Page 15: of Maritime Logistics Professional Magazine (May/Jun 2019)

US and International Navy Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2019 Maritime Logistics Professional Magazine

P

A

R

K

E

R

Marine Highways Gain

Traction in the Intermodal

Supply Chain itime Administration’s shortsea shipping initiative, the so-called lar amount, $1.8 million, went to Harbor Harvest, a newly launched

Americas Marine Highway program, is ?nally gaining traction. service linking Long Island with southern Connecticut (circum-

The DOT’s initial justi?cation for shortsea shipping was to re- venting the worsening I-95 and I-495 snarl in the NYC metro area. duce road congestion, but its mandate has now broadened to in- The three programs mentioned above, today small in actual clude environmental concerns and a more ef?cient supply chain. volumes, represent important nodes in the broader supply chain.

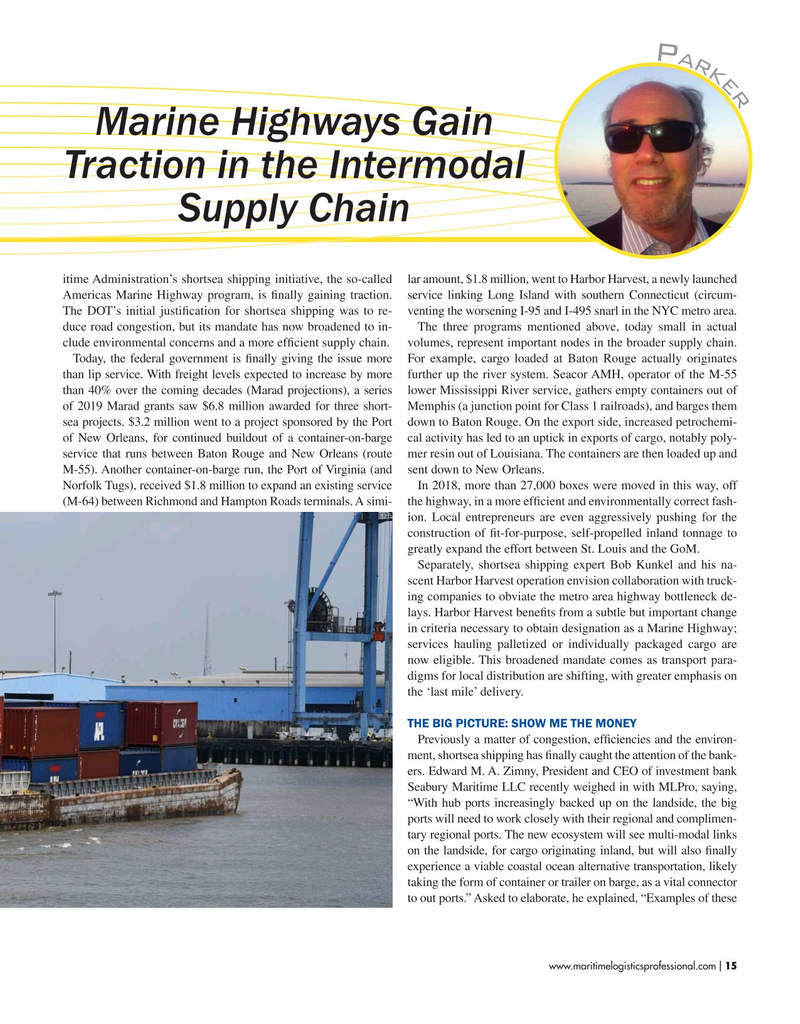

Today, the federal government is ?nally giving the issue more For example, cargo loaded at Baton Rouge actually originates than lip service. With freight levels expected to increase by more further up the river system. Seacor AMH, operator of the M-55 than 40% over the coming decades (Marad projections), a series lower Mississippi River service, gathers empty containers out of of 2019 Marad grants saw $6.8 million awarded for three short- Memphis (a junction point for Class 1 railroads), and barges them sea projects. $3.2 million went to a project sponsored by the Port down to Baton Rouge. On the export side, increased petrochemi- of New Orleans, for continued buildout of a container-on-barge cal activity has led to an uptick in exports of cargo, notably poly- service that runs between Baton Rouge and New Orleans (route mer resin out of Louisiana. The containers are then loaded up and

M-55). Another container-on-barge run, the Port of Virginia (and sent down to New Orleans.

Norfolk Tugs), received $1.8 million to expand an existing service In 2018, more than 27,000 boxes were moved in this way, off (M-64) between Richmond and Hampton Roads terminals. A simi- the highway, in a more ef?cient and environmentally correct fash- ion. Local entrepreneurs are even aggressively pushing for the construction of ?t-for-purpose, self-propelled inland tonnage to greatly expand the effort between St. Louis and the GoM.

Separately, shortsea shipping expert Bob Kunkel and his na- scent Harbor Harvest operation envision collaboration with truck- ing companies to obviate the metro area highway bottleneck de- lays. Harbor Harvest bene?ts from a subtle but important change in criteria necessary to obtain designation as a Marine Highway; services hauling palletized or individually packaged cargo are now eligible. This broadened mandate comes as transport para- digms for local distribution are shifting, with greater emphasis on the ‘last mile’ delivery.

THE BIG PICTURE: SHOW ME THE MONEY

Previously a matter of congestion, ef?ciencies and the environ- ment, shortsea shipping has ?nally caught the attention of the bank- ers. Edward M. A. Zimny, President and CEO of investment bank

Seabury Maritime LLC recently weighed in with MLPro, saying, “With hub ports increasingly backed up on the landside, the big ports will need to work closely with their regional and complimen- tary regional ports. The new ecosystem will see multi-modal links on the landside, for cargo originating inland, but will also ?nally experience a viable coastal ocean alternative transportation, likely taking the form of container or trailer on barge, as a vital connector to out ports.” Asked to elaborate, he explained, “Examples of these www.maritimelogisticsprofessional.com 15

I

14

14

16

16