Page 18: of Maritime Logistics Professional Magazine (Q3 2013)

Training & Security

Read this page in Pdf, Flash or Html5 edition of Q3 2013 Maritime Logistics Professional Magazine

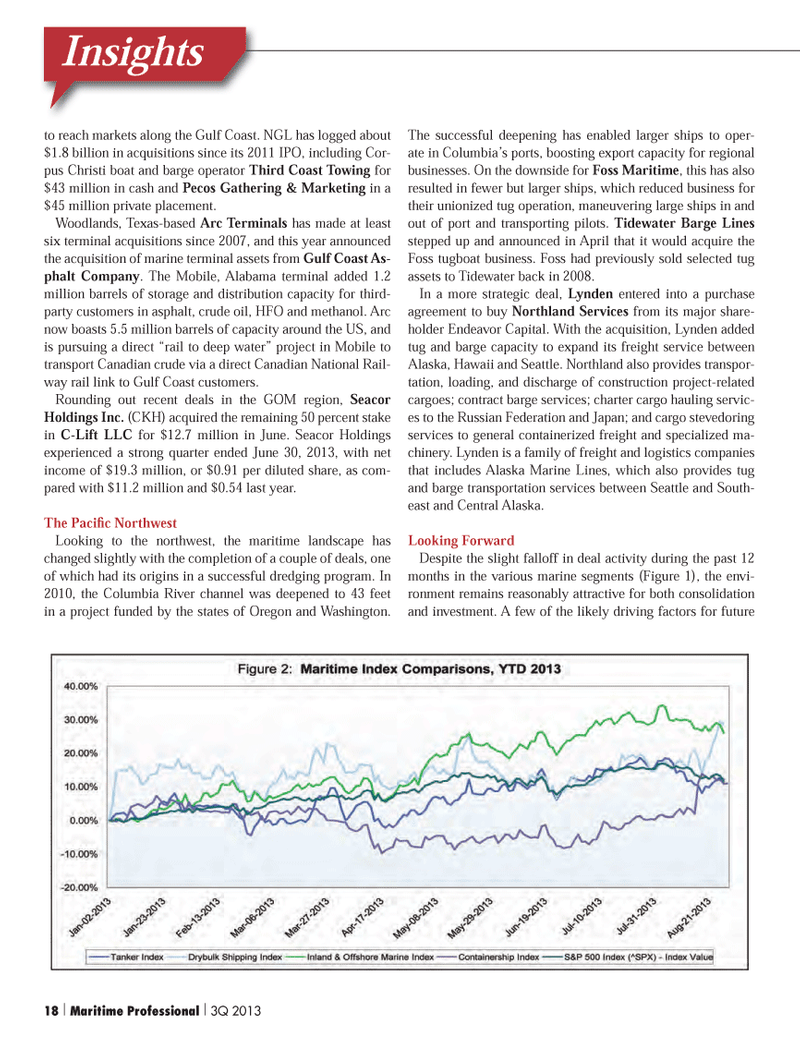

Insightsto reach markets along the Gulf Coast. NGL has logged about $1.8 billion in acquisitions since its 2011 IPO, including Cor- pus Christi boat and barge operator Third Coast Towing for $43 million in cash and Pecos Gathering & Marketing in a $45 million private placement. Woodlands, Texas-based Arc Terminals has made at least six terminal acquisitions since 2007, and this year announced the acquisition of marine terminal assets from Gulf Coast As- phalt Company. The Mobile, Alabama terminal added 1.2 million barrels of storage and distribution capacity for third- party customers in asphalt, crude oil, HFO and methanol. Arc now boasts 5.5 million barrels of capacity around the US, and is pursuing a direct ?rail to deep water? project in Mobile to transport Canadian crude via a direct Canadian National Rail-way rail link to Gulf Coast customers. Rounding out recent deals in the GOM region, Seacor Holdings Inc. (CKH) acquired the remaining 50 percent stake in C-Lift LLC for $12.7 million in June. Seacor Holdings experienced a strong quarter ended June 30, 2013, with net income of $19.3 million, or $0.91 per diluted share, as com-pared with $11.2 million and $0.54 last year. The PaciÞ c Northwest Looking to the northwest, the maritime landscape has changed slightly with the completion of a couple of deals, one of which had its origins in a successful dredging program. In 2010, the Columbia River channel was deepened to 43 feet in a project funded by the states of Oregon and Washington. The successful deepening has enabled larger ships to oper- ate in Columbia?s ports, boosting export capacity for regional businesses. On the downside for Foss Maritime , this has also resulted in fewer but larger ships, which reduced business for their unionized tug operation, maneuvering large ships in and out of port and transporting pilots. Tidewater Barge Lines stepped up and announced in April that it would acquire the Foss tugboat business. Foss had previously sold selected tug assets to Tidewater back in 2008. In a more strategic deal, Lynden entered into a purchase agreement to buy Northland Services from its major share-holder Endeavor Capital. With the acquisition, Lynden added tug and barge capacity to expand its freight service between Alaska, Hawaii and Seattle. Northland also provides transpor- tation, loading, and discharge of construction project-related cargoes; contract barge services; charter cargo hauling servic- es to the Russian Federation and Japan; and cargo stevedoring services to general containerized freight and specialized ma-chinery. Lynden is a family of freight and logistics companies that includes Alaska Marine Lines, which also provides tug and barge transportation services between Seattle and South- east and Central Alaska. Looking Forward Despite the slight falloff in deal activity during the past 12 months in the various marine segments (Figure 1), the envi- ronment remains reasonably attractive for both consolidation and investment. A few of the likely driving factors for future 18 | Maritime Professional | 3Q 2013MP #3 18-33.indd 18MP #3 18-33.indd 189/10/2013 10:06:30 AM9/10/2013 10:06:30 AM

17

17

19

19