skyrocket its feet valuation to $3.4 - $3.77 billion. The next largest player, ADNOC Drilling, holds a feet worth $1.96 - $2.16 billion, 42% lower.

Shelf Drilling’s presence in Southeast Asia, India, and

West Africa broadens ADES’s geographic reach beyond its core Middle Eastern markets. The combination enhances the group’s ability to serve clients across multiple regions, strengthens its position in the Middle East, and diversifes its customer base beyond Saudi Aramco.

ADES-Shelf Drilling Expanded Footprint

Redrawing Competitive Map

As seen with the Noble-Diamond merger, consolida- tion often leads to divestment of older, less effcient rigs.

Shelf Drilling has recently announced that it’s holding the Trident XII for sale for non-drilling purposes. Earlier this year, the contractor sold the Trident VIII for recy- cling to an undisclosed buyer, and the Main Pass I to

Perenco for conversion.

Building on Shelf Drilling’s recent steps to streamline its feet, Esgian has identifed potential optimization oppor- tunities the combined company may explore to improve effciency and focus on higher-value assets. Likely candi- 16 OFFSHORE ENGINEER OEDIGITAL.COM

15

15

17

17