Page 20: of Maritime Logistics Professional Magazine (Q2 2011)

Energy Transportation

Read this page in Pdf, Flash or Html5 edition of Q2 2011 Maritime Logistics Professional Magazine

20 Maritime Professional 2Q 2011

S o, where do you turn when you would like to start your own ship management company, but you need a million dollars and the worst financial crisis of a life- time has rendered traditional sources moot? In the case of

Dubai, UAE-based Noah Ship Management’s Svein Elof

Pedersen and Thomas Chacko Arakal, the core tenants of the real estate business – Location, Location, Location – applied to their vision of creating a small, efficient ship management company. “The banks would not even let us in” the front door, said Pedersen. But because he lived in Dubai for more than a dozen years and had a network of connections with the locals, he successfully reached out to one for the seed invest- ment that effectively gave rise to Noah Ship

Management, a progressive ship management company which is long on experience as well as ideas on simple yet crucial methods to save ship owners millions annually.

SETTING UP SHOP

Though the investment in and growth of Dubai over the past decade is in a word spectacular, Dubai too was swept into the global finan- cial meltdown, which served to grind to a halt its construc- tion and infrastructure spending spree. Storm cloud for many, silver lining for some. “Dubai is very inexpensive right now, as this office cost about 250,000 AED ($68k) to set up; the space was just 50

AED (about $13.50) per square foot,” said Pedersen, meaning the time was ideal for a small company to open its doors and build business without onerous overhead.

Noah received its license to operate nearly one year ago,

May 13, 2010, and officially opened its doors two months later in July 2010, earning its first contract to manage one ship in August 2010. At the time of Maritime Professional’s meeting with Pedersen in his office in Dubai, the company had grown to 12 employees including two technical superin- tendants managing six ships for two owners; one local owner for three ships, and a Maltese owner for three ships. Noah’s projection for the end of 2011 is 15 ships under management, and the five-year plan is 35 vessels. “Our optimum size is 35 ships … the intention is to keep this smaller, more manage- able,” Pedersen said. “If you have 35 ships or 150 ships, it really doesn’t matter because you’re not making more money, due to the increased top end management costs” of a larger organization. “We are concentrating now on the UAE as there is a lot of investment in the region,” Pedersen said, particularly in the offshore sector, where there are 482 offshore vessels oper- ating in the region, but there is no one management company specialized in the offshore sector, as Pedersen intends to steer Noah.

While Noah is currently small in terms of personnel and vessels, it is large in expe- rience, as both he and manag- ing director Thomas Chacko

Arakal have a combined 60 years maritime ship manage- ment experience, with names such as EMS Ship

Management, Thome Ship

Management, Barber Ship

Management and VShips highlighted on their CV.

CONTROL = PROFITABILITY

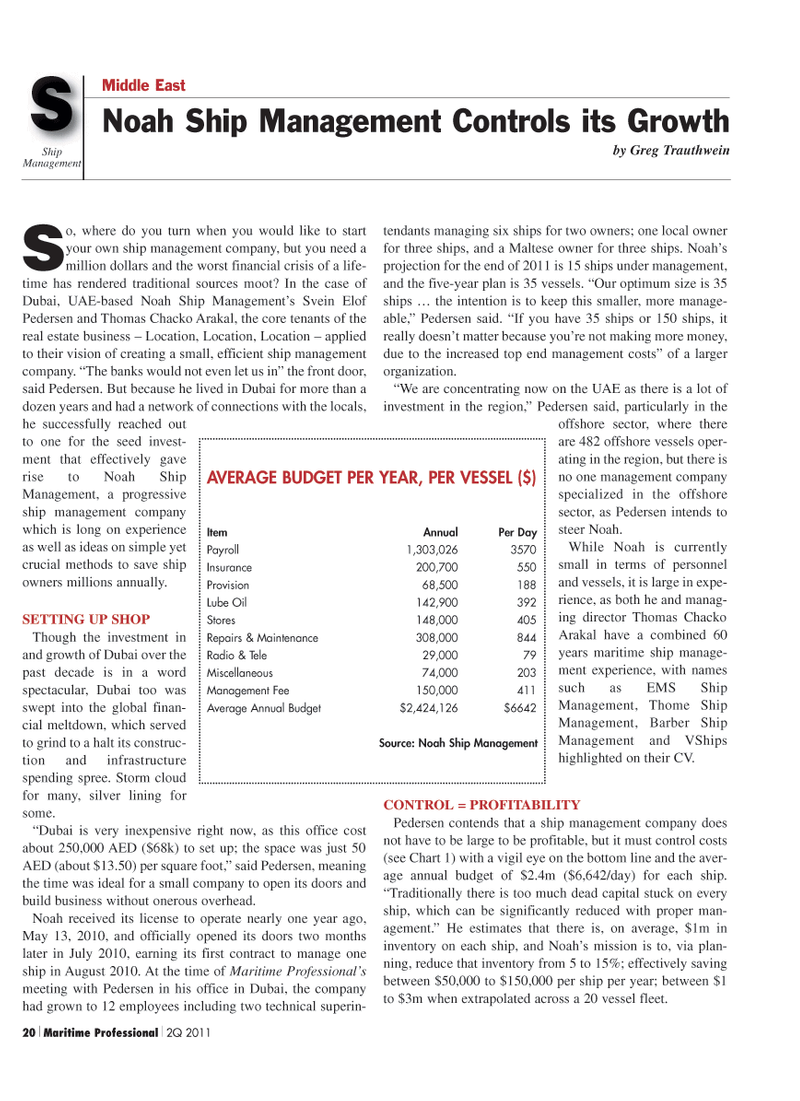

Pedersen contends that a ship management company does not have to be large to be profitable, but it must control costs (see Chart 1) with a vigil eye on the bottom line and the aver- age annual budget of $2.4m ($6,642/day) for each ship. “Traditionally there is too much dead capital stuck on every ship, which can be significantly reduced with proper man- agement.” He estimates that there is, on average, $1m in inventory on each ship, and Noah’s mission is to, via plan- ning, reduce that inventory from 5 to 15%; effectively saving between $50,000 to $150,000 per ship per year; between $1 to $3m when extrapolated across a 20 vessel fleet.

S

Ship

Management

Noah Ship Management Controls its Growth by Greg Trauthwein

Middle East

AVERAGE BUDGET PER YEAR, PER VESSEL ($)

Item Annual Per Day

Payroll 1,303,026 3570

Insurance 200,700 550

Provision 68,500 188

Lube Oil 142,900 392

Stores 148,000 405

Repairs & Maintenance 308,000 844

Radio & Tele 29,000 79

Miscellaneous 74,000 203

Management Fee 150,000 411

Average Annual Budget $2,424,126 $6642

Source: Noah Ship Management

19

19

21

21