Page 10: of Maritime Logistics Professional Magazine (Q3 2014)

Power & Fuel Management

Read this page in Pdf, Flash or Html5 edition of Q3 2014 Maritime Logistics Professional Magazine

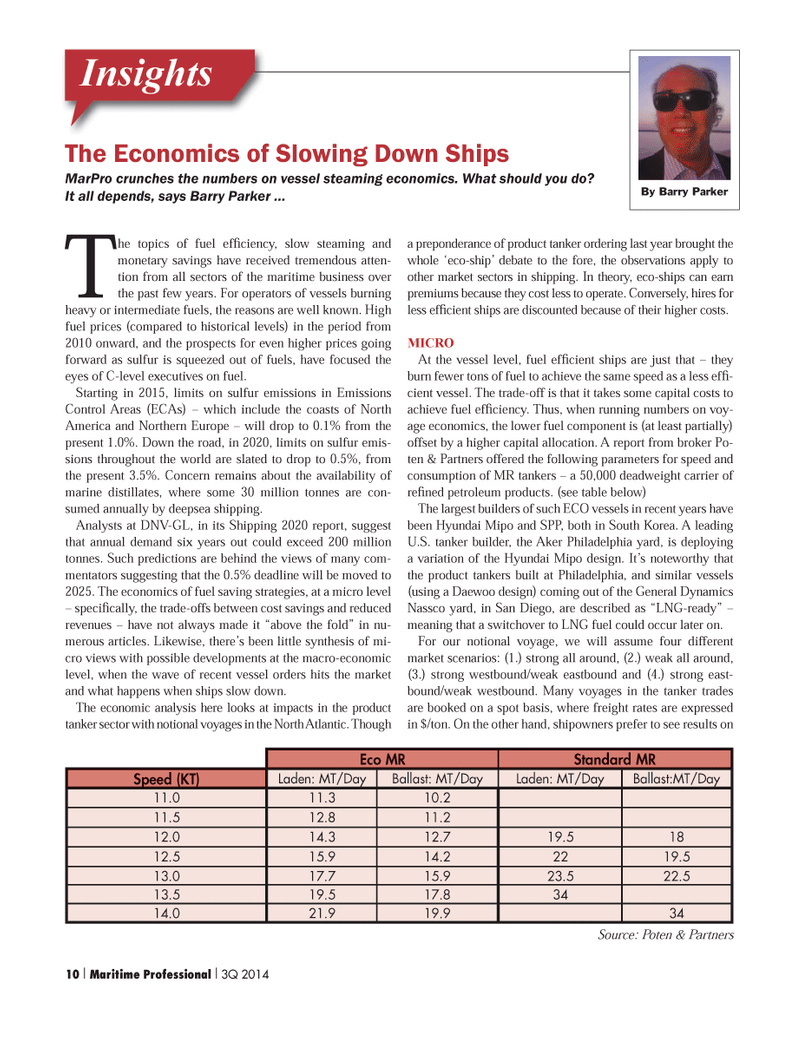

The Economics of Slowing Down Ships MarPro crunches the numbers on vessel steaming economics. What should you do? It all depends, says Barry Parker ? InsightsThe topics of fuel efÞ ciency, slow steaming and monetary savings have received tremendous atten- tion from all sectors of the maritime business over the past few years. For operators of vessels burning heavy or intermediate fuels, the reasons are well known. High fuel prices (compared to historical levels) in the period from 2010 onward, and the prospects for even higher prices going forward as sulfur is squeezed out of fuels, have focused the eyes of C-level executives on fuel. Starting in 2015, limits on sulfur emissions in Emissions Control Areas (ECAs) Ð which include the coasts of North America and Northern Europe Ð will drop to 0.1% from the present 1.0%. Down the road, in 2020, limits on sulfur emis- sions throughout the world are slated to drop to 0.5%, from the present 3.5%. Concern remains about the availability of marine distillates, where some 30 million tonnes are con-sumed annually by deepsea shipping.Analysts at DNV-GL, in its Shipping 2020 report, suggest that annual demand six years out could exceed 200 million tonnes. Such predictions are behind the views of many com- mentators suggesting that the 0.5% deadline will be moved to 2025. The economics of fuel saving strategies, at a micro level Ð speciÞ cally, the trade-offs between cost savings and reduced revenues Ð have not always made it Òabove the foldÓ in nu- merous articles. Likewise, thereÕs been little synthesis of mi- cro views with possible developments at the macro-economic level, when the wave of recent vessel orders hits the market and what happens when ships slow down. The economic analysis here looks at impacts in the product tanker sector with notional voyages in the North Atlantic. Though a preponderance of product tanker ordering last year brought the whole Ôeco-shipÕ debate to the fore, the observations apply to other market sectors in shipping. In theory, eco-ships can earn premiums because they cost less to operate. Conversely, hires for less efÞ cient ships are discounted because of their higher costs. MICRO At the vessel level, fuel efÞ cient ships are just that Ð they burn fewer tons of fuel to achieve the same speed as a less efÞ -cient vessel. The trade-off is that it takes some capital costs to achieve fuel efÞ ciency. Thus, when running numbers on voy- age economics, the lower fuel component is (at least partially) offset by a higher capital allocation. A report from broker Po- ten & Partners offered the following parameters for speed and consumption of MR tankers Ð a 50,000 deadweight carrier of reÞ ned petroleum products. (see table below) The largest builders of such ECO vessels in recent years have been Hyundai Mipo and SPP, both in South Korea. A leading U.S. tanker builder, the Aker Philadelphia yard, is deploying a variation of the Hyundai Mipo design. ItÕs noteworthy that the product tankers built at Philadelphia, and similar vessels (using a Daewoo design) coming out of the General Dynamics Nassco yard, in San Diego, are described as ÒLNG-readyÓ Ð meaning that a switchover to LNG fuel could occur later on. For our notional voyage, we will assume four different market scenarios: (1.) strong all around, (2.) weak all around, (3.) strong westbound/weak eastbound and (4.) strong east-bound/weak westbound. Many voyages in the tanker trades are booked on a spot basis, where freight rates are expressed in $/ton. On the other hand, shipowners prefer to see results on By Barry ParkerEco MRStandard MRSpeed (KT)Laden: MT/DayBallast: MT/DayLaden: MT/DayBallast:MT/Day 11.011.310.2 11.512.811.2 12.014.312.719.518 12.515.914.22219.5 13.017.715.923.522.5 13.519.517.834 14.021.919.934 Source: Poten & Partners 10 I Maritime Professional I 3Q 20141-17 Q3 MP2014.indd 101-17 Q3 MP2014.indd 108/13/2014 4:02:23 PM8/13/2014 4:02:23 PM

9

9

11

11