Page 12: of Maritime Logistics Professional Magazine (Q1 2015)

LNG Transport & Technology

Read this page in Pdf, Flash or Html5 edition of Q1 2015 Maritime Logistics Professional Magazine

Insights

Shipping Under Pressure

Improving Revenue-to-Operating Costs Ratio will be the Key

By Richard Greiner

FTER enjoying a continuing boom for four years up The operating cost for a Feedermax container ship in 2013 to late 2008, the international shipping markets hit a was $4,491 per day, as against average time-charter earnings

A wall, and thereafter started to slide down it. Although for the year of $4,842. The corresponding ? gures for 1,000-to- there has been a recovery from that freight market nadir, the 2,000 teu container ships were $5,300 and $7,096, and for main six years from 2009 to 2014 have been very challenging in liner vessels of between 2,000 and 6,000 teu, $7,389 and $7,021.

terms of trying to achieve a reasonable return from the tanker, dry bulk and container ship sectors. Freight Rates

Over the same period of time, some of the volatility has gone Freight levels may never recover to reach the heights out of ship operating costs, with a small decrease (the ? rst for achieved in their mid-2008 heyday, when it was reported that six years) recorded in respect of 2009, prior to two years of some Panamax vessels could earn up to $100,000 per day. small increases. Operating costs then fell by a small margin in Owners and operators, however, will clearly be looking to im- the following two years, but are thought to have risen again in prove signi? cantly on the returns achieved in 2013. Indeed, 2014 and are predicted to increase once more this year. ? gures from Clarksons show a de? nite improvement in 2014

So where does this leave the industry now, in terms of average time-charter rates in the crude tanker market for 2014, measuring revenue against costs? The latest year for which with a near-42 percent improvement for VLCCs, for example. comparable ? gures are currently available is 2013. According Average time-charter rates for 2014 in the bulker sector were to the latest OpCost study (www.opcostonline.com), which also signi? cantly improved, with rates for Capesize bulkers,

Moore Stephens uses uniquely to benchmark ship operating for example, up 38 percent on the previous year.

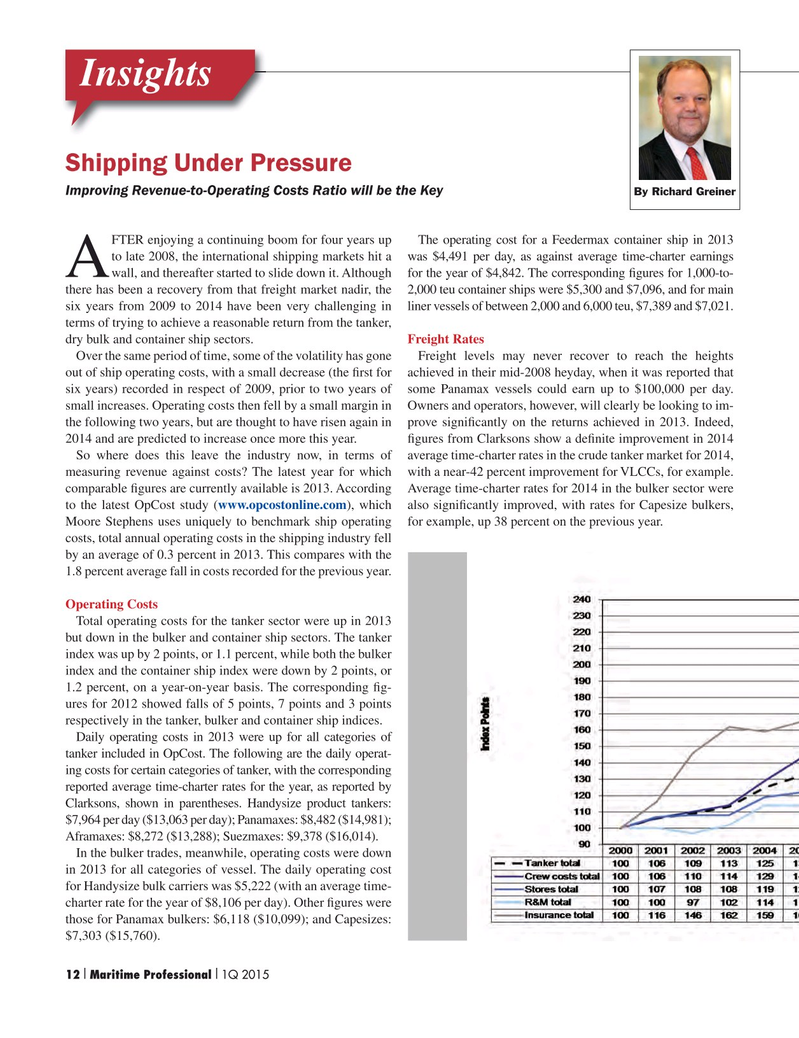

costs, total annual operating costs in the shipping industry fell by an average of 0.3 percent in 2013. This compares with the 1.8 percent average fall in costs recorded for the previous year.

Operating Costs

Total operating costs for the tanker sector were up in 2013 but down in the bulker and container ship sectors. The tanker index was up by 2 points, or 1.1 percent, while both the bulker index and the container ship index were down by 2 points, or 1.2 percent, on a year-on-year basis. The corresponding ? g- ures for 2012 showed falls of 5 points, 7 points and 3 points respectively in the tanker, bulker and container ship indices.

Daily operating costs in 2013 were up for all categories of tanker included in OpCost. The following are the daily operat- ing costs for certain categories of tanker, with the corresponding reported average time-charter rates for the year, as reported by

Clarksons, shown in parentheses. Handysize product tankers: $7,964 per day ($13,063 per day); Panamaxes: $8,482 ($14,981);

Aframaxes: $8,272 ($13,288); Suezmaxes: $9,378 ($16,014).

In the bulker trades, meanwhile, operating costs were down in 2013 for all categories of vessel. The daily operating cost for Handysize bulk carriers was $5,222 (with an average time- charter rate for the year of $8,106 per day). Other ? gures were those for Panamax bulkers: $6,118 ($10,099); and Capesizes: $7,303 ($15,760).

12 Maritime Professional 1Q 2015I I

11

11

13

13