One-on-One with Martin McDonald, SVP, ROV Division, Oceaneering

Martin McDonald, an industry veteran with more than 35 years under his belt, is responsible for Oceaneering’s global ROV business. With a broad based of ROV experience – from operation to repair to maintenance to management – McDonald shares with MTR his insights on the historical development and future prospects of this high-profile subsea sector.

How and when did you know that your career would be in the maritime/subsea industry?

I grew up in Fraserburgh, Scotland, a small town 40 miles north of the oilfield city of Aberdeen. Fraserburgh is best known for commercial fishing. My father was a boat builder and, from an early age, I was fascinated by the maritime industry, so it was either commercial fishing or the oil field. I chose the oil field and, specifically, the subsea industry. I studied electric and electronic engineering at college, and began my career with a subsea construction and diving company as a hydrographic survey engineer working on positioning and navigational equipment. That company also had a small fleet of ROVs, (which at the time) were an emerging technology. I was interested in this technology, along with the variety of work scopes where ROVs could be involved, and the potential they had to develop further. I later transferred to work full time on ROVs and their associated sensors.

The Oceaneering name is well known, but can you give a size and scope of Oceaneering’s ROV offering.

We currently have 275 work class ROVs in our fleet, the world’s largest fleet of work class ROVs, and we operate 60 observation class ROVs. The ROV division has approximately 2,400 full-time personnel, with the majority (about 2,000) in the field. With ROVs diving every day, we conduct over 100,000 missions in a year of varying durations and intensity.

The (offshore energy) downturn has naturally reduced activity levels, and, as with other markets (vessels and rigs), we have retired units that have come to the end of their working life. Our fleet count peaked at 318 work class ROVs in 2014. While we have removed ROVs, we are also adding units, so, net-net, we are at 275 (work class) ROVs today.

When you’re adding units, is there a specific technology that is most important?

Yes, when we’re adding units, we’re upgrading them with the latest technologies, such as the latest control systems, navigation sensors, software, pumping packages, and intervention equipment.

Looking at work class, inspection class, and observation class vehicles, are there any product gaps that still need to be filled?

We’ve identified some gaps in the market. As we move forward, autonomy, remote operations, speed, and reliability are all coming into play. The opportunity will come from reducing the cost of development for our customers. We see more remote and autonomous operations taking place that are in line with the industry focus of reducing risk to personnel and lowering carbon emissions with fewer assets at the worksite.

Additionally, there is a need for more specialized equipment. Today, ROVs are working in deeper waters on increasingly complex work scopes and also in harsh shallow-water environments with high-current, low-visibility areas, so it is essential to have higher-powered units with high-specification and reliable intervention capabilities that are able to work efficiently through the full range of environmental conditions in the frontier oil and gas, and renewables sectors. We see opportunities to enhance our service offerings by bringing remote operations, autonomy, and subsea residency (via resident ROVs) to the market.

A Millennium ROV recovered from the water. Courtesy of Oceaneering International

A Millennium ROV recovered from the water. Courtesy of Oceaneering International

How is Oceaneering working to fill these gaps?

We have a strong team specializing in technology and new product development that is working on our next generation of vehicles, which will encompass residency, robotic, and autonomous functions. We’re developing this technology at an advanced stage now, and we expect to be trialing one of our next-generation vehicles in Q3 2019.

Recently, we conducted a demonstration of remote operations and autonomous docking in the Gulf of Mexico, where we remotely piloted an ROV, which was stationed on board a drilling rig, from our operations center in Houston while also performing autonomous docking functions. Remote piloting technology is maturing and is currently operational in the North Sea, where we have a number of contracts. We’re piloting ROVs remotely from our mission support center in Stavanger, Norway. This center has enabled us to complement ROV operations offshore with onshore operations. The same skilled pilots are working between offshore and onshore locations on rotations, and this is a new way of working.

To accomplish this, our equipment has to be reliable. We are investing significant energy and resources into improving systems reliability, along with component and material qualifications, so that today’s ROVs can become resident subsea vehicles that can be controlled remotely and operated with minimum to zero maintenance.

What do you count as the most important technology, or technology trend, that has made ROVs more efficient and cost effective?

Software and control systems – the two go hand-in-hand. They allow us to optimize the ROV power management systems, along with navigation, station keeping, manipulator tasks, sensors, intervention tooling, and system diagnostics, which leads to improved performance and efficiency gains. Continued software and control systems development are key components to enable subsea residency and autonomous interventions.

There’s also machine learning and machine vision. As I mentioned earlier, we have been working on automated operations, such as auto docking, where the ROV pilot can direct the ROV to move autonomously to a docking point by moving a cursor on the screen, without any intervention on the joystick. It is the machine vision recognition software tied into the control and inertial navigation systems that allows it to perform those tasks consistently. This is still an emerging technology, and it takes a little time to dock autonomously. The reality today is that a really good pilot could do it quicker, but not necessarily consistently and repeatedly. The technology is evolving, but I expect that auto docking and intervention operations will become faster and more consistent in the near future, providing more efficient and reliable operations.

The telemetry, control systems, and communication links for ROVs have come a long way as well. Faster communication and reliable telemetry, control systems, and software advancements have enabled us to get to where we are today and will help us get to where we’re going.

Does Oceaneering develop its software and control systems in house?

That’s a key differentiator for Oceaneering: we have our own in-house software development teams. All of our controls software is developed by our staff engineers, and we’re currently developing the advanced software that will run our next-generation ROVs and autonomous underwater vehicles (AUVs). Our current fleet runs on our own software and control systems, and I expect that our future vehicles will run on our next-generation software and control systems. We don’t currently outsource any of this development; however, we are not averse to partnering or collaborating with other companies that have unique skill sets. We’re always open and on the lookout, but, right now, we have planned our own development.

What are the prevailing technical trends driving ROV design and development today? What do you need these vehicles to do that they currently cannot do?

Keeping with the theme of residency and autonomy, electric ROVs have been around for a long time, but continued advancements in electrical systems and battery technology will be an extremely important enabler allowing increased range, durability, and more complex autonomous operations – ultimately leading to a reduction in surface vessel days. If our customers can use less vessel days in the support of their field development, operations, and maintenance, then we’re going to lower the overall cost of ownership and open up new opportunities.

Robust communications systems are another important need – 4G networks didn’t exist in the North Sea a few years ago, and now there is close to 100% coverage. Soon 4G networks will come to the Gulf of Mexico. Communication networks are expanding out into the fields, as are improvements in satellite technologies. Adding to these two are advancements in subsea wireless technologies. These three components will open up a new theater of operations for autonomy and remote operations.

Oceaneering's E-ROV vehicle. Courtesy of Oceaneering International

Oceaneering's E-ROV vehicle. Courtesy of Oceaneering International

Real-time data processing and subsea imaging comprise another important area – integrating the cameras and sensors to the ROVs to provide real-time 3D imaging of structures that are communicated directly to engineers onshore so they can then make asset-integrity decisions quickly. The images can also be built into a virtual reality environment, effectively digitizing the field and enhancing subsea navigation. Traditional methods use sonar and acoustic navigation, but virtual reality is here and becoming more advanced. As we move forward, we will build up 3D images of particular fields and other locations. Virtual reality is used on the surface, and its capabilities are expanding subsea. We are currently working on a project to enhance subsea 3D imaging capabilities in real time. You cut out the data processing so that the processing is done immediately. Looking for anomalies has historically been done post-processing, which takes up time and involves extra vessel days and personnel days. If it can be done on a real-time basis at the worksite, then it’s going to be more efficient and, of course, more cost effective.

What evolution or improvement to ROVs – the vehicle, control elements, or accessories – would you most like to see?

It’s a balance between hydraulic and electric propulsion systems. We will see electric manipulators coming into play, reducing the reliance on hydraulic systems. ROVs today still require some heavy-duty pumping and intervention capabilities, so that’s the challenge between getting the all-electric systems vs. hydraulic systems. Today, for example, electric manipulators offer less than 50% of the lift capability and efficiency of a hydraulic manipulator.

We’re talking specifically about ROVs, but critical components of the ROV system are the handling systems and reliability of the deepwater umbilicals. Oceaneering has invested a significant amount of money on the research and development (R&D) of umbilical design and maintenance. As a result, we have been able to implement better maintenance plans that result in improved life expectancy, lower cost of maintenance, and improved life expectancy of our umbilicals and handling systems. In the automated space, ultimately, we see ourselves going toward automated launch and recovery systems as well.

When you look at the market today, what do you see? Where do you see opportunity?

The opportunities exist in the themes I mentioned earlier. We have been affected like everyone else in this prolonged downturn. We are a leaner and more efficient organization. We have a significant geographic spread across the globe. The opportunities lie in us collaborating with our customers to not only lower the costs of their field developments, but to also lower the operational costs of their fields. We are designing our next generation of vehicles to participate in those themes: autonomy and remote operations, residency, and reliability of those systems.

Our industry has structurally changed. We are living in a low oil price environment, and this is the new norm. We are designing our systems and service offerings to be profitable and sustainable in this low oil price environment.

How has this offshore energy slump materially impacted the Oceaneering ROV unit? How is it different today from four years ago?

We’re a leaner organization today, having consolidated groups and support functions together. We’re more efficient, and we maintain strategic locations around the globe. Having a dedicated installations group that deals only with the installation, reactivation, and demobilization of systems is important to our business. Today, we have less than 50% of the onshore support group prior to the downturn, yet we are still efficiently serving our customers and business. We’ve been able to streamline our operations globally by implementing operational excellence initiatives.

At one point, prior to the downturn, we were manufacturing ROVs at the rate of one approximately every week. There was an overcapacity in the market, however, so we turned our attention to refurbishing and upgrading existing equipment. Instead of building new ROVs, we’ve been refreshing our existing fleet and advancing them by introducing cutting-edge technologies.

We have also become a lot more efficient at mobilization and demobilization activities. Prior to the downturn, we would mobilize ROVs for a two-year or three-year contract. The new reality sees shorter-term contracts where, for example, three-week and three-month contracts are common. We have also spent a lot of time improving our installation and reactivation processes.

We’re focusing our capital investment and R&D spend on selective projects, and, as I said earlier, we’re listening to our customers, so we’re confident that we are headed in the right direction. We have a five-year technology roadmap that will be rolled out during this period. The first success is our self-contained, battery-powered E-ROV contract award. This concept is generating a lot of industry interest, and we see more opportunities for E-ROV in the near term in field and drilling support. Through 2019 and 2020, we’ll be rolling out more technology advancements from our portfolio.

Please discuss in depth a case study or two that you believe best exemplifies your ROV unit’s capabilities.

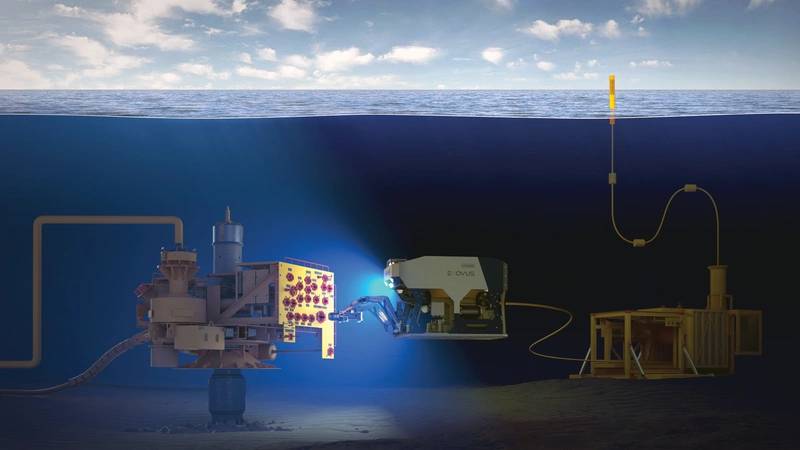

We were awarded a contract from a major operator in the North Sea to deploy the first version of our resident vehicle, the E-ROV, which stands for “Empowered ROV.” The E-ROV is a resident, battery-powered ROV that will go subsea with a surface buoy. It’s a work class electric vehicle with a hydraulic power pack to support its manipulator functions, and it is controlled remotely from our onshore mission support center with communications via the 4G broadband network, using a self-deployed surface buoy. We’re very proud of this achievement. Subsequent to the initial scope, we’ve been awarded a three-year contract with options from the same customer, where the E-ROV will be deployed in a variety of locations and work scopes, servicing multiple fields. The E-ROV can be placed subsea in a particular location by a vessel of opportunity with a self-deploying buoy, and it can be recovered similarly by a vessel of opportunity and redeployed to another location within 48 hours.

It was a worldwide effort to develop the E-ROV system, combining the expertise of a number of groups within Oceaneering. We believe it is a significant technological advancement to the next stage of subsea ROV residency. Our next generation of vehicle (the Freedom ROV) will be supported by a docking station at seabed and will have a hybrid functionality that will enable it to operate in two modes: remotely piloted via tether to provide real-time control – or operated in an autonomous and tetherless mode, using battery power.

What is the E-ROV’s current duration capability?

The E-ROV is currently battery-operated, but it can also be connected to a subsea power source in order to have an unlimited duration. Current battery-operated subsea residency is designed for three months, but we are working to extend that. Our next-generation vehicle will be designed for six months.

The duration is dependent on the intensity of the intervention work scope that the E-ROV is performing. If it is purely observational, then it uses less battery power and will have a longer life cycle. If it is a manipulative or an injection skid intervention, then it is going to require more battery power, which will result in a shorter work life cycle.

Are you looking into any other power options?

Yes, we’re exploring fuel cells and kinetic power buoys. A power buoy obviously works where there is wave action, so it may not be suitable in certain benign locations. It’s possible to access power on selective existing subsea production systems, and we are working with customers to explore opportunities for deployment.

What other developments are most crucial to subsea residency?

Advancements in through-water communications is crucial. If that technology can be perfected, then it opens up another and more direct method of communicating with the subsea vehicle. For example, today, AUVs have to recalibrate and verify their positions. If we can do that subsea and also on the move, then that extends the duration and efficiency of any particular mission.

Performance, reliability, and innovation continue to be our priority. Current fleet performance is in excess of 99% uptime and, with two industry awards in 2018 for ROV technology and innovation under our belt, we are confident that these successes will continue. It takes dedicated resources: project planning, maintenance, operations support, R&D, and, of course, the most important component: our dedicated and skilled team of professionals.