Page 25: of Maritime Logistics Professional Magazine (Jan/Feb 2017)

CRUISE SHIPPING PORTS

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2017 Maritime Logistics Professional Magazine

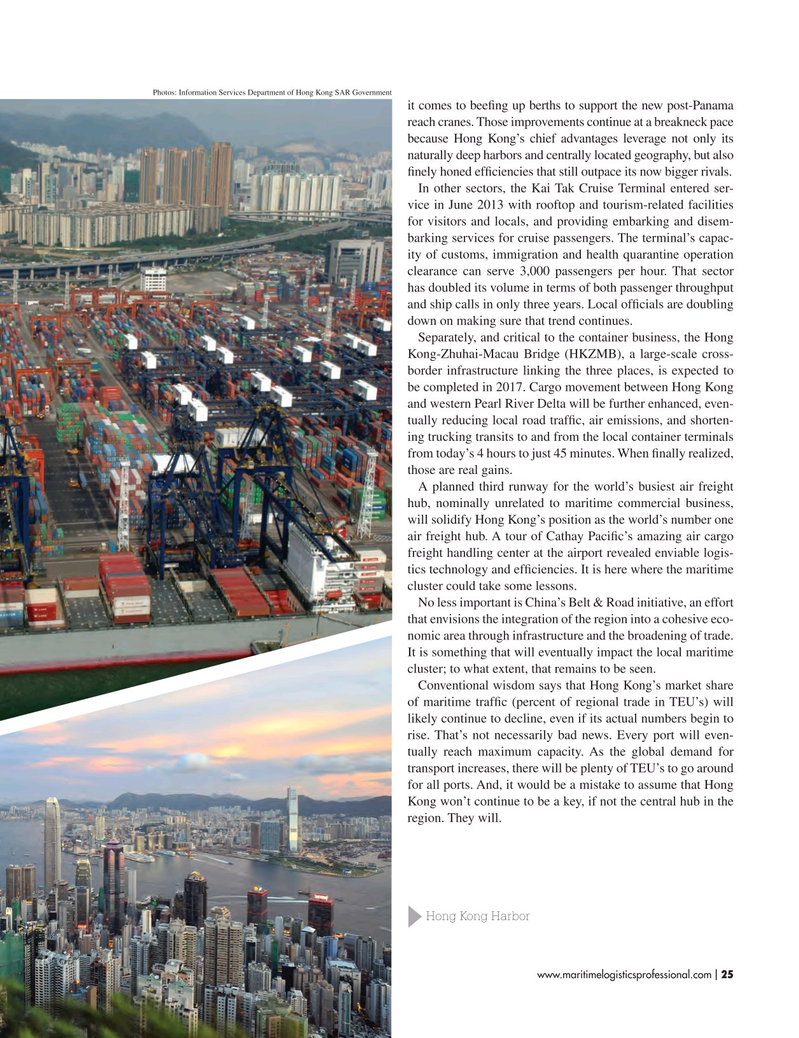

Photos: Information Services Department of Hong Kong SAR Government it comes to bee? ng up berths to support the new post-Panama reach cranes. Those improvements continue at a breakneck pace because Hong Kong’s chief advantages leverage not only its naturally deep harbors and centrally located geography, but also ? nely honed ef? ciencies that still outpace its now bigger rivals.

In other sectors, the Kai Tak Cruise Terminal entered ser- vice in June 2013 with rooftop and tourism-related facilities for visitors and locals, and providing embarking and disem- barking services for cruise passengers. The terminal’s capac- ity of customs, immigration and health quarantine operation clearance can serve 3,000 passengers per hour. That sector has doubled its volume in terms of both passenger throughput and ship calls in only three years. Local of? cials are doubling down on making sure that trend continues.

Separately, and critical to the container business, the Hong

Kong-Zhuhai-Macau Bridge (HKZMB), a large-scale cross- border infrastructure linking the three places, is expected to be completed in 2017. Cargo movement between Hong Kong and western Pearl River Delta will be further enhanced, even- tually reducing local road traf? c, air emissions, and shorten- ing trucking transits to and from the local container terminals from today’s 4 hours to just 45 minutes. When ? nally realized, those are real gains.

A planned third runway for the world’s busiest air freight hub, nominally unrelated to maritime commercial business, will solidify Hong Kong’s position as the world’s number one air freight hub. A tour of Cathay Paci? c’s amazing air cargo freight handling center at the airport revealed enviable logis- tics technology and ef? ciencies. It is here where the maritime cluster could take some lessons.

No less important is China’s Belt & Road initiative, an effort that envisions the integration of the region into a cohesive eco- nomic area through infrastructure and the broadening of trade.

It is something that will eventually impact the local maritime cluster; to what extent, that remains to be seen.

Conventional wisdom says that Hong Kong’s market share of maritime traf? c (percent of regional trade in TEU’s) will likely continue to decline, even if its actual numbers begin to rise. That’s not necessarily bad news. Every port will even- tually reach maximum capacity. As the global demand for transport increases, there will be plenty of TEU’s to go around for all ports. And, it would be a mistake to assume that Hong

Kong won’t continue to be a key, if not the central hub in the region. They will.

Hong Kong Harbor www.maritimelogisticsprofessional.com 25

I

24

24

26

26