Page 28: of Maritime Logistics Professional Magazine (Mar/Apr 2019)

Container Ports

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2019 Maritime Logistics Professional Magazine

Container Ports

Credit: Port NY/NJ

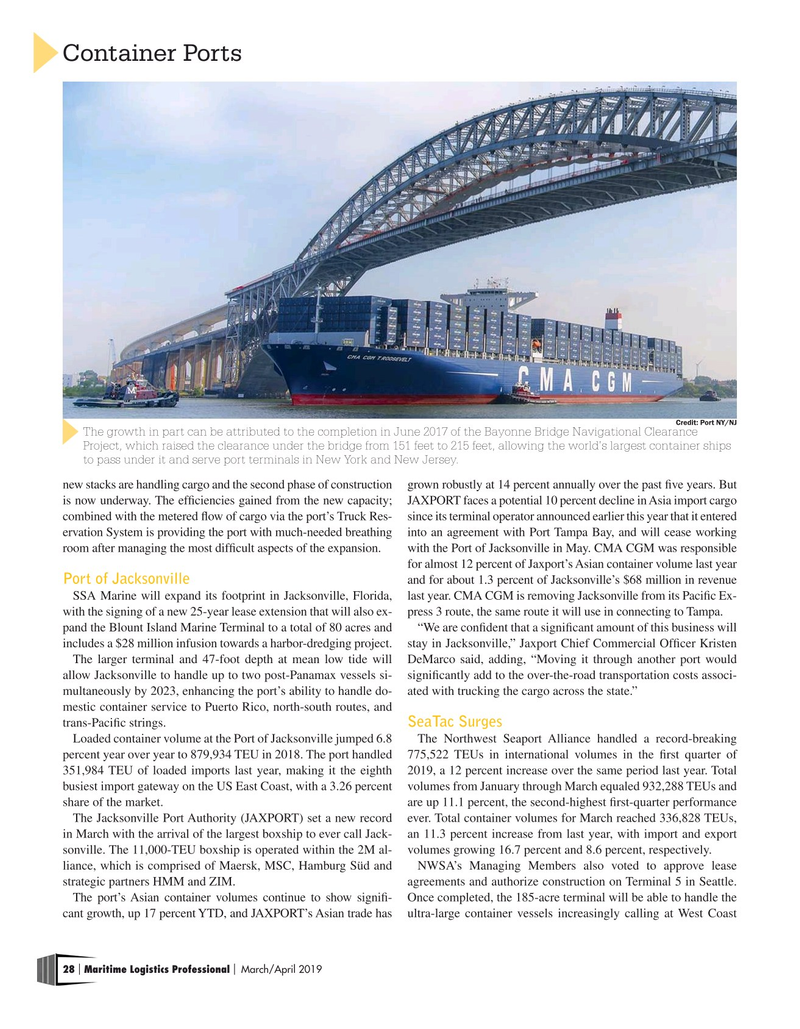

The growth in part can be attributed to the completion in June 2017 of the Bayonne Bridge Navigational Clearance

Project, which raised the clearance under the bridge from 151 feet to 215 feet, allowing the world’s largest container ships to pass under it and serve port terminals in New York and New Jersey.

new stacks are handling cargo and the second phase of construction grown robustly at 14 percent annually over the past ?ve years. But is now underway. The ef?ciencies gained from the new capacity; JAXPORT faces a potential 10 percent decline in Asia import cargo combined with the metered ?ow of cargo via the port’s Truck Res- since its terminal operator announced earlier this year that it entered ervation System is providing the port with much-needed breathing into an agreement with Port Tampa Bay, and will cease working room after managing the most dif?cult aspects of the expansion. with the Port of Jacksonville in May. CMA CGM was responsible for almost 12 percent of Jaxport’s Asian container volume last year

Port of Jacksonville and for about 1.3 percent of Jacksonville’s $68 million in revenue

SSA Marine will expand its footprint in Jacksonville, Florida, last year. CMA CGM is removing Jacksonville from its Paci?c Ex- with the signing of a new 25-year lease extension that will also ex- press 3 route, the same route it will use in connecting to Tampa.

pand the Blount Island Marine Terminal to a total of 80 acres and “We are con?dent that a signi?cant amount of this business will includes a $28 million infusion towards a harbor-dredging project. stay in Jacksonville,” Jaxport Chief Commercial Of?cer Kristen

The larger terminal and 47-foot depth at mean low tide will DeMarco said, adding, “Moving it through another port would allow Jacksonville to handle up to two post-Panamax vessels si- signi?cantly add to the over-the-road transportation costs associ- multaneously by 2023, enhancing the port’s ability to handle do- ated with trucking the cargo across the state.” mestic container service to Puerto Rico, north-south routes, and trans-Paci?c strings. SeaTac Surges

Loaded container volume at the Port of Jacksonville jumped 6.8 The Northwest Seaport Alliance handled a record-breaking percent year over year to 879,934 TEU in 2018. The port handled 775,522 TEUs in international volumes in the ?rst quarter of 351,984 TEU of loaded imports last year, making it the eighth 2019, a 12 percent increase over the same period last year. Total busiest import gateway on the US East Coast, with a 3.26 percent volumes from January through March equaled 932,288 TEUs and share of the market. are up 11.1 percent, the second-highest ?rst-quarter performance

The Jacksonville Port Authority (JAXPORT) set a new record ever. Total container volumes for March reached 336,828 TEUs, in March with the arrival of the largest boxship to ever call Jack- an 11.3 percent increase from last year, with import and export sonville. The 11,000-TEU boxship is operated within the 2M al- volumes growing 16.7 percent and 8.6 percent, respectively.

liance, which is comprised of Maersk, MSC, Hamburg Süd and NWSA’s Managing Members also voted to approve lease strategic partners HMM and ZIM. agreements and authorize construction on Terminal 5 in Seattle.

The port’s Asian container volumes continue to show signi?- Once completed, the 185-acre terminal will be able to handle the cant growth, up 17 percent YTD, and JAXPORT’s Asian trade has ultra-large container vessels increasingly calling at West Coast 28 Maritime Logistics Professional March/April 2019 | |

27

27

29

29