Page 11: of Maritime Logistics Professional Magazine (Q1 2014)

The Energy Edition: Exploration, Production & Transportation

Read this page in Pdf, Flash or Html5 edition of Q1 2014 Maritime Logistics Professional Magazine

a booming Jones Act shipbuilder in recent years. Norwegian holding company Aker took over the yard in 2005 and worked a contract with Shell Oil for 12 product tankers. The yard was hit hard during the fi nancial crisis and with the help of state and local taxpayers, Aker kept the operation alive by securing fi nancing for two spec-built ships. Fast forward three years, and AKPS has booked contracts with SeaRiver Maritime and

Crowley Maritime for up to 14 new vessels, and the publicly- traded stock is up over 2200% in the past 18 months.

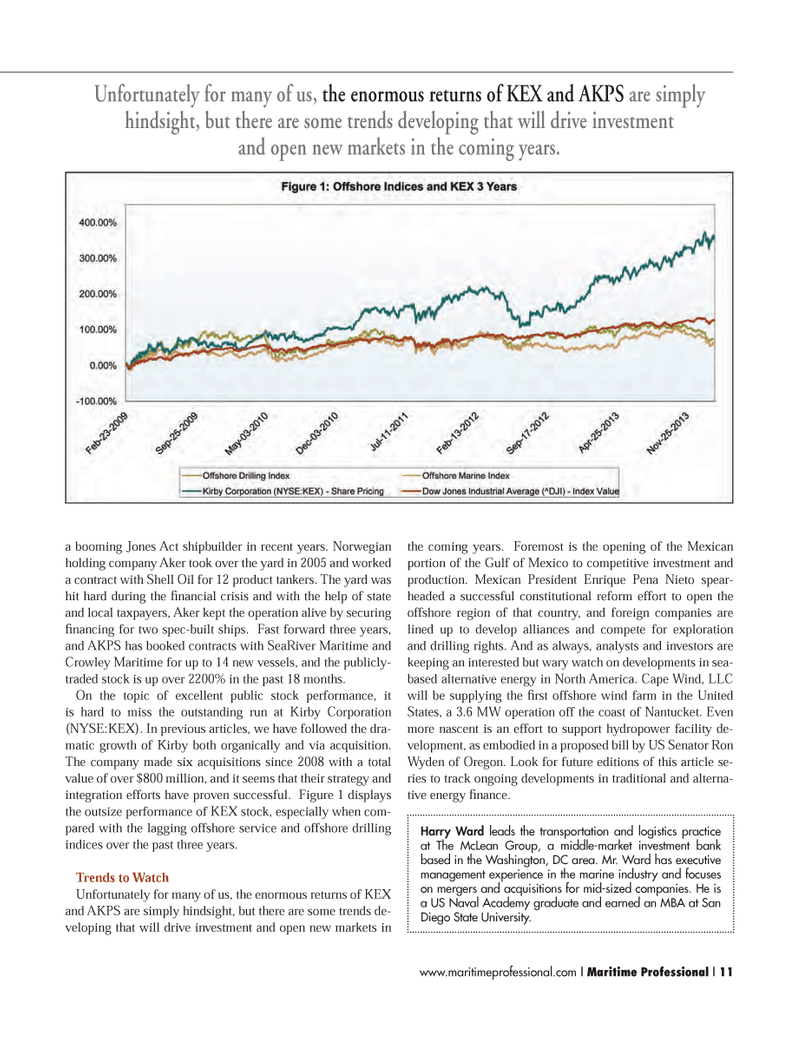

On the topic of excellent public stock performance, it is hard to miss the outstanding run at Kirby Corporation (NYSE:KEX). In previous articles, we have followed the dra- matic growth of Kirby both organically and via acquisition.

The company made six acquisitions since 2008 with a total value of over $800 million, and it seems that their strategy and integration efforts have proven successful. Figure 1 displays the outsize performance of KEX stock, especially when com- pared with the lagging offshore service and offshore drilling indices over the past three years.

Trends to Watch

Unfortunately for many of us, the enormous returns of KEX and AKPS are simply hindsight, but there are some trends de- veloping that will drive investment and open new markets in the coming years. Foremost is the opening of the Mexican portion of the Gulf of Mexico to competitive investment and production. Mexican President Enrique Pena Nieto spear- headed a successful constitutional reform effort to open the offshore region of that country, and foreign companies are lined up to develop alliances and compete for exploration and drilling rights. And as always, analysts and investors are keeping an interested but wary watch on developments in sea- based alternative energy in North America. Cape Wind, LLC will be supplying the fi rst offshore wind farm in the United

States, a 3.6 MW operation off the coast of Nantucket. Even more nascent is an effort to support hydropower facility de- velopment, as embodied in a proposed bill by US Senator Ron

Wyden of Oregon. Look for future editions of this article se- ries to track ongoing developments in traditional and alterna- tive energy fi nance.

Unfortunately for many of us, the enormous returns of KEX and AKPS are simply hindsight, but there are some trends developing that will drive investment and open new markets in the coming years.

Harry Ward leads the transportation and logistics practice at The McLean Group, a middle-market investment bank based in the Washington, DC area. Mr. Ward has executive management experience in the marine industry and focuses on mergers and acquisitions for mid-sized companies. He is a US Naval Academy graduate and earned an MBA at San

Diego State University. www.maritimeprofessional.com | Maritime Professional | 11

MP Q1 2014 1-17.indd 11 2/26/2014 1:17:29 PM

10

10

12

12