Page 18: of Maritime Logistics Professional Magazine (Q4 2014)

Read this page in Pdf, Flash or Html5 edition of Q4 2014 Maritime Logistics Professional Magazine

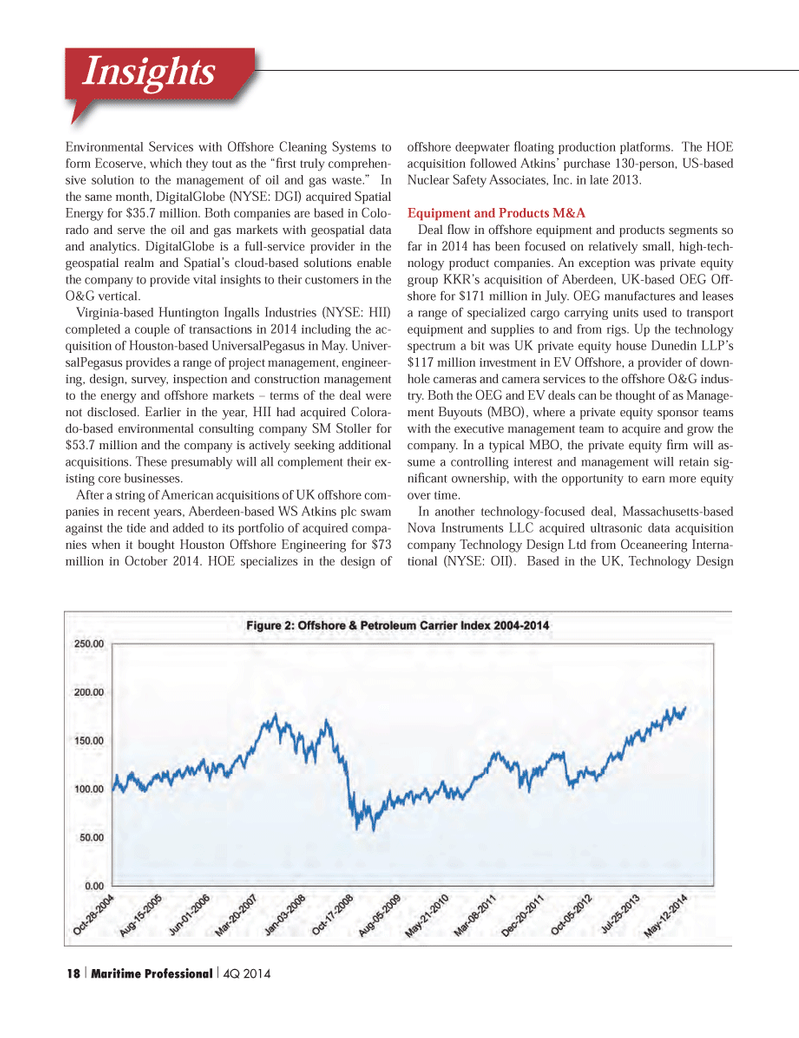

InsightsEnvironmental Services with Offshore Cleaning Systems to form Ecoserve, which they tout as the ? rst truly comprehen- sive solution to the management of oil and gas waste.? In the same month, DigitalGlobe (NYSE: DGI) acquired Spatial Energy for $35.7 million. Both companies are based in Colo- rado and serve the oil and gas markets with geospatial data and analytics. DigitalGlobe is a full-service provider in the geospatial realm and Spatial?s cloud-based solutions enable the company to provide vital insights to their customers in the O&G vertical. Virginia-based Huntington Ingalls Industries (NYSE: HII) completed a couple of transactions in 2014 including the ac-quisition of Houston-based UniversalPegasus in May. Univer- salPegasus provides a range of project management, engineer- ing, design, survey, inspection and construction management to the energy and offshore markets ? terms of the deal were not disclosed. Earlier in the year, HII had acquired Colora- do-based environmental consulting company SM Stoller for $53.7 million and the company is actively seeking additional acquisitions. These presumably will all complement their ex- isting core businesses. After a string of American acquisitions of UK offshore com- panies in recent years, Aberdeen-based WS Atkins plc swam against the tide and added to its portfolio of acquired compa-nies when it bought Houston Offshore Engineering for $73 million in October 2014. HOE specializes in the design of offshore deepwater oating production platforms. The HOE acquisition followed Atkins? purchase 130-person, US-based Nuclear Safety Associates, Inc. in late 2013. Equipment and Products M&A Deal ow in offshore equipment and products segments so far in 2014 has been focused on relatively small, high-tech- nology product companies. An exception was private equity group KKR?s acquisition of Aberdeen, UK-based OEG Off- shore for $171 million in July. OEG manufactures and leases a range of specialized cargo carrying units used to transport equipment and supplies to and from rigs. Up the technology spectrum a bit was UK private equity house Dunedin LLP?s $117 million investment in EV Offshore, a provider of down- hole cameras and camera services to the offshore O&G indus- try. Both the OEG and EV deals can be thought of as Manage- ment Buyouts (MBO), where a private equity sponsor teams with the executive management team to acquire and grow the company. In a typical MBO, the private equity rm will as- sume a controlling interest and management will retain sig-ni cant ownership, with the opportunity to earn more equity over time. In another technology-focused deal, Massachusetts-based Nova Instruments LLC acquired ultrasonic data acquisition company Technology Design Ltd from Oceaneering Interna- tional (NYSE: OII). Based in the UK, Technology Design 18 | Maritime Professional | 4Q 201418-33 Q4 MP2014.indd 1818-33 Q4 MP2014.indd 1811/17/2014 11:08:23 AM11/17/2014 11:08:23 AM

17

17

19

19