Page 14: of Maritime Logistics Professional Magazine (Q1 2015)

LNG Transport & Technology

Read this page in Pdf, Flash or Html5 edition of Q1 2015 Maritime Logistics Professional Magazine

Insights dustry which had seen increases of more than 20 percent at All Costs, at a glance ...

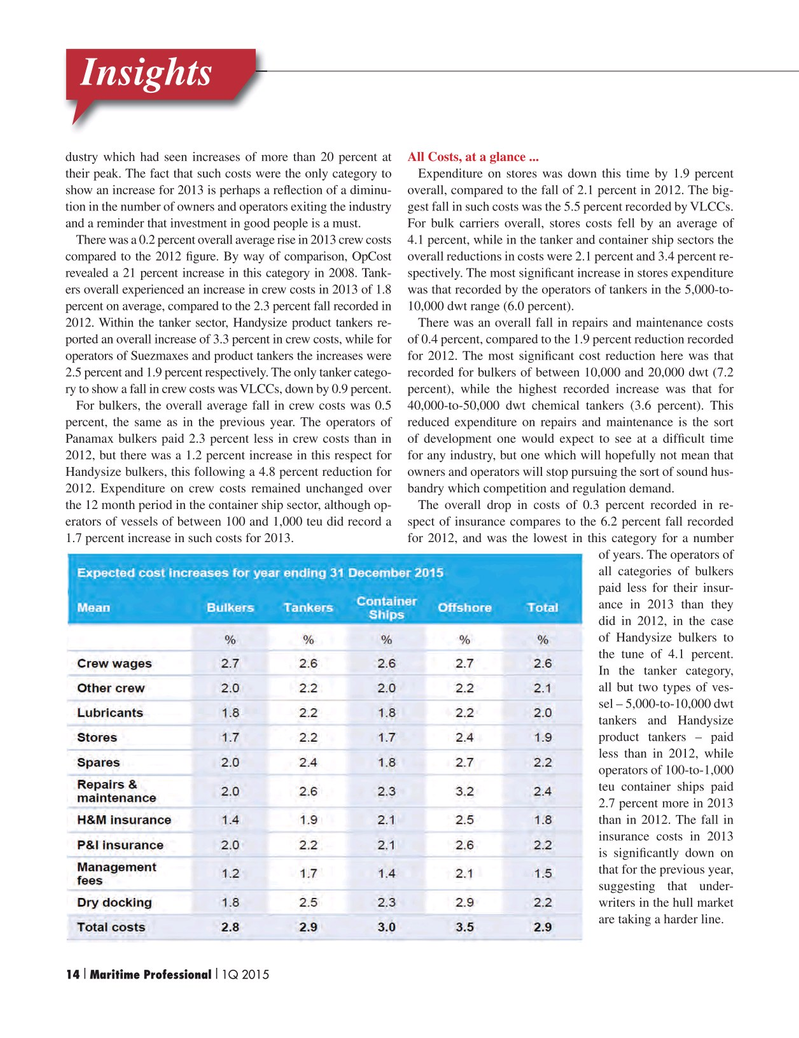

their peak. The fact that such costs were the only category to Expenditure on stores was down this time by 1.9 percent show an increase for 2013 is perhaps a re? ection of a diminu- overall, compared to the fall of 2.1 percent in 2012. The big- tion in the number of owners and operators exiting the industry gest fall in such costs was the 5.5 percent recorded by VLCCs. and a reminder that investment in good people is a must. For bulk carriers overall, stores costs fell by an average of

There was a 0.2 percent overall average rise in 2013 crew costs 4.1 percent, while in the tanker and container ship sectors the compared to the 2012 ? gure. By way of comparison, OpCost overall reductions in costs were 2.1 percent and 3.4 percent re- revealed a 21 percent increase in this category in 2008. Tank- spectively. The most signi? cant increase in stores expenditure ers overall experienced an increase in crew costs in 2013 of 1.8 was that recorded by the operators of tankers in the 5,000-to- percent on average, compared to the 2.3 percent fall recorded in 10,000 dwt range (6.0 percent).

2012. Within the tanker sector, Handysize product tankers re- There was an overall fall in repairs and maintenance costs ported an overall increase of 3.3 percent in crew costs, while for of 0.4 percent, compared to the 1.9 percent reduction recorded operators of Suezmaxes and product tankers the increases were for 2012. The most signi? cant cost reduction here was that 2.5 percent and 1.9 percent respectively. The only tanker catego- recorded for bulkers of between 10,000 and 20,000 dwt (7.2 ry to show a fall in crew costs was VLCCs, down by 0.9 percent. percent), while the highest recorded increase was that for

For bulkers, the overall average fall in crew costs was 0.5 40,000-to-50,000 dwt chemical tankers (3.6 percent). This percent, the same as in the previous year. The operators of reduced expenditure on repairs and maintenance is the sort

Panamax bulkers paid 2.3 percent less in crew costs than in of development one would expect to see at a dif? cult time 2012, but there was a 1.2 percent increase in this respect for for any industry, but one which will hopefully not mean that

Handysize bulkers, this following a 4.8 percent reduction for owners and operators will stop pursuing the sort of sound hus- 2012. Expenditure on crew costs remained unchanged over bandry which competition and regulation demand.

the 12 month period in the container ship sector, although op- The overall drop in costs of 0.3 percent recorded in re- erators of vessels of between 100 and 1,000 teu did record a spect of insurance compares to the 6.2 percent fall recorded 1.7 percent increase in such costs for 2013. for 2012, and was the lowest in this category for a number of years. The operators of all categories of bulkers paid less for their insur- ance in 2013 than they did in 2012, in the case of Handysize bulkers to the tune of 4.1 percent.

In the tanker category, all but two types of ves- sel – 5,000-to-10,000 dwt tankers and Handysize product tankers – paid less than in 2012, while operators of 100-to-1,000 teu container ships paid 2.7 percent more in 2013 than in 2012. The fall in insurance costs in 2013 is signi? cantly down on that for the previous year, suggesting that under- writers in the hull market are taking a harder line.

14 Maritime Professional 1Q 2015I I

13

13

15

15