Page 24: of Maritime Reporter Magazine (June 1989)

Read this page in Pdf, Flash or Html5 edition of June 1989 Maritime Reporter Magazine

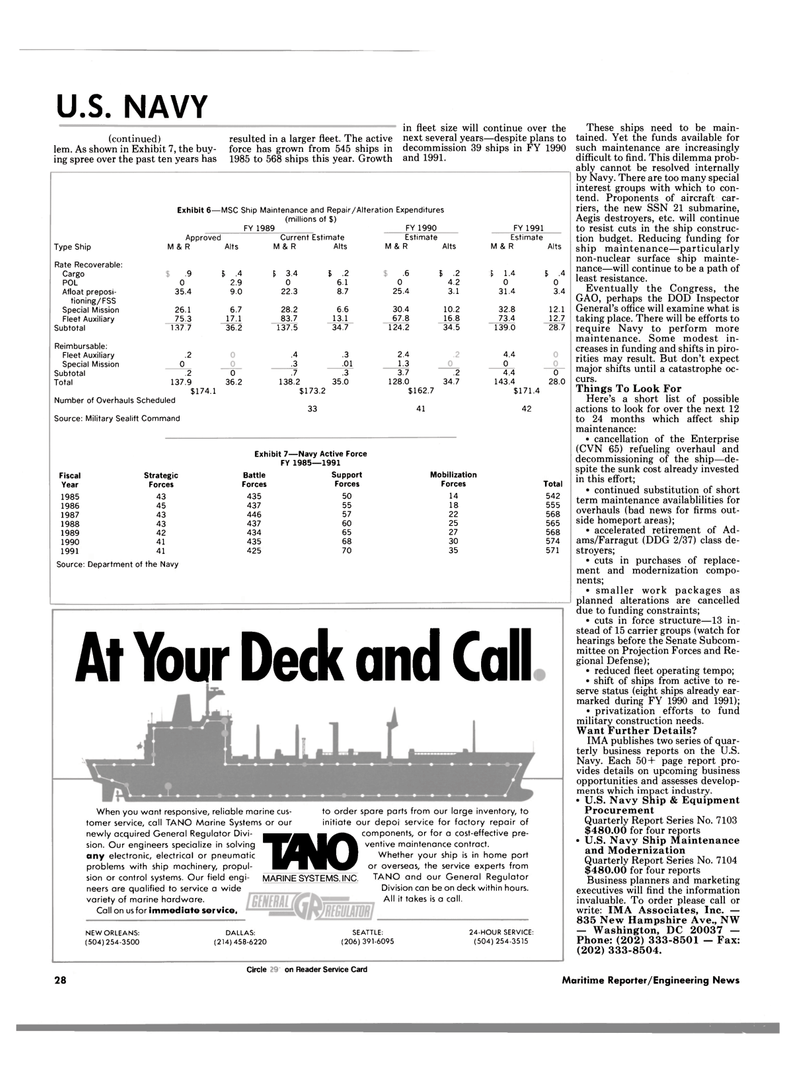

U.S. NAVY (continued) lem. As shown in Exhibit 7, the buy- ing spree over the past ten years has

Type Ship

Rate Recoverable:

Cargo

POL

Afloat preposi- tioning/FSS

Special Mission

Fleet Auxiliary

Subtotal

Reimbursable:

Fleet Auxiliary .2

Special Mission 0

Subtotal .2

Total 137.9 $174.1

Number of Overhauls Scheduled

Source: Military Sealift Command

Fiscal Strategic

Year Forces 1985 43 1986 45 1987 43 1988 43 1989 42 1990 41 1991 41

Source: Department of the Navy resulted in a larger fleet. The active force has grown from 545 ships in 1985 to 568 ships this year. Growth in fleet size will continue over the next several years—despite plans to decommission 39 ships in FY 1990 and 1991.

These ships need to be main- tained. Yet the funds available for such maintenance are increasingly difficult to find. This dilemma prob- ably cannot be resolved internally by Navy. There are too many special interest groups with which to con- tend. Proponents of aircraft car- riers, the new SSN 21 submarine,

Aegis destroyers, etc. will continue to resist cuts in the ship construc- tion budget. Reducing funding for ship maintenance—particularly non-nuclear surface ship mainte- nance—will continue to be a path of least resistance.

Eventually the Congress, the

GAO, perhaps the DOD Inspector

General's office will examine what is taking place. There will be efforts to require Navy to perform more maintenance. Some modest in- creases in funding and shifts in piro- rities may result. But don't expect major shifts until a catastrophe oc- curs.

Things To Look For

Here's a short list of possible actions to look for over the next 12 to 24 months which affect ship maintenance: • cancellation of the Enterprise (CVN 65) refueling overhaul and decommissioning of the ship—de- spite the sunk cost already invested in this effort; • continued substitution of short term maintenance availablilities for overhauls (bad news for firms out- side homeport areas); • accelerated retirement of Ad- ams/Farragut (DDG 2/37) class de- stroyers; • cuts in purchases of replace- ment and modernization compo- nents; • smaller work packages as planned alterations are cancelled due to funding constraints; • cuts in force structure—13 in- stead of 15 carrier groups (watch for hearings before the Senate Subcom- mittee on Projection Forces and Re- gional Defense); • reduced fleet operating tempo; • shift of ships from active to re- serve status (eight ships already ear- marked during FY 1990 and 1991); • privatization efforts to fund military construction needs.

Want Further Details?

IMA publishes two series of quar- terly business reports on the U.S.

Navy. Each 50+ page report pro- vides details on upcoming business opportunities and assesses develop- ments which impact industry. • U.S. Navy Ship & Equipment

Procurement

Quarterly Report Series No. 7103 $480.00 for four reports • U.S. Navy Ship Maintenance and Modernization

Quarterly Report Series No. 7104 $480.00 for four reports

Business planners and marketing executives will find the information invaluable. To order please call or write: IMA Associates, Inc. — 835 New Hampshire Ave., NW — Washington, DC 20037 —

Phone: (202) 333-8501 - Fax: (202) 333-8504.

Exhibit 6—MSC Ship Maintenance and Repair/Alteration Expenditures (millions of $)

FY 1989

M & R

Approved

Alts

Current Estimate

M & R Alts

FY 1990

Estimate

M & R Alts

FY 1991

Estimate

M & R Alts .9 0 35.4 26.1 75.3 137.7 $ .4 2.9 9.0 6.7 17.1 36.2 i 3.4 0 22.3 28.2 83.7 137.5 5 .2 6.1 8.7 6.6 13.1 34.7 .6 0 25.4 30.4 67.8 124.2 $ .2 4.2 3.1 10.2 16.8 34.5

I 1.4 0 31.4 32.8 73.4 139.0

I .4 0 3.4 12.1 12.7 28.7 0 36.2 .4 .3 .7 138.2 .3 .01 .3 35.0 $173.2 33 2.4 1.3 3.7 128.0 .2 34.7 $162.7 41 4.4 0 4.4 143.4 0 28.0 $171.4 42

Exhibit 7—Navy Active Force

FY 1985—1991

Battle

Forces 435 437 446 437 434 435 425

Support

Forces 50 55 57 60 65 68 70

Mobilization

Forces 14 18 22 25 27 30 35

Total 542 555 568 565 568 574 571

At Your Deck and Call

When you want responsive, reliable marine cus- tomer service, call TANO Marine Systems or our newly acquired General Regulator Divi- sion. Our engineers specialize in solving any electronic, electrical or pneumatic problems with ship machinery, propul- sion or control systems. Our field engi- neers are qualified to service a wide variety of marine hardware.

Call on us for immediate service.

TOO

MARINE SYSTEMS, INC. to order spare parts from our large inventory, to initiate our depoi service for factory repair of components, or for a cost-effective pre- ventive maintenance contract.

Whether your ship is in home port or overseas, the service experts from

TANO and our General Regulator

Division can be on deck within hours.

All it takes is a call.

NEW ORLEANS: (504)254-3500

DALLAS: (2)4)458-6220

SEATTLE: (206) 391-6095 24-HOUR SERVICE: (504) 254-3515

Circle 308 on Reader Service Card 28 Maritime Reporter/Engineering News

23

23

25

25