Page 34: of Maritime Logistics Professional Magazine (Sep/Oct 2017)

CONTAINER PORTS

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2017 Maritime Logistics Professional Magazine

STATISTICS

NOLA P t … B N , O yOrt rAffic y the umBers ver the eArs

They don’t call the Port of New Orleans America’s ‘Most three years. That growth equates to an estimated increase of

Intermodal Port’ for nothing. That’s because Port NOLA to- 400,000 TEUs of plastic resin exports from the Gulf region day is the only U.S. port served by all six frst-class roads. between now and 2020. Port NOLA aims to win the lion’s

But it also enjoys several other distinctions, another being one share of that volume.

of the nation’s diverse ports. With breakbulk, bulk, container, And, while it is rare for a port to be able to peacefully co- tanker, and cruise traffc all calling at the port in robust num- exist with a robust industrial cargo sector while also hosting a bers, there is little that the port doesn’t handle in a commer- thriving cruise business, that’s exactly what the Big Easy has cial fashion. The U.S. Army Corps of Engineers has a plan to done. Where other ports fret about harbor ‘regentrifcation’ deepen the Mississippi River Ship Channel from its current 45 and loss of commercial waterfront space due to encroaching feet to a 50-foot draft, the controlling draft of the expanded hotels, condos and retail growth, Port NOLA has – in an in-

Panama Canal locks, something that will no doubt increase novative fashion – engineered land swaps that maximize both the port’s tonnage totals when it comes to fruition. But, even sides of the equation. Notably, Royal Caribbean International the advent of bigger megaships hasn’t (yet) slowed the port’s has announced that it will return to New Orleans in 2018. As total ship call numbers, which have spiked to 1,676 in the past a tourist destination rich in culture, history and hospitality fve years alone. A look at the data also tells us that in most knowhow, the Port handled 1,070,695 cruise passengers in categories, tonnage totals, TEU’s, port calls, and passenger 2016 (and that number is increasing year-on-year) and ranks numbers are all headed in the same direction: UP. as the sixth-largest cruise port in the United States, with direct

The port’s diversity is its real strength, serving as an eco- industry expenditures in Louisiana of $406 million. A key as- nomic driver in the region, and able to transcend down years pect of growing cruise opportunities includes optimizing ca- in one sector by strong years in another. Containers now ac- pacity at two state-of-the-art cruise terminals.

count for nearly 50% of its cargo revenue. That trend is like The Port of New Orleans – a public agency that manages to continue, as the Port dedicated the $25 million Mississippi more than $60 million in revenues, nearly 300 employees and

River Intermodal Terminal in April 2016. Made possible by $200 million in capital projects – is known in some circles as a $16.7 million TIGER grant, the terminal is equipped with the nation’s most intermodal port. If so, then the descriptor on-dock rail access to move cargo via the New Orleans Pub- “most multimodal” should also be added to its moniker.

lic Belt Railroad which serves Port tenants and switches for all 6 Class I railroads. Beyond this, the terminal has the ca- pacity of moving 160,000 TEUs per year by rail. Because of those types of investments, overall container volumes have grown signifcantly. Today, the Port handles about 540,000

TEUs on an annual basis, but can handle more – up to

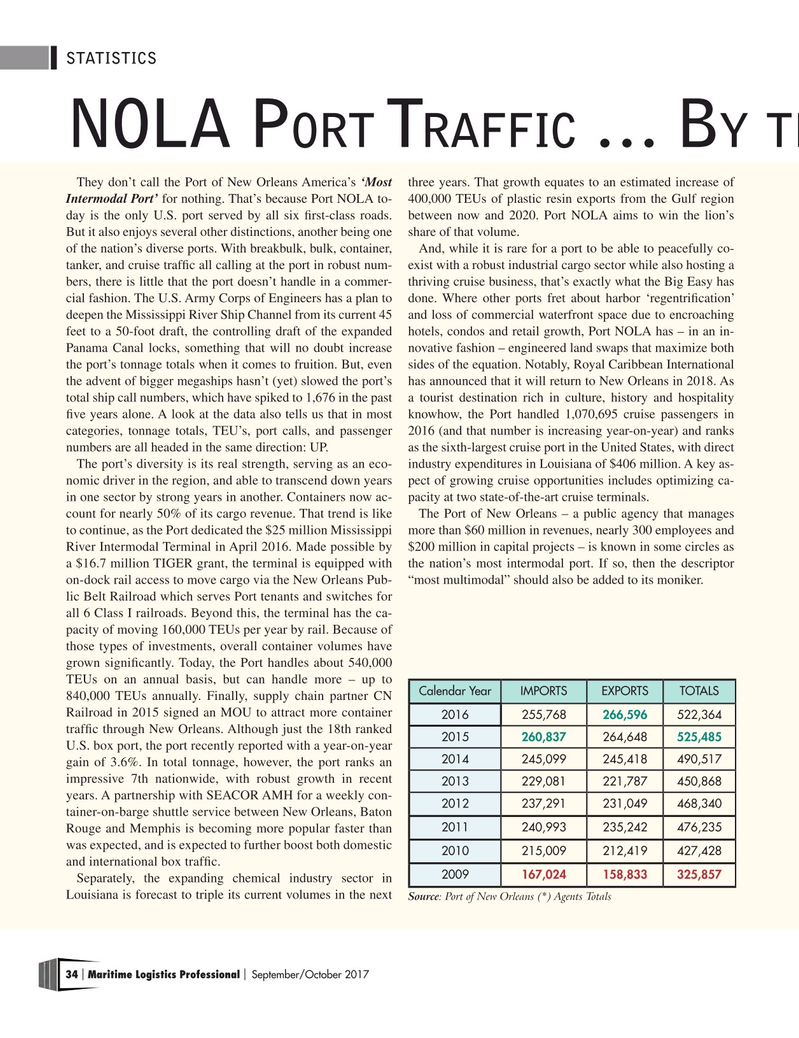

Calendar Year IMPORTS EXPORTS TOTALS 840,000 TEUs annually. Finally, supply chain partner CN

Railroad in 2015 signed an MOU to attract more container 2016 255,768 266,596 522,364 traffc through New Orleans. Although just the 18th ranked 2015 260,837 264,648 525,485

U.S. box port, the port recently reported with a year-on-year 2014 245,099 245,418 490,517 gain of 3.6%. In total tonnage, however, the port ranks an impressive 7th nationwide, with robust growth in recent 2013 229,081 221,787 450,868 years. A partnership with SEACOR AMH for a weekly con- 2012 237,291 231,049 468,340 tainer-on-barge shuttle service between New Orleans, Baton 2011 240,993 235,242 476,235

Rouge and Memphis is becoming more popular faster than was expected, and is expected to further boost both domestic 2010 215,009 212,419 427,428 and international box traffc.

2009 167,024 158,833 325,857

Separately, the expanding chemical industry sector in

Louisiana is forecast to triple its current volumes in the next

Source: Port of New Orleans (*) Agents Totals 34 Maritime Logistics Professional September/October 2017 | |

33

33

35

35