Page 41: of Maritime Logistics Professional Magazine (Q3 2012)

Classification Societies, Quality & Design

Read this page in Pdf, Flash or Html5 edition of Q3 2012 Maritime Logistics Professional Magazine

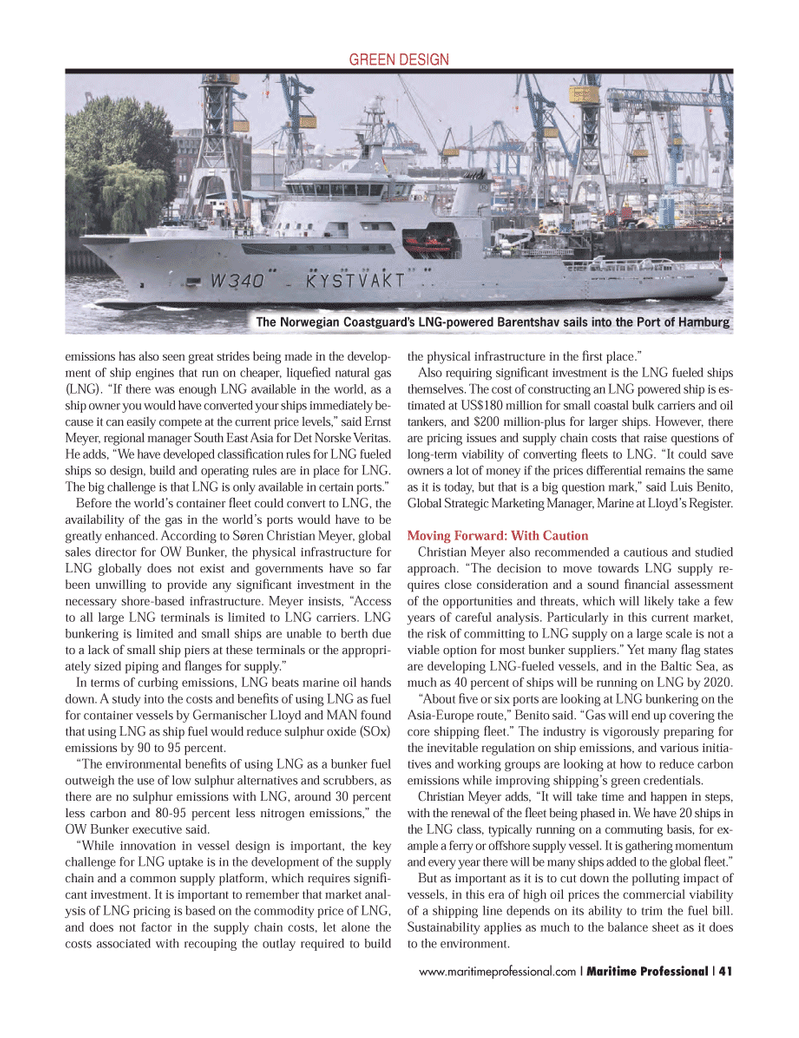

www.maritimeprofessional.com | Maritime Professional | 41emissions has also seen great strides being made in the develop- ment of ship engines that run on cheaper, liqueÞ ed natural gas (LNG). ÒIf there was enough LNG available in the world, as a ship owner you would have converted your ships immediately be- cause it can easily compete at the current price levels,Ó said Ernst Meyer, regional manager South East Asia for Det Norske Veritas. He adds, ÒWe have developed classiÞ cation rules for LNG fueled ships so design, build and operating rules are in place for LNG. The big challenge is that LNG is only available in certain ports.Ó Before the worldÕs container ß eet could convert to LNG, the availability of the gas in the worldÕs ports would have to be greatly enhanced. According to S¿ren Christian Meyer, global sales director for OW Bunker, the physical infrastructure for LNG globally does not exist and governments have so far been unwilling to provide any signiÞ cant investment in the necessary shore-based infrastructure. Meyer insists, ÒAccess to all large LNG terminals is limited to LNG carriers. LNG bunkering is limited and small ships are unable to berth due to a lack of small ship piers at these terminals or the appropri-ately sized piping and ß anges for supply.Ó In terms of curbing emissions, LNG beats marine oil hands down. A study into the costs and beneÞ ts of using LNG as fuel for container vessels by Germanischer Lloyd and MAN found that using LNG as ship fuel would reduce sulphur oxide (SOx) emissions by 90 to 95 percent.ÒThe environmental beneÞ ts of using LNG as a bunker fuel outweigh the use of low sulphur alternatives and scrubbers, as there are no sulphur emissions with LNG, around 30 percent less carbon and 80-95 percent less nitrogen emissions,Ó the OW Bunker executive said. ÒWhile innovation in vessel design is important, the key challenge for LNG uptake is in the development of the supply chain and a common supply platform, which requires signiÞ -cant investment. It is important to remember that market anal- ysis of LNG pricing is based on the commodity price of LNG, and does not factor in the supply chain costs, let alone the costs associated with recouping the outlay required to build the physical infrastructure in the Þ rst place.Ó Also requiring signiÞ cant investment is the LNG fueled ships themselves. The cost of constructing an LNG powered ship is es- timated at US$180 million for small coastal bulk carriers and oil tankers, and $200 million-plus for larger ships. However, there are pricing issues and supply chain costs that raise questions of long-term viability of converting ß eets to LNG. ÒIt could save owners a lot of money if the prices differential remains the same as it is today, but that is a big question mark,Ó said Luis Benito, Global Strategic Marketing Manager, Marine at LloydÕs Register. Moving Forward: With Caution Christian Meyer also recommended a cautious and studied approach. ÒThe decision to move towards LNG supply re- quires close consideration and a sound Þ nancial assessment of the opportunities and threats, which will likely take a few years of careful analysis. Particularly in this current market, the risk of committing to LNG supply on a large scale is not a viable option for most bunker suppliers.Ó Yet many ß ag states are developing LNG-fueled vessels, and in the Baltic Sea, as much as 40 percent of ships will be running on LNG by 2020.ÒAbout Þ ve or six ports are looking at LNG bunkering on the Asia-Europe route,Ó Benito said. ÒGas will end up covering the core shipping ß eet.Ó The industry is vigorously preparing for the inevitable regulation on ship emissions, and various initia- tives and working groups are looking at how to reduce carbon emissions while improving shippingÕs green credentials. Christian Meyer adds, ÒIt will take time and happen in steps, with the renewal of the ß eet being phased in. We have 20 ships in the LNG class, typically running on a commuting basis, for ex- ample a ferry or offshore supply vessel. It is gathering momentum and every year there will be many ships added to the global ß eet.Ó But as important as it is to cut down the polluting impact of vessels, in this era of high oil prices the commercial viability of a shipping line depends on its ability to trim the fuel bill. Sustainability applies as much to the balance sheet as it does to the environment. The Norwegian Coastguard?s LNG-powered Barentshav sails into the Port of Hamburg GREEN DESIGN

40

40

42

42