Page 33: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

States, the EU and China – is getting louder. After all, much of the global supply chain is holding its breath

For his part, BIMCO’s Peter Sand has insisted that the impend- to see what happens next.

ing trade war “…is all about the eastbound trans-Pacifc trade To that end, and in terms of the bigger sanctions picture, lane.” In mid May, the U.S. toned down its rhetoric, suggesting Drewry noted, “Previous trading restrictions have meant that that it would look for a rapprochement with China, rather than neither Russia nor Iran has lived up to its billing on the con- turning the China to West Coast U.S. trades into a war zone, with tainer market. A return to the trade wilderness through greater widespread tariff increases. By mid June, the U.S. had changed sanctions (deserved or not) will only increase the likelihood of its tune, in line with the rising summer temperatures. It remains that untapped container potential going to waste.” to be seen what will really happen. Data from MDS Transmodal, a UK-based consultant, shows that 18.6 million TEUs moved HORSES FOR COURSES & OTHER VARIABLES from the Far East to North America overall in 2017. Container shipping is not homogenous; it breaks down into

Separately, U.S. sanctions against Russia and now Iran are multiple subsectors. What is clear is that smaller vessels, back in the news. Consultants from Drewry, writing in their which include ships in North-South trades and regional feed-

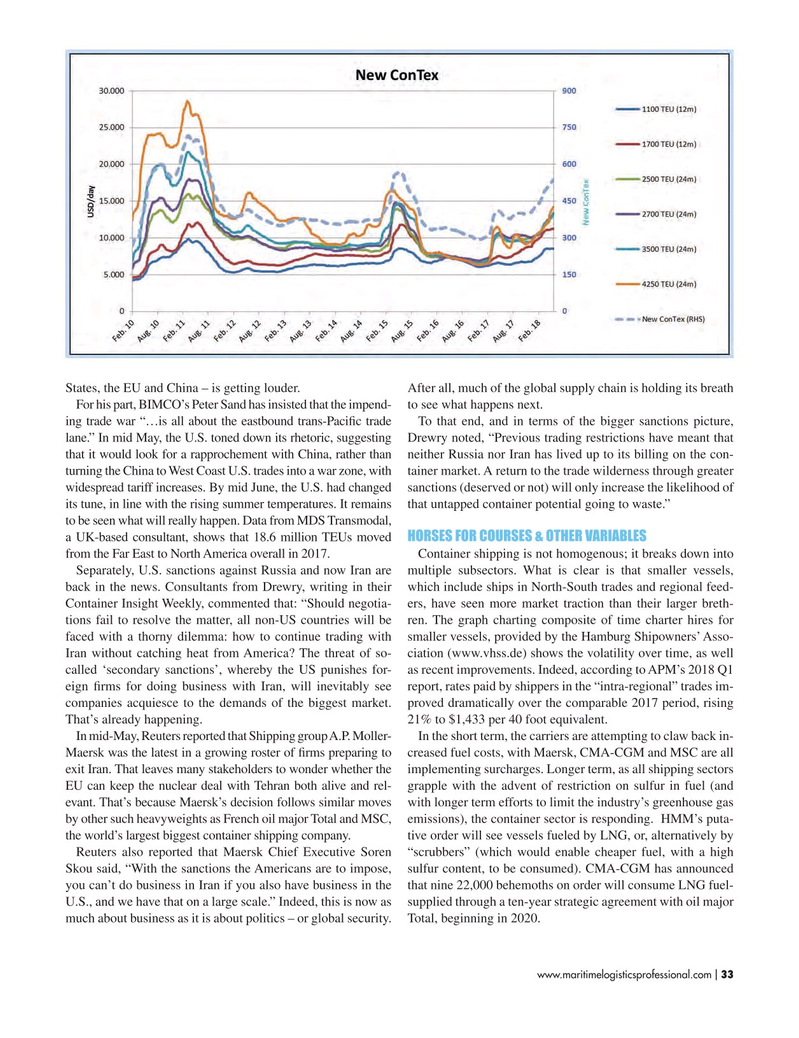

Container Insight Weekly, commented that: “Should negotia- ers, have seen more market traction than their larger breth- tions fail to resolve the matter, all non-US countries will be ren. The graph charting composite of time charter hires for faced with a thorny dilemma: how to continue trading with smaller vessels, provided by the Hamburg Shipowners’ Asso-

Iran without catching heat from America? The threat of so- ciation (www.vhss.de) shows the volatility over time, as well called ‘secondary sanctions’, whereby the US punishes for- as recent improvements. Indeed, according to APM’s 2018 Q1 eign frms for doing business with Iran, will inevitably see report, rates paid by shippers in the “intra-regional” trades im- companies acquiesce to the demands of the biggest market. proved dramatically over the comparable 2017 period, rising

That’s already happening. 21% to $1,433 per 40 foot equivalent.

In mid-May, Reuters reported that Shipping group A.P. Moller- In the short term, the carriers are attempting to claw back in-

Maersk was the latest in a growing roster of frms preparing to creased fuel costs, with Maersk, CMA-CGM and MSC are all exit Iran. That leaves many stakeholders to wonder whether the implementing surcharges. Longer term, as all shipping sectors

EU can keep the nuclear deal with Tehran both alive and rel- grapple with the advent of restriction on sulfur in fuel (and evant. That’s because Maersk’s decision follows similar moves with longer term efforts to limit the industry’s greenhouse gas by other such heavyweights as French oil major Total and MSC, emissions), the container sector is responding. HMM’s puta- the world’s largest biggest container shipping company. tive order will see vessels fueled by LNG, or, alternatively by

Reuters also reported that Maersk Chief Executive Soren “scrubbers” (which would enable cheaper fuel, with a high

Skou said, “With the sanctions the Americans are to impose, sulfur content, to be consumed). CMA-CGM has announced you can’t do business in Iran if you also have business in the that nine 22,000 behemoths on order will consume LNG fuel-

U.S., and we have that on a large scale.” Indeed, this is now as supplied through a ten-year strategic agreement with oil major much about business as it is about politics – or global security. Total, beginning in 2020. www.maritimelogisticsprofessional.com 33

I

32

32

34

34