Page 51: of Maritime Logistics Professional Magazine (Sep/Oct 2017)

CONTAINER PORTS

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2017 Maritime Logistics Professional Magazine

EQUIPMENT

MEET ZPMC THE SUPPLY CHAIN OF CRANES

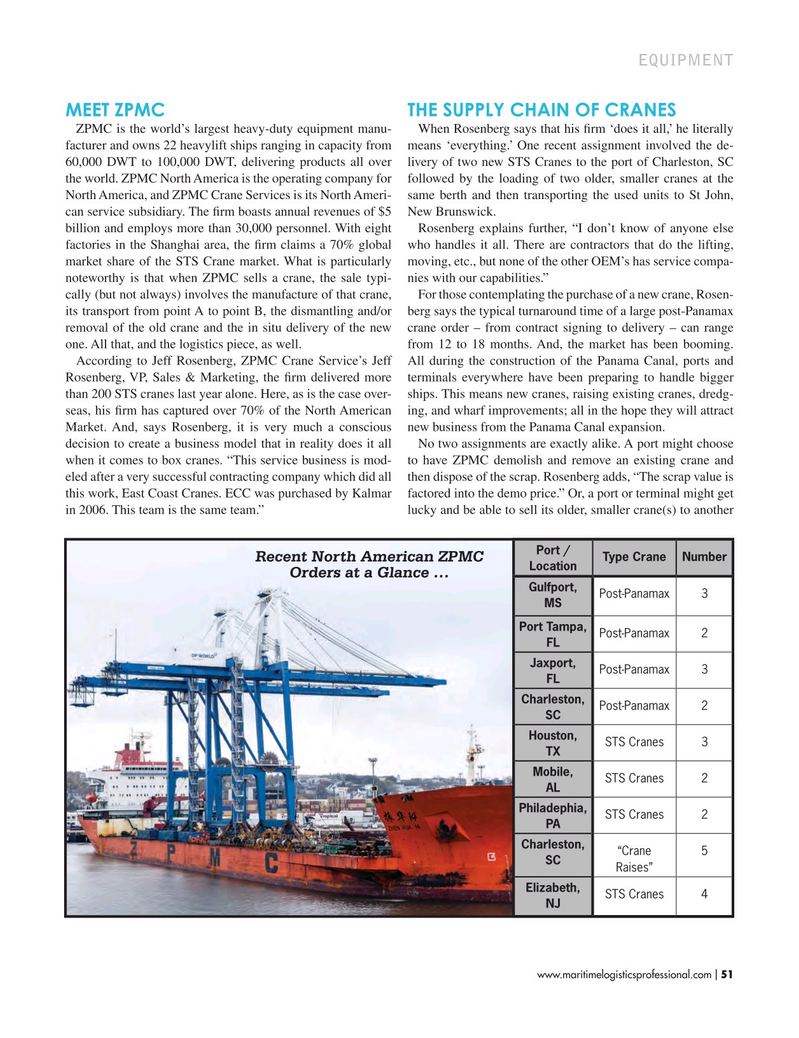

ZPMC is the world’s largest heavy-duty equipment manu- When Rosenberg says that his frm ‘does it all,’ he literally facturer and owns 22 heavylift ships ranging in capacity from means ‘everything.’ One recent assignment involved the de- 60,000 DWT to 100,000 DWT, delivering products all over livery of two new STS Cranes to the port of Charleston, SC the world. ZPMC North America is the operating company for followed by the loading of two older, smaller cranes at the

North America, and ZPMC Crane Services is its North Ameri- same berth and then transporting the used units to St John, can service subsidiary. The frm boasts annual revenues of $5 New Brunswick.

billion and employs more than 30,000 personnel. With eight Rosenberg explains further, “I don’t know of anyone else factories in the Shanghai area, the frm claims a 70% global who handles it all. There are contractors that do the lifting, market share of the STS Crane market. What is particularly moving, etc., but none of the other OEM’s has service compa- noteworthy is that when ZPMC sells a crane, the sale typi- nies with our capabilities.” cally (but not always) involves the manufacture of that crane, For those contemplating the purchase of a new crane, Rosen- its transport from point A to point B, the dismantling and/or berg says the typical turnaround time of a large post-Panamax removal of the old crane and the in situ delivery of the new crane order – from contract signing to delivery – can range one. All that, and the logistics piece, as well. from 12 to 18 months. And, the market has been booming.

According to Jeff Rosenberg, ZPMC Crane Service’s Jeff All during the construction of the Panama Canal, ports and

Rosenberg, VP, Sales & Marketing, the frm delivered more terminals everywhere have been preparing to handle bigger than 200 STS cranes last year alone. Here, as is the case over- ships. This means new cranes, raising existing cranes, dredg- seas, his frm has captured over 70% of the North American ing, and wharf improvements; all in the hope they will attract

Market. And, says Rosenberg, it is very much a conscious new business from the Panama Canal expansion.

decision to create a business model that in reality does it all No two assignments are exactly alike. A port might choose when it comes to box cranes. “This service business is mod- to have ZPMC demolish and remove an existing crane and eled after a very successful contracting company which did all then dispose of the scrap. Rosenberg adds, “The scrap value is this work, East Coast Cranes. ECC was purchased by Kalmar factored into the demo price.” Or, a port or terminal might get in 2006. This team is the same team.” lucky and be able to sell its older, smaller crane(s) to another

Port /

Type Crane Number

Recent North American ZPMC

Location

Orders at a Glance …

Gulfport,

Post-Panamax 3

MS

Port Tampa, Post-Panamax 2

FL

Jaxport,

Post-Panamax 3

FL

Charleston,

Post-Panamax 2

SC

Houston,

STS Cranes 3

TX

Mobile,

STS Cranes 2

AL

Philadephia,

STS Cranes 2

PA

Charleston, “Crane 5

SC

Raises”

Elizabeth,

STS Cranes 4

NJ www.maritimelogisticsprofessional.com 51

I

50

50

52

52