Internet World

-

- INSIGHTS Focus: Robert Kunkel Talks Power and Propulsion Marine News, Jul 2014 #12

Those MarineNews readers who are not familiar with Bob Kunkel probably should be. That’s because Kunkel, President of Alternative Marine Technologies, previously served as the Federal Chairman of the Short Sea Shipping Cooperative Program under the Maritime Administration and Department of Transportation from 2003 until 2008. He is a past Vice President of the Connecticut Maritime Association, a contributing writer for many maritime and technical trades publications, including Maritime Professional Magazine and MarineNews. He continues as the Technical Advisor for several Private Equity firms, financial institutions and Coastal Connect, developing the maritime component of short sea shipping and offshore wind energy along the coasts of United States.

A graduate of the Massachusetts Maritime Academy, Kunkel sailed with several U.S flag companies as a licensed engineer, was commissioned as a Navy Officer and continued his career in ship construction at National Steel and Shipbuilding , San Diego, Hyundai Heavy Industries, South Korea , Chengxi Shipyard and Dalian New Shipyard in Mainland China. He is a senior member of the Special Committee on Ship Operation with the American Bureau of Shipping and an elected member of the National Cargo Bureau. Amtech is currently involved in several construction supervision projects in Korea and the United States building for the Product Carrier, Chemical Carrier and Offshore markets. Bob Kunkel’s experience with marine construction and propulsion is too long to list within the pages of this publication. What he has to say about today’s challenges in the engine room is not. Follow along as Bob provides the ultimate propulsion primer as this month’s INSIGHTS focus.

What’s the number one driver for engine selection today for workboat operators? Would it be emissions control, fuel consumption, or both?

The problem in today’s market is the amount of technology available and as a result no single driver to make the selection. The operator will first consider engine cost, performance and the ability to contract with a single manufacturer to control his fleet spares, crew experience and inventory. In the foreign markets, the decision is fuel performance based – everything we see in Asian construction is “ECO” driven. Heavy fuel is still being utilized and the construction takes into account the fuel tank sizes and the switch between low sulfur fuel use and heavy fuel use when entering an emissions zone. The U.S. markets, operating solely in the emissions control areas (ECA), wrestle with the emissions driven selection as they are locked into the most heavily regulated trading areas. Dual Fuel engines using natural gas as a primary fuel looked to be the answer. That said, the infrastructure to support that engine selection has not moved forward at the speed most hoped for and gas prices have been moving up. The latest buzz is now liquid gas injection (LGI) and dual fuel methanol. As we discuss emissions issues, remember there are two “Tiers” to watch: the International IMO tiers and the U.S. EPA Tiers. There is a lot of confusion in the U.S. markets on this issue.

What’s the number one mistake today’s marine operators make when making repower solutions for their fleet?

In our experience, the lead mistake involves the lack of communication between the operator’s commercial department and his technical department or the inability of a marine consultant to address the synergy between the two groups. A successful repowering or propulsion selection must take into account the trading patterns, operating tempo and load patterns of the propulsion system. Does the engine run at a normal continuous rating (say 85% load) for long periods of time? Does the vessel operate at low loads for intermittent periods? Is speed or fuel efficiency the major factor for profitability? What is the optimal horsepower range and have all of the vessel’s operating patterns taken that power into account? Commercial input helps to make the project economically feasible. Anyone with a pile of money can build the space shuttle. The successful operator builds one that pays the bills and is profitable.

Diesel electric drive is once again hot. For what reasons and under what circumstances would you advise a client to go that route?

Variable Frequency drives, digital automation and advanced electronics has moved diesel electric back toward the head of the class. The systems are more compact and reliability has increased through documented trend analysis in the offshore markets. You will see this propulsion package move into bluewater and coastal shipping in the near future as it fits with our discussions regarding operating tempos and hybrid applications. Diesel Electric drives provide a more flexible load analysis and an opportunity to place the asset into niche trading beyond its basic operating scenario. Dynamic Positioning becomes an easier option, slow steaming and a greater selection of speed is a better fit and the azimuth units can add a new range of maneuverability. The emissions issue also sneaks into this trend as the engine manufacturers have a much easier time getting their Tier ratings if the engines run at a fixed RPM. This has driven some owners away from the historical clutch and direct drive to CPP and Diesel Electric. All of these “plus” factors must always be weighed against a higher cost of construction and future maintenance. We like the propulsion options in coastal operations and vessels employed on shorter routes and multiple port entries; in other words, schedules that require flexible speed ranges and maneuverability.

LNG is the so-called hot, new fuel for workboat operators. It is now in the process of penetrating the market for OSV’s and designs are being submitted for bunker barges, infrastructure to support LNG, LNG tugs, etc. What’s your take on LNG in the marine fuel pecking order?

We completed one of the first LNG/CNG design projects on a compact RoRo for Coastal Connect back in 2007 when “green” fuel applications and the reduction of CO2 was the focus. The major hurdle at that time was the “urban legend” of the dangers of LNG and the lack of infrastructure to support the fuel in the U.S. The price of natural gas at that time was low and the gas producers were looking for a large consumer. The cost advantages as a propulsion fuel looked to be the correct move forward. Unfortunately, the infrastructure has not developed and as we get closer to U.S. export opportunities, we believe the price of natural gas will rise to international levels and may take that cost advantage away. Natural gas propulsion reduces sulfur emissions by over 80%. CO2 is reduced by approximately 15% and NOx reduction is still an issue that may require scrubbing once Tier III international regulations and EPA Tier 4 come into effect. LNG as a propulsion fuel is a huge investment; both on board the vessel and ashore where bunkering facilities and liquefaction are required. No doubt the move to gas is a move to a cleaner fuel. The issue becomes the payback on your investment and the industry’s ability to support it.

Talk about the cost premiums for installing a dual fuel and / or LNG engine over that of a conventional engine burning distillates. Is it really worth it?

There isn’t one operator that does not support the quest for a cleaner burning fuel or the easy answer to solving the mandated emissions regulations. The dual fuel gas engine is not the issue and the cost for a DF engine depending on horsepower and size ranges between $750,000 to $1million above an engine capable of burning heavy fuels. The cost of this fuel modification is the delivery system – tankage, refrigeration, double wall piping, compression stations, etc. That additional construction cost can reach $10 million, depending propulsion size and power. With the exception of one or two offshore projects, most of the construction contracts in place for dual fuel propulsion in the U.S. are “LNG Ready.” That tag only prepares the vessel with a dual fuel capable engine and the space to install the delivery equipment. We can answer the “is it really worth it?” question when you see construction describing “LNG delivered.” That next stage can be reached only when the bunkering infrastructure is in place. Simply put, if the gas price stays well below the low sulfur distillate price and someone takes up the infrastructure issue then a payback scenario on the investment will be worth it. Until then, other fuel choices are available to comply with the regulations.

Looking at the typical OSV, tug, pushboat and any other conventional workboat platform – do any really have the room for after-treatment as a way to reduce emissions? Assuming space is at a real premium, what are the options otherwise?

Most do not and it all depends on the system installed; closed loop, open loop, exhaust gas recirculation, the list goes on and on. Many systems require a horizontal exhaust run and we have been designing ships and workboats for years to make sure there were limited horizontal piping runs in your exhaust system. There are also deck mounted options if space is a premium. The simple answer is to burn low sulfur marine diesel oil or gas oil until all of the regulations fall into place. NOx reduction will be the most difficult regulation to meet and exhaust gas recirculation looks to be the answer to solve that problem.

You’ve been quoted as saying that methanol will overtake LNG as the new fuel of choice in the future. Why, how and when?

Methanol burns with similar characteristics as natural gas and without methane slip. A 95% reduction in SOx and a 24% reduction on NOx is available in two stroke applications. Keep in mind the first diesel engines burned alcohol so the introduction of this fuel is not a technological reach. It does not require the refrigeration characteristics of LNG for storage and is liquid form at injection. MAN B&W has been successful with the diesel cycle using MeOH or Methyl Alcohol in their two stroke LGI engines. The formation of formaldehyde in the exhaust of the four stroke engine in the Otto cycle still remains a problem for this fuel to be introduced at the workboat or tugboat level. We have seen the Europeans move to two stroke engines in their tugs and offshore workboats to solve that issue. Using Methanol and Ethanol solves the sulfur issue with a 95% reduction, and reduces the NOx to levels that can be handled by exhaust gas recirculation (EGR) or Selective Catalytic Reduction (SCR). All of these modifications can work towards simpler retrofits and the reduction of the fuel delivery costs that LNG requires. Large Bluewater vessel have been ordered with ME-LGI engines, and more movement towards this fuel type in 2015 could occur as the Tier II keel laying dates disappear and the new Tier III/Tier 4 regulations come into place.

Retrofit (re-power) or rebuild: that is the question. What should today’s workboat operators do and why?

Our advice would be to make the necessary changes to your fuel delivery and lubrication systems to meet Tier II regulations and safely use ultra-low sulfur in your existing engines. Most of that work requires only timing changes and new fuel injectors. Remember, this fuel type has been required by the EPA for road transportation since 2006 under the Clean Air Act and the latest discussion lead us to believe that the price of ultra-low sulfur fuels may not reach the levels some are predicting as the refineries have already made modifications to meet the road transportation requirements. Meeting those levels and burning that fuel will get you to 2020. From there, EGR and SCR requirements will be needed to reduce NOx emissions. On existing vessels, meet Tier II/2 and take a break. Your new construction is a different story. That is where big decisions on what fuel you will burn are taking place.

What do you think the repower market looks like in the near term for Workboats? If operators decide not to repower, will there be a rush for replacement tonnage?

New construction slots in the U.S. shipyards are limited and most of the contracts in place took into account the dates required for Tier 2 and Tier 3 compliance. Historically, this market was built on the analysis of supply and demand, not regulatory advances. We see repowering and or engine modification as the first step in compliance. That said, most owners will ride out the “grandfather” period and then make their decisions for replacement tonnage. Technological advances move quickly in this Internet world and the best advice now is to let this regulatory market develop and move on a slow bell.

Which existing engines are “grandfathered” under the new EPA Tier rules? Can an existing 10 year old engine stay in operation even it doesn’t meet future or existing Tier requirements. Lead us through that matrix.

The answer to this question and the route through the regulatory matrix is complicated. Engine size, application, date built all come into play. At this point in time the best course is to ask the manufacturer if you can comply with Tier II/2 and operate on distillate fuels until 2020.

You advise a myriad of clients on all sorts of power plant decisions. What’s new and what do you tell your clients when they ask about power options?

We advise our clients to first look at their operating parameters and trading patterns; then look to fuel efficiency. The first thing that should be understood is the less fuel you burn, the less in emissions that are produced. Look for slower revolutions in your engines, larger propellers and optimum efficiency in the power train. Analysis of the full propulsion system from engine to wheels is important. Listen to all of the engine manufacturers and then take on a company that is capable of integrating the correct system for you. The analysis goes well beyond engine type or size. From a fuel perspective the current situation is an interesting dynamic and it is dependent on market sector. For new construction operating within an ECA, we have recommended the use of low sulfur diesel as the primary fuel for four stroke applications and the removal of heavy fuel equipment to save costs. We are also looking at the installation of two stroke engines in this market sector – one that historically bought and installed four stroke equipment. At our foreign construction sites in the tanker and chemical markets, we have continued with the use of low sulfur heavy fuel operation and extended the size of the vessel’s low sulfur marine diesel fuel tankage. This allows for extend periods in the ECAs when the vessel is trading those areas. The engines to this date are Tier II compliant. We have seen over 150 new construction slots filled in Korea in the Product tanker and chemical tanker sector. Not one has installed after treatment systems.

One of your more exciting jobs perhaps was the research / classroom vessel up in Connecticut. Tell us about the power requirements on that vessel. Didn’t it have an electric mode for quiet operation?

The Marine transportation sector historically is late in adjusting to new technology. If you look to the Automotive and Airline industry, major changes are occurring in power and again most of these changes take place in the interest of fuel efficiency. The airlines are moving away from hydraulics and into digital electrical systems fueled by lithium powered batteries. The automotive industry has also moved to Hybrid powered fueled by advanced lithium powered energy. This battery source integrates well with marine transportation at several levels. In the research vessel project, we were tasked with providing a “green” propulsion platform. As we discussed above, the vessels operating tempo and trade was part of the analysis. The vessel used limited periods of peak engine power, towed ROV and arrays at slow speed and was used as an education platform to teach students. One of the major complaints was engine noise during those classroom sessions. We partnered with Northern Lights, BAE Hybrid, Incat and Derecktor shipyard to develop a 65’ catamaran that held seventy students and operated on Corvus Lithium powered batteries. The power requirement is about 500 horsepower to make 12 knots full speed. Two variable frequency Lugger generators provide charging power to the lithium battery packs which drive two electric traction motors. The generators start automatically under certain load requirements and when the battery discharge reaches 27%. The operation during classroom sessions and sonar research is completely silent and emissions during operation were reduced to near zero. We are now working to apply this technology to a Chemical ATB project using Marflex Variable Frequency deepwell pumps for silent cargo operations on the U.S. West Coast where complaints of terminal noise have forced limited cargo operations. Hybrid operations will gain traction in the workboat sector as the batteries provide an energy buffer and allow diesel generators to run at optimum potential despite reduced load requirements. The excess energy is stored and when the batteries are charged, the engines can be stopped. And all of us know the best way to achieve lower emissions and better fuel economy is to simply not run the engine.

(As published in the July 2014 edition of Marine News - http://magazines.marinelink.com/Magazines/MaritimeNews)

-

)

March 2024 - Marine Technology Reporter page: 45

)

March 2024 - Marine Technology Reporter page: 45ronments. The new agreement will address speci? c techni- cal gaps in the UUV defense and offshore energy markets especially for long duration, multi-payload mission opera- tions where communications are often denied or restricted. As part of the new alliance, Metron’s Resilient Mission Autonomy portfolio

-

)

March 2024 - Marine Technology Reporter page: 35

)

March 2024 - Marine Technology Reporter page: 35Figure 1 A self-righting vehicle design with buoyancy high and weight low, WHOI’s SeaBED AUV captures the attention of a pair of curious Antarctic penguins as it is deployed from the British research vessel James Clark Ross. Vehicle designers allowed for temperature reduction of battery capacity. Recharge

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33regulated industry in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’

-

)

March 2024 - Marine Technology Reporter page: 32

)

March 2024 - Marine Technology Reporter page: 32FEATURE SEABED MINING by a sea? oor plume from its pilot collection system test. pact, nodule collection system that utilizes mechanical and The Metals Company recently signed a binding MoU with hydraulic technology. Paci? c Metals Corporation of Japan for a feasibility study on The company’s SMD

-

)

March 2024 - Marine Technology Reporter page: 29

)

March 2024 - Marine Technology Reporter page: 29n January, Norway said “yes” to sea- bed mining, adding its weight to the momentum that is likely to override the calls for a moratorium by over 20 countries and companies such as I Google, BMW, Volvo and Samsung. Those against mining aim to protect the unique and largely unknown ecology of the sea?

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25by RV Tanga- NIWA statement from November 2022. that couples into the water column.” roa outside the caldera.” In all, Maxlimer Tonga’s severed domestic internet cable mapped more than 800 km2 and travelled was buried under 30 m of ash and sedi- TESMaP Makes it Mark 1331 nautical miles over 34 days. ment

-

)

March 2024 - Marine Technology Reporter page: 23

)

March 2024 - Marine Technology Reporter page: 23elatively inactive since 2014, the Hunga Tonga–Hunga Ha‘apai (HT-HH) submarine volcano began erupting on December 20, 2021, reaching peak intensity on January 15, 2022. This triggered tsunamis throughout the Pa- R ci? c, destroyed lives and infrastructure, and generated the largest explosion recorded

-

)

March 2024 - Marine Technology Reporter page: 21

)

March 2024 - Marine Technology Reporter page: 21Connect with colleagues around the world by joining the industry’s largest Linkedin Group. 218,774 members http://www.linkedin.com/group/44626 MTR #3 (18-33).indd 21 4/4/2024 3:37:21 PM

-

)

March 2024 - Marine Technology Reporter page: 15

)

March 2024 - Marine Technology Reporter page: 15sensor options for longer mission periods. About the Author For glider users working in ? sheries and conservation, Shea Quinn is the Product Line Manager the Sentinel can run several high-energy passive and active of the Slocum Glider at Teledyne Webb acoustic sensors, on-board processing, and imaging

-

)

March 2024 - Marine Technology Reporter page: 14

)

March 2024 - Marine Technology Reporter page: 14TECH FEATURE TELEDYNE SLOCUM GLIDERS to hold over 3.5 times as many lithium primary batteries as the the water column and its thrusters give it the ability to stay standard Slocum Glider, and to physically accommodate up to on track in strong currents or other dif? cult ocean condi- 8 different sensor

-

)

March 2024 - Marine Technology Reporter page: 13

)

March 2024 - Marine Technology Reporter page: 13nyone familiar with glider hardware options integrated for a broad Glider answers that need,” said Shea autonomous underwater ve- range of missions. Quinn, Slocum Glider Product Line hicles (AUVs) is certainly “As the use of Slocum Gliders grew, Manager at TWR. A familiar with the popular- so did

-

)

March 2024 - Marine Technology Reporter page: 11

)

March 2024 - Marine Technology Reporter page: 11assist in identifying mines and act as a neutralization device. About the Author Bottom mines pose even greater chal- David R. Strachan is a defense analyst and founder of lenges. Unlike contact mines, bottom Strikepod Systems, a research and strategic advisory mines utilize a range of sensors to

-

)

March 2024 - Marine Technology Reporter page: 4

)

March 2024 - Marine Technology Reporter page: 4Editorial NIWA-Nippon Foundation TESMaP/ Rebekah Parsons-King www.marinetechnologynews.com ast month marked the resounding NEW YORK 118 E. 25th St., New York, NY 10010 return of Oceanology Interna- Tel: (212) 477-6700; Fax: (212) 254-6271 tional in London, perennially one Lof the world’s most important

-

)

March 2024 - Marine Technology Reporter page: 3

)

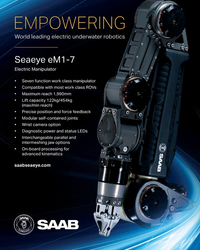

March 2024 - Marine Technology Reporter page: 3EMPOWERING World leading electric underwater robotics Seaeye eM1-7 Electric Manipulator • Seven function work class manipulator • Compatible with most work class ROVs • Maximum reach 1,990mm • Lift capacity 122kg/454kg (max/min reach) • Precise position and force feedback • Modular self-contained

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43“The industry is an ecosystem which includes owners, managers, mariners, shipyards, equipment makers, designers, research institutes and class societies: all of them are crucial,” – Eero Lehtovaara, Head of Regulatory & Public Affairs, ABB Marine & Ports All images courtesy ABB Marine and Ports provi

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42OPINION: The Final Word Seeing the Ship as a System Shipping must engage with the decarbonization realities that lie ahead by changing the way it crafts maritime legislation to re? ect its place in the interconnected, interdependent world economy, said Eero Lehtovaara, ABB Marine & Ports. ABB Marine &

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41Nautel provides innovative, industry-leading solutions speci? cally designed for use in harsh maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications

-

)

April 2024 - Maritime Reporter and Engineering News page: 40

)

April 2024 - Maritime Reporter and Engineering News page: 40TECH FEATURE SITUATIONAL AWARENESS SITUATIONAL AWARENESS SYSTEM BATTLES COGNITIVE FATIGUE IN WATCHKEEPERS All images courtesy Groke Technologies Today’s evolving maritime security risks pose all-too-familiar threats to international shipping, and as just one of the many causes of fatigue, they add

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38Tech Files Latest Products, Systems and Ship Designs Zero-Emission Mooring Service of a Tanker Consulmar achieved a milestone by executing what it calls ing boat Castalia, which operates on full electric propulsion. the world's ? rst zero-emissions mooring service for a tanker. Equipped with two 150 kW

-

)

April 2024 - Maritime Reporter and Engineering News page: 31

)

April 2024 - Maritime Reporter and Engineering News page: 31CRANES & OFFSHORE WIND Cadeler’s new NG-20000X class vessels will have 2,600t cranes, and its new NG-20000F class vessel will have a 3,200t crane. Similar new vessels for Havfram will have a crane of approximately 3,200t, as will Van Oord’s KNUD E. HAN- SEN-designed newbuilding currently being built in

-

)

April 2024 - Maritime Reporter and Engineering News page: 28

)

April 2024 - Maritime Reporter and Engineering News page: 28FEATURE INTERVIEW track missiles and warheads for the Mis- sile Defense Agency, and it travels with its support ship, the MV Hercules. For our Service Support ships, we have the two hospital ships, USNS Mer- cy and Comfort; two rescue and salvage ships; two submarine tenders; and the Sixth Fleet ?

-

)

April 2024 - Maritime Reporter and Engineering News page: 27

)

April 2024 - Maritime Reporter and Engineering News page: 27RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND With COVID, we had to make some hard choices for our Do your CIVMARs have upward mobility? mariners because we couldn’t rotate. Many of our mariners The Navy has Sailors who become “Mustangs,” and work found other employment, and were able to use their skills

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND Photo by Brian Suriani USN Military Sealift Command From a global supply chain perspective, What makes MSC so vital to the we’ve learned a lot about dealing with Navy’s ? eet and our military disruptions. COVID delivered a big forces around the world? wake-up

-

)

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22INTERVIEW WE ARE ENGAGED WITH MULTIPLE US OSW WIND DEVELOPMENTS AND SEEING AN UP-TICK FOR CVA, TECHNOLOGY REVIEW AND RISK REDUCTION SERVICES IN EARLY DEVELOPMENT PHASES. WITH NEW LEASE ROUNDS COMING AND NEW OPPORTUNITIES, WE DO NOT SEE A BIG SLOWDOWN FOR OSW DEVELOPMENTS APART FROM THE OBVIOUS