Page 40: of Maritime Reporter Magazine (June 1989)

Read this page in Pdf, Flash or Html5 edition of June 1989 Maritime Reporter Magazine

CANADIAN SHIPBUILDING

REVIEW AND OUTLOOK

BY J.Y. CLARKE, PRESIDENT,

CANADIAN MARITIME INDUSTRIES ASSOCIATION

The bombshell provided by Cana- da's April 1989 budget completely overshadowed any definitive review of 1988, with respect to Canada's shipyards and associated marine manufacturing and supply indus- tries. I'll return to this dramatic issue after a quick look at the year ending on December 31, 1988.

Our 1988 Shipyard Order Book total, i.e., vessels under construction and on order, declined slightly from 89,309 GT to 85,037 GT, a drop of 4.8 percent. As expected, Govern- ment contracts accounted for a ma- jority of this total, i.e., 62 percent, with the commercial component comprising fishing vessels, tugs, barges and component structures.

The value of new construction, how- ever, more than doubled.

It should also be noted that the total value of repairs and conver- sions for 1988 grew from $180 mil- lion to $214 million, or by 19 per- cent, reflecting both a significant increase of commercial refits, par- ticularly on the West Coast, and an increase in the refit value of Govern- ment vessels, including the Tribal

Class destroyer modernization pro- gram, after the effect of a 4.2 per- cent inflation rate is discounted.

On a discouraging note, the num- ber of foreign-built vessels regis- tered in Canada rose from 7 in 1987 to 18 in 1988, an increase of 257 per- cent, although the actual gross ton- nage increase was only 5.6 percent.

Nevertheless, this reflects the fail- ure of the minimal, ineffective Gov- ernment policies currently in place to protect our industry, the survival of which does not seem to be among

Government priorities, in spite of encouraging rhetoric from the bu- reaucrats of the departments con- cerned.

Employment in our member ship- yards increased by 39 percent dur- ing 1988, to an average annual figure of 7,848 from 5,649 a year earlier.

Also, at the end of 1988, employ- ment stood at 8,820, the highest lev- el for several years.

All told, 1988 tended to confirm our hopes and expectations that shipyards in Canada had "bot- tomed-out" from the 1985-86 slump and were now into a gradual recov- ery phase.

And now for the outlook—aye, there's the rub! On the commercial side, the last delivery of vessels cur- rently under construction is sched- uled for January 1990, and very lit- tle remains on the order book beyond that date. We believe that the larger fisheries are still planning accelerated fleet renovation pro- grams, although recent reductions in some fish quotas have probably eased their urgency. Our problem is to attract any such orders into Ca- nadian yards.

It is the Federal Government's segment of future new construction, however, that generates real gloom.

The 1989 Federal budget, tailored to gain control of the annual deficit, contained staggering news—the

Government's project to acquire a fleet of 10-12 nuclear-powered sub- marines was cancelled. To add in- sult to injury, cutbacks and delays were announced for other capital acquisitions; and although details

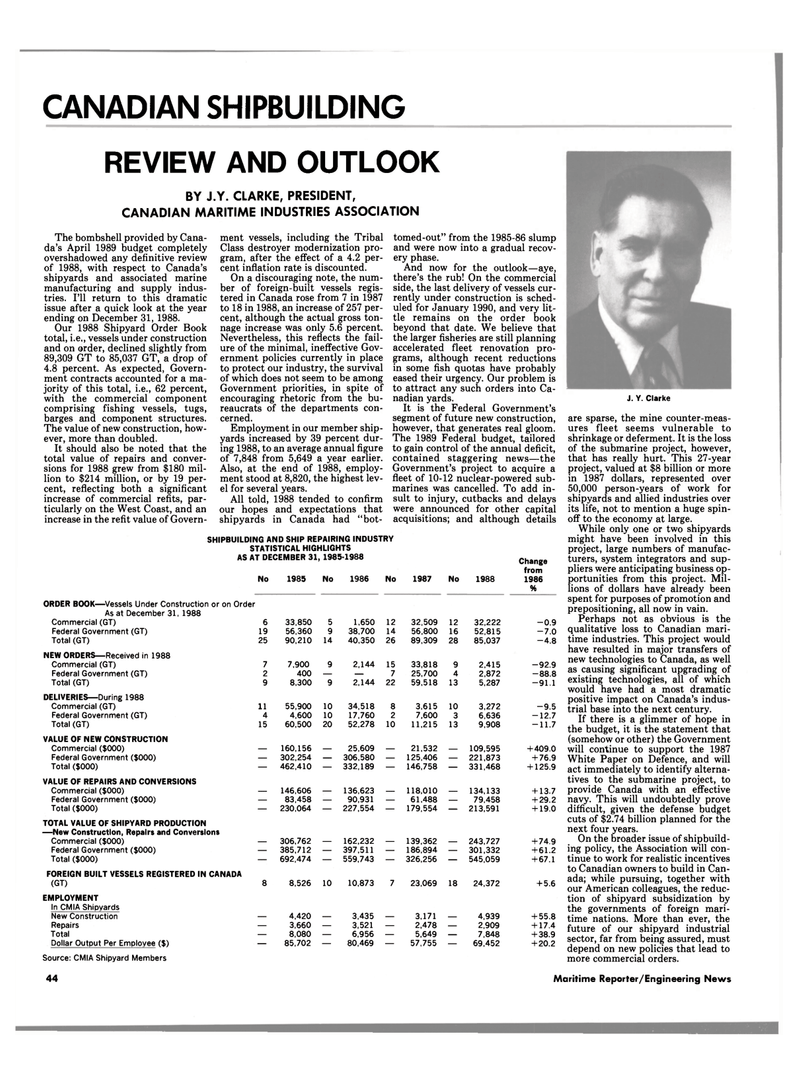

SHIPBUILDING AND SHIP REPAIRING INDUSTRY

STATISTICAL HIGHLIGHTS

AS AT DECEMBER 31, 1985-1988 Change

No 1985 No 1986 No 1987 No 1988 from 1986 %

ORDER BOOK—Vessels Under Construction or on Order

As at December 31, 1988

Commercial (GT) 6 33,850 5 1,650 12 32,509 12 32,222 -0.9

Federal Government (GT) 19 56,360 9 38,700 14 56,800 16 52,815 -7.0

Total (GT) 25 90,210 14 40,350 26 89,309 28 85,037 -4.8

NEW ORDERS—Received in 1988

Commercial (GT) 7 7,900 9 2,144 15 33,818 9 2,415 -92.9

Federal Government (GT) 2 400 — — 7 25,700 4 2,872 -88.8

Total (GT) 9 8,300 9 2,144 22 59,518 13 5,287 — 91.1

DELIVERIES—During 1988

Commercial (GT) 11 55,900 10 34,518 8 3,615 10 3,272 -9.5

Federal Government (GT) 4 4,600 10 17,760 2 7,600 3 6,636 -12.7

Total (GT) 15 60,500 20 52,278 10 11,215 13 9,908 -11.7

VALUE OF NEW CONSTRUCTION

Commercial ($000) — 160,156 — 25,609 — 21,532 — 109,595 + 409.0

Federal Government ($000) — 302,254 — 306,580 — 125,406 — 221,873 + 76.9

Total ($000) — 462,410 — 332,189 — 146,758 — 331,468 + 125.9

VALUE OF REPAIRS AND CONVERSIONS

Commercial ($000) — 146,606 — 136,623 — 118.010 — 134,133 + 13.7

Federal Government ($000) — 83,458 — 90,931 — 61,488 — 79,458 + 29.2

Total ($000) — 230,064 — 227,554 — 179,554 — 213,591 + 19.0

TOTAL VALUE OF SHIPYARD PRODUCTION —New Construction, Repairs and Conversions

Commercial ($000) — 306,762 — 162,232 — 139,362 — 243,727 + 74.9

Federal Government ($000) — 385,712 — 397,511 — 186,894 — 301,332 + 61.2

Total ($000) — 692,474 — 559,743 — 326,256 — 545,059 + 67.1

FOREIGN BUILT VESSELS REGISTERED IN CANADA (GT) 8 8,526 10 10,873 7 23,069 18 24,372 + 5.6

EMPLOYMENT

In CMIA Shipyards

New Construction — 4,420 — 3,435 — 3,171 — 4,939 + 55.8

Repairs — 3,660 — 3,521 — 2,478 — 2,909 + 17.4

Total — 8,080 — 6,956 — 5,649 — 7,848 + 38.9

Dollar Output Per Employee ($) — 85,702 — 80,469 — 57,755 — 69,452 + 20.2

Source: CMIA Shipyard Members

J. Y. Clarke are sparse, the mine counter-meas- ures fleet seems vulnerable to shrinkage or deferment. It is the loss of the submarine project, however, that has really hurt. This 27-year project, valued at $8 billion or more in 1987 dollars, represented over 50,000 person-years of work for shipyards and allied industries over its life, not to mention a huge spin- off to the economy at large.

While only one or two shipyards might have been involved in this project, large numbers of manufac- turers, system integrators and sup- pliers were anticipating business op- portunities from this project. Mil- lions of dollars have already been spent for purposes of promotion and prepositioning, all now in vain.

Perhaps not as obvious is the qualitative loss to Canadian mari- time industries. This project would have resulted in major transfers of new technologies to Canada, as well as causing significant upgrading of existing technologies, all of which would have had a most dramatic positive impact on Canada's indus- trial base into the next century.

If there is a glimmer of hope in the budget, it is the statement that (somehow or other) the Government will continue to support the 1987

White Paper on Defence, and will act immediately to identify alterna- tives to the submarine project, to provide Canada with an effective navy. This will undoubtedly prove difficult, given the defense budget cuts of $2.74 billion planned for the next four years.

On the broader issue of shipbuild- ing policy, the Association will con- tinue to work for realistic incentives to Canadian owners to build in Can- ada; while pursuing, together with our American colleagues, the reduc- tion of shipyard subsidization by the governments of foreign mari- time nations. More than ever, the future of our shipyard industrial sector, far from being assured, must depend on new policies that lead to more commercial orders. 44 Maritime Reporter/Engineering News

39

39

41

41