Page 12: of Maritime Logistics Professional Magazine (Q4 2012)

The Environment: Stewardship & Compliance

Read this page in Pdf, Flash or Html5 edition of Q4 2012 Maritime Logistics Professional Magazine

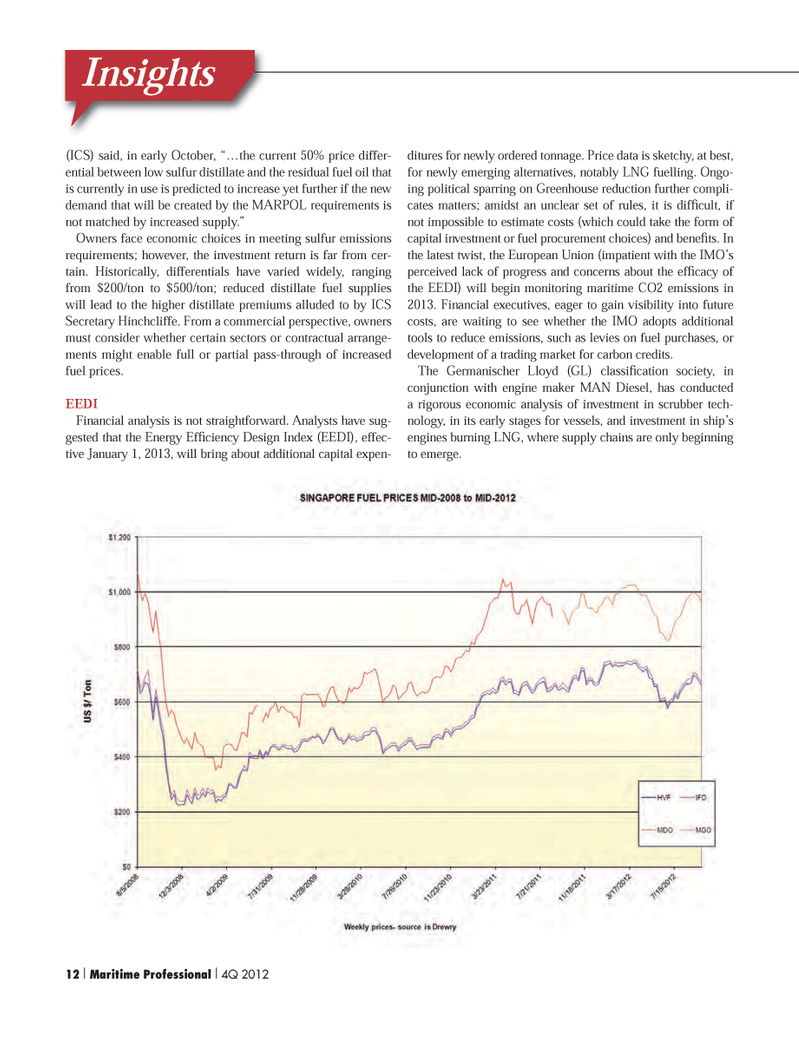

(ICS) said, in early October, ??the current 50% price differ- ential between low sulfur distillate and the residual fuel oil that is currently in use is predicted to increase yet further if the new demand that will be created by the MARPOL requirements is not matched by increased supply.? Owners face economic choices in meeting sulfur emissions requirements; however, the investment return is far from cer- tain. Historically, differentials have varied widely, ranging from $200/ton to $500/ton; reduced distillate fuel supplies will lead to the higher distillate premiums alluded to by ICS Secretary Hinchcliffe. From a commercial perspective, owners must consider whether certain sectors or contractual arrange-ments might enable full or partial pass-through of increased fuel prices. EEDIFinancial analysis is not straightforward. Analysts have sug- gested that the Energy Ef ciency Design Index (EEDI), effec- tive January 1, 2013, will bring about additional capital expen- ditures for newly ordered tonnage. Price data is sketchy, at best, for newly emerging alternatives, notably LNG fuelling. Ongo- ing political sparring on Greenhouse reduction further compli-cates matters; amidst an unclear set of rules, it is dif cult, if not impossible to estimate costs (which could take the form of capital investment or fuel procurement choices) and bene ts. In the latest twist, the European Union (impatient with the IMO?s perceived lack of progress and concerns about the ef cacy of the EEDI) will begin monitoring maritime CO2 emissions in 2013. Financial executives, eager to gain visibility into future costs, are waiting to see whether the IMO adopts additional tools to reduce emissions, such as levies on fuel purchases, or development of a trading market for carbon credits. The Germanischer Lloyd (GL) classi cation society, in conjunction with engine maker MAN Diesel, has conducted a rigorous economic analysis of investment in scrubber tech- nology, in its early stages for vessels, and investment in ship?s engines burning LNG, where supply chains are only beginning to emerge. Insights12 I Maritime Professional I 4Q 2012MP #4 1-17.indd 12MP #4 1-17.indd 1211/12/2012 12:08:24 PM11/12/2012 12:08:24 PM

11

11

13

13