Page 48: of Maritime Logistics Professional Magazine (Q4 2016)

Workboats

Read this page in Pdf, Flash or Html5 edition of Q4 2016 Maritime Logistics Professional Magazine

FINANCE

Shipping Industry Con? dence Improves – with Caveats

Operating Cost Movements are Central to Shipping’s Fortunes.

By Richard Greiner hipping has certainly lived up to its reputation for

Line Items: crew costs surprisingly down volatility during the past twelve months. The quarterly There was a 1.2% overall average fall in 2015 crew costs,

SMoore Stephens Shipping Con? dence Survey showed compared to the 2014 ? gure, which itself was 0.1% down on industry con? dence improving for the second successive 2013. By way of comparison, the 2008 report revealed a 21% quarter in the three months to end-August 2016, but this was increase in this category. Tankers overall experienced a fall in from its lowest level for eight years. crew costs of 1.3% on average, compared to the 0.4% fall re- corded in 2014. All categories of tankers reported a reduction

Familiar Story, a Welcome New Chapter in crew costs for 2015 with the exception of Panamaxes and

The industry has been beset by a range of all-too-familiar VLCCs. The most signi? cant reduction in tanker crew costs problems, including depressed freight rates, tonnage over- for 2015 was the 3.6% recorded by Product Tankers.

capacity in many sectors, problematic geopolitical develop- For bulkers, meanwhile, the overall average fall in crew ments and mounting regulation. The good news, however, is costs in 2015 was 1.1%. The operators of Handysize Bulkers that total annual operating costs in the industry fell by an av- paid 2.3% more in crew costs than in 2014, but the operators erage of 2.4% in 2015. This compares with the 0.8% average of other categories of bulker paid less, in the case of Panamax fall in costs recorded for 2014, and is the fourth successive Bulkers to the tune of 3.2%.

overall year-on-year reduction in such costs. All categories of Expenditure on crew costs was down 3.3% in the container expenditure were down on those for the previous 12-month ship sector. The biggest fall in crew costs in this category was period. This suggests continued pragmatic management of the 3.6% reduction recorded for vessels of between 2,000 and costs by ship owners and operators. 6,000 teu.

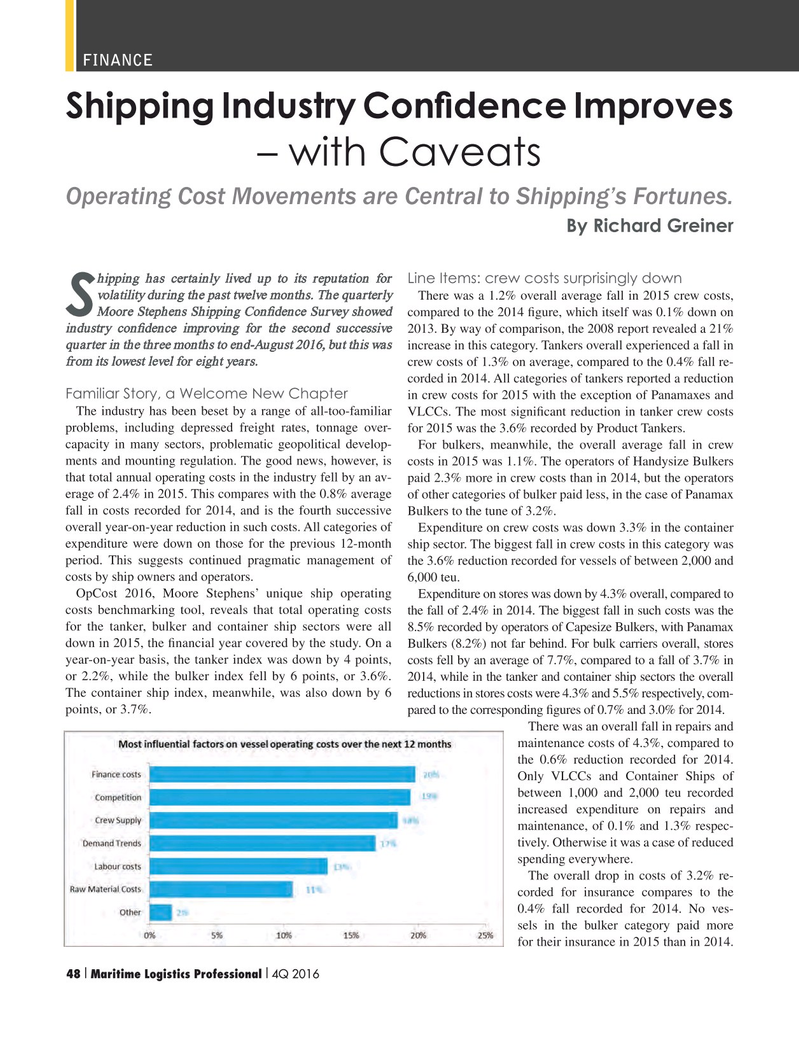

OpCost 2016, Moore Stephens’ unique ship operating Expenditure on stores was down by 4.3% overall, compared to costs benchmarking tool, reveals that total operating costs the fall of 2.4% in 2014. The biggest fall in such costs was the for the tanker, bulker and container ship sectors were all 8.5% recorded by operators of Capesize Bulkers, with Panamax down in 2015, the ? nancial year covered by the study. On a Bulkers (8.2%) not far behind. For bulk carriers overall, stores year-on-year basis, the tanker index was down by 4 points, costs fell by an average of 7.7%, compared to a fall of 3.7% in or 2.2%, while the bulker index fell by 6 points, or 3.6%. 2014, while in the tanker and container ship sectors the overall

The container ship index, meanwhile, was also down by 6 reductions in stores costs were 4.3% and 5.5% respectively, com- points, or 3.7%. pared to the corresponding ? gures of 0.7% and 3.0% for 2014.

There was an overall fall in repairs and maintenance costs of 4.3%, compared to the 0.6% reduction recorded for 2014.

Only VLCCs and Container Ships of between 1,000 and 2,000 teu recorded increased expenditure on repairs and maintenance, of 0.1% and 1.3% respec- tively. Otherwise it was a case of reduced spending everywhere.

The overall drop in costs of 3.2% re- corded for insurance compares to the 0.4% fall recorded for 2014. No ves- sels in the bulker category paid more for their insurance in 2015 than in 2014. 48 Maritime Logistics Professional 4Q 2016I I 34-49 Q4 MP2016.indd 48 11/9/2016 12:27:51 PM

47

47

49

49