Page 11: of Maritime Logistics Professional Magazine (Q2 2014)

Maritime Risk & Shipping Finance

Read this page in Pdf, Flash or Html5 edition of Q2 2014 Maritime Logistics Professional Magazine

“annualized volatility” for the Baltic Capesize Index (a statis- tical measure of variations in a time series of shipping rates) was an off-the-charts 120% in the fi rst two months of 2014.

In setting the stage for Sandler and the other speakers, Alex

Gray enumerated some of the risk pitfalls in traditional char- ters, which include “the knock on effect of defaults through period relets, the failure to address and accurately assess counterparty risk, and too much reliance on tradition and trust.” The freight derivatives markets are able to overcome these issues because the vast majority are traded through a fi nancial clearing-house, analogous to a central guarantor.

Speaker Isabella Kurek-Smith, representing LCH.Clearnet

Group (with a majority ownership by the London Stock Ex- change, and the balance by other exchanges, and the big bro- kerages) noted that 75% of drybulk cleared Forward Freight

Agreements (FFA) are handled through her organization. In (Photo: Dynagas)

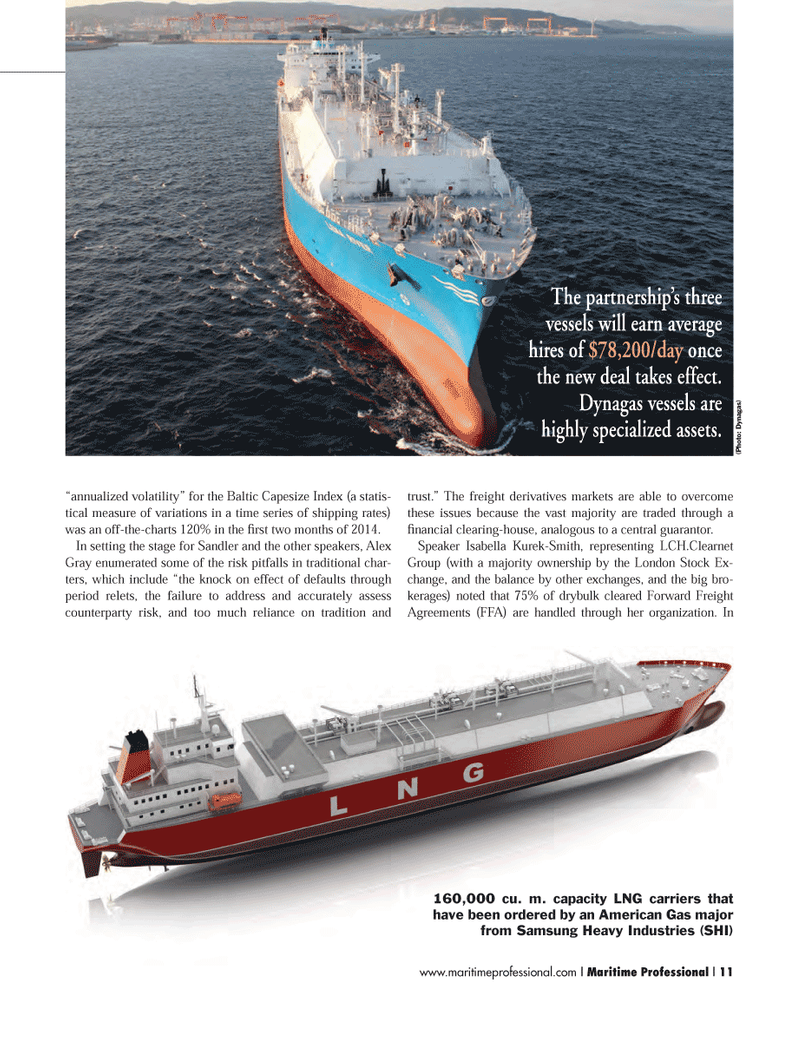

The partnership’s three The partnerships three vessels will earn average essels will earn average hires of hires of $78,200/day$78,200/day once once the new deal takes effect. the new deal takes effect.

Dynagas vessels are Dynagas vessels ar highly specialized assets.highly specialized assets. 160,000 cu. m. capacity LNG carriers that have been ordered by an American Gas major from Samsung Heavy Industries (SHI) www.maritimeprofessional.com | Maritime Professional | 11 1-17 Q2 MP2014.indd 11 5/16/2014 4:24:53 PM

10

10

12

12