ROV Services Market Update

Chart courtesy Kimberlite International Oilfield Research The ROV Services market continues to be a key component for helping subsea operators achieve greater levels of operational efficiency and to reduce costs and will play a growing role in supporting the expansion of future offshore wind projects with tasks like laying cables, pre- and post-lay cable survey and other seabed activities.

Chart courtesy Kimberlite International Oilfield Research The ROV Services market continues to be a key component for helping subsea operators achieve greater levels of operational efficiency and to reduce costs and will play a growing role in supporting the expansion of future offshore wind projects with tasks like laying cables, pre- and post-lay cable survey and other seabed activities.

The size of the ROV Services market has declined to approximately $1 billion, from about $2 billion in 2014, reflecting a wider industry decline in activity from approximately 800 ROVs in operation to only approximately 400 ROVs operating today on average.

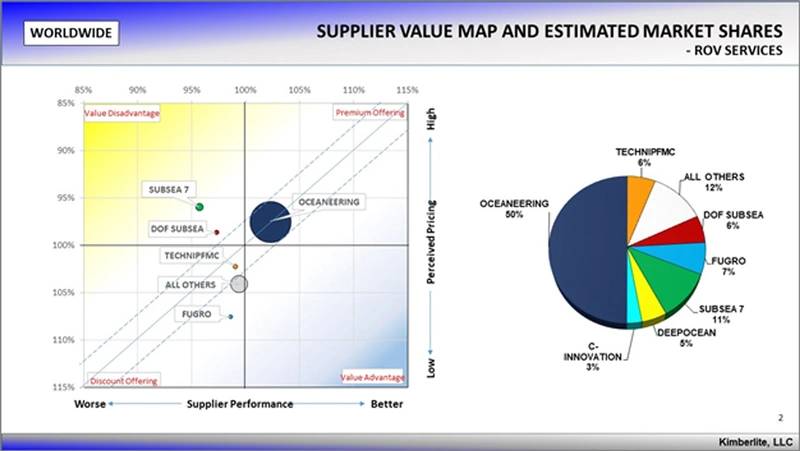

While utilization continues to improve from the 2020 trough, most industry experts do not expect the market to return to 2014 levels Oceaneering commands approximately 50% of the ROV services market share, followed by Subsea 7 at 11%, Fugro at 7%, DOF Subsea at 6% and TechnipFMC with approximately 6%.

Oceaneering continues to invest in technology and capabilities with the Isurus workclass ROV to support work in the offshore renewables segment, the Liberty which is a battery-powered electric ROV to support IMR, commissioning, and underwater intervention activities with up to 90% reduction in carbon footprint and the soon to be released Freedom, an autonomous vehicle to support pipeline survey, seabed survey, close visual inspection and light intervention activities.

TechnipFMC, a relatively newer entrant into the ROV Services business, albeit with a long heritage in ROV design and manufacture, has deployed its Gemini workclass ROV in the Gulf of Mexico which offers the capability tool changing and advanced operations to conduct longer duration missions translating into time and cost savings for drilling operations.

More broadly, 2020 represented an unprecedented year in which the benefits of leveraging remote operations, automation and digital solutions became more visible among both operators and suppliers alike and is being prioritized as key investment initiatives for the future of subsea operations.

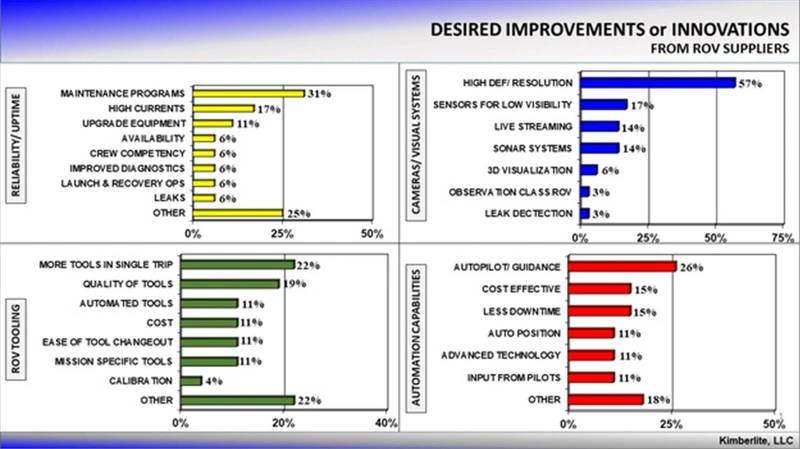

Looking specifically at ROV services, a recent industry survey conducted by Kimberlite International Oilfield Research found that subsea operators are looking for improved ROV reliability/uptime and visualization systems and for further improvements to ROV tooling and automation capabilities.

These desired improvements and advancements in ROV capabilities will enable subsea operators to conduct longer missions while supporting advancements in digitalization initiatives designed to improve real time reporting and analysis along with improved remote operational support.

Whatever the future holds in the years ahead, the oil and gas industry has proven time and again the ability to innovate and adjust to challenging market conditions.

One difference coming out of the COVID pandemic is the realization that the use of remote operations and digital solutions will continue to grow and develop as operators seek to improve efficiencies and financial returns.  About the Author: David Bat is President of Kimberlite International Oilfield Research and brings over 30 years of extensive energy and oil & gas experience. Kimberlite is a recognized leader in the industry for “voice of the customer” oilfield research tracking all facets of the upstream industry including technologies and supplier performance.

About the Author: David Bat is President of Kimberlite International Oilfield Research and brings over 30 years of extensive energy and oil & gas experience. Kimberlite is a recognized leader in the industry for “voice of the customer” oilfield research tracking all facets of the upstream industry including technologies and supplier performance.

Homepage photo for illustration only - Credit: pixone3d/AdobeStock

Read ROV Services Market Update in Pdf, Flash or Html5 edition of May 2021 Marine Technology