Page 47: of Maritime Logistics Professional Magazine (Q2 2012)

Maritime Risk

Read this page in Pdf, Flash or Html5 edition of Q2 2012 Maritime Logistics Professional Magazine

” “

Vale has met with strong opposition in its bid to berth the Valemax ships in major Chinese ports. That said, the Brazilian government has intervened on behalf of the company and it is now expected (although not guaranteed) that permission to dock in Chinese ports will be released within a few months.

BRAZIL

Photo cr edit:

V ale do Rio Doce

At sea, the news was not much better. One of their new Vale- max ships ran aground while loading in Brazil and another experienced a ballast tank leak. It is here where Vale’s bid to build a fl eet of Valemax ships – the biggest bulk carriers by volume in the world – has also been met with skepticism; in

Brazil and abroad. Some shipowners – particularly Chinese- based operators – complain that, with these ships, Vale may have a stranglehold on iron ore and minerals exports from

Brazil, which negatively affects the already struggling off- shore minerals and iron ore transport market.

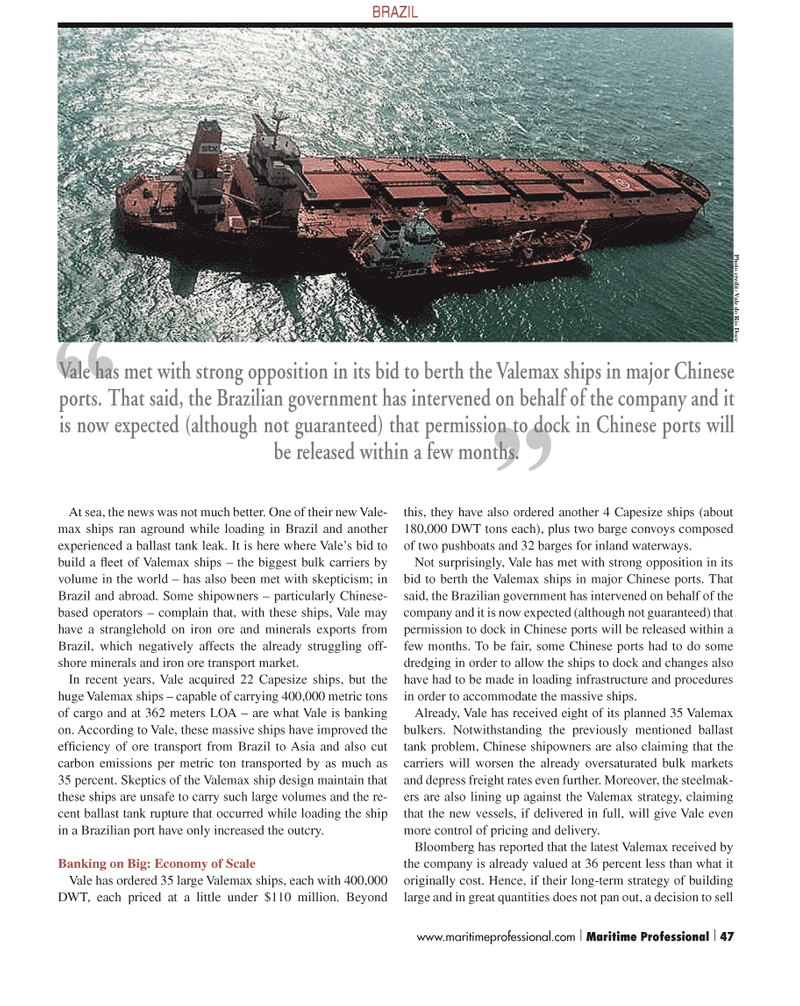

In recent years, Vale acquired 22 Capesize ships, but the huge Valemax ships – capable of carrying 400,000 metric tons of cargo and at 362 meters LOA – are what Vale is banking on. According to Vale, these massive ships have improved the effi ciency of ore transport from Brazil to Asia and also cut carbon emissions per metric ton transported by as much as 35 percent. Skeptics of the Valemax ship design maintain that these ships are unsafe to carry such large volumes and the re- cent ballast tank rupture that occurred while loading the ship in a Brazilian port have only increased the outcry.

Banking on Big: Economy of Scale

Vale has ordered 35 large Valemax ships, each with 400,000

DWT, each priced at a little under $110 million. Beyond this, they have also ordered another 4 Capesize ships (about 180,000 DWT tons each), plus two barge convoys composed of two pushboats and 32 barges for inland waterways.

Not surprisingly, Vale has met with strong opposition in its bid to berth the Valemax ships in major Chinese ports. That said, the Brazilian government has intervened on behalf of the company and it is now expected (although not guaranteed) that permission to dock in Chinese ports will be released within a few months. To be fair, some Chinese ports had to do some dredging in order to allow the ships to dock and changes also have had to be made in loading infrastructure and procedures in order to accommodate the massive ships.

Already, Vale has received eight of its planned 35 Valemax bulkers. Notwithstanding the previously mentioned ballast tank problem, Chinese shipowners are also claiming that the carriers will worsen the already oversaturated bulk markets and depress freight rates even further. Moreover, the steelmak- ers are also lining up against the Valemax strategy, claiming that the new vessels, if delivered in full, will give Vale even more control of pricing and delivery.

Bloomberg has reported that the latest Valemax received by the company is already valued at 36 percent less than what it originally cost. Hence, if their long-term strategy of building large and in great quantities does not pan out, a decision to sell www.maritimeprofessional.com | Maritime Professional | 47

MP #2 34-49 NEW STYLES.indd 47 5/4/2012 5:15:58 PM

46

46

48

48