Page 45: of Maritime Logistics Professional Magazine (Mar/Apr 2018)

IT & Software

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2018 Maritime Logistics Professional Magazine

BULK CARRIER REPORT

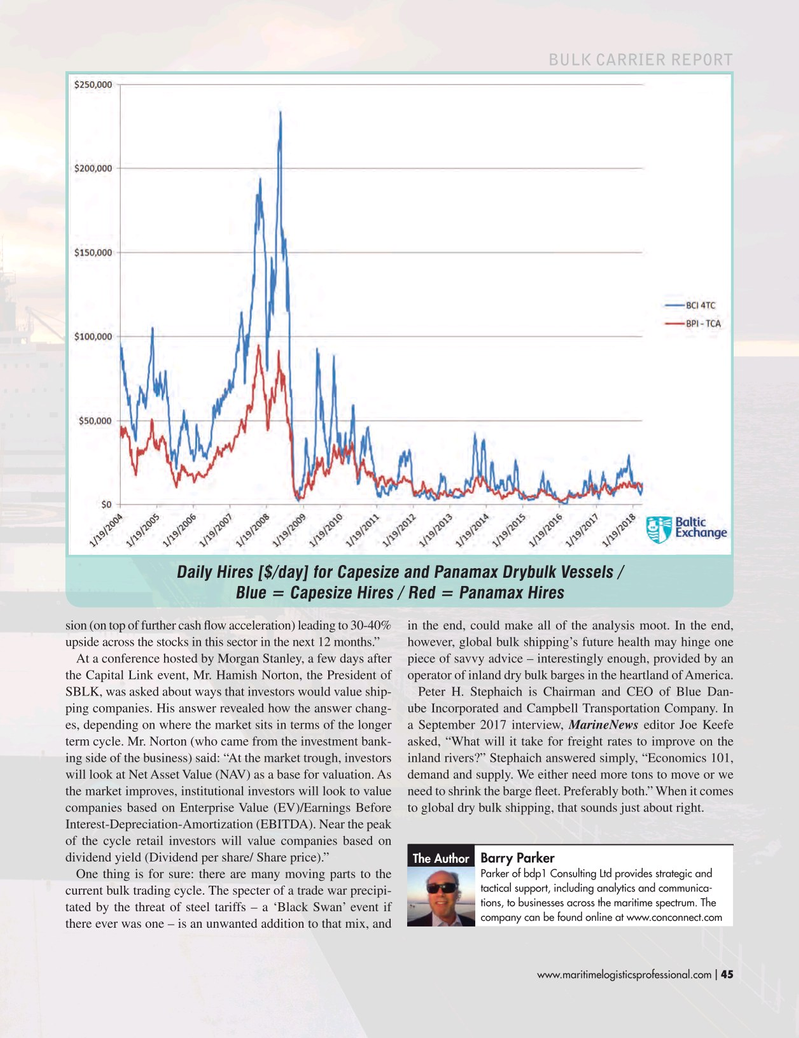

Daily Hires [$/day] for Capesize and Panamax Drybulk Vessels /

Blue = Capesize Hires / Red = Panamax Hires sion (on top of further cash fow acceleration) leading to 30-40% in the end, could make all of the analysis moot. In the end, upside across the stocks in this sector in the next 12 months.” however, global bulk shipping’s future health may hinge one

At a conference hosted by Morgan Stanley, a few days after piece of savvy advice – interestingly enough, provided by an the Capital Link event, Mr. Hamish Norton, the President of operator of inland dry bulk barges in the heartland of America.

SBLK, was asked about ways that investors would value ship- Peter H. Stephaich is Chairman and CEO of Blue Dan- ping companies. His answer revealed how the answer chang- ube Incorporated and Campbell Transportation Company. In es, depending on where the market sits in terms of the longer a September 2017 interview, MarineNews editor Joe Keefe term cycle. Mr. Norton (who came from the investment bank- asked, “What will it take for freight rates to improve on the ing side of the business) said: “At the market trough, investors inland rivers?” Stephaich answered simply, “Economics 101, will look at Net Asset Value (NAV) as a base for valuation. As demand and supply. We either need more tons to move or we the market improves, institutional investors will look to value need to shrink the barge feet. Preferably both.” When it comes companies based on Enterprise Value (EV)/Earnings Before to global dry bulk shipping, that sounds just about right.

Interest-Depreciation-Amortization (EBITDA). Near the peak of the cycle retail investors will value companies based on dividend yield (Dividend per share/ Share price).” Barry Parker

The Author

Parker of bdp1 Consulting Ltd provides strategic and

One thing is for sure: there are many moving parts to the tactical support, including analytics and communica- current bulk trading cycle. The specter of a trade war precipi- tions, to businesses across the maritime spectrum. The tated by the threat of steel tariffs – a ‘Black Swan’ event if company can be found online at www.conconnect.com there ever was one – is an unwanted addition to that mix, and www.maritimelogisticsprofessional.com 45

I

44

44

46

46