Page 26: of Maritime Reporter Magazine (June 1991)

Read this page in Pdf, Flash or Html5 edition of June 1991 Maritime Reporter Magazine

World Shipbuilding & Repair (continued)

Scrapping Down

The broken-up tonnage in 1990 was negligible, totaling just over 1 million gt for all vessels types. The apparent shortage of construction capacity, and high prices, have pro- vided a strong incentive to owners to prolong the lives of existing ships.

With only an estimated 0.25 million gt of tankers broken up in 1990, there is clearly a significant increase in the average age of the tanker fleet. However, environmental is- sues and legislation, particularly in the U.S., are expected to focus atten- tion on this aspect and the economic viability of older ships.

Laid-Up Tonnage

Levels Off

The fall in total laid-up tonnage appears to have bottomed out in 1990 following a continuous decline since 1982. The end of the year total of 2.9 million gt was only 0.1 million gt down on the December 1989 total.

There did, however, appear to be a change in the proportions of vessel types making up this tonnage. Laid- up tanker tonnage continued to fall, ending the year at 1.6 million gt.

This was counteracted by an ob- served rise in dry cargo tonnage to 1.3 million gt.

The modest lay-up is put into perspective when noting that 2.9 million gt is only 0.7 percent of the total world fleet.

Fleet Growth

Increases in the total gross ton- nage of each of the tanker, dry bulk and general cargo/container vessel groups resulted in a rise of over 13 million gt in 1990. The total gross

Cross Tonnage Ordered Annually 1981-1990

Million gt 25 1

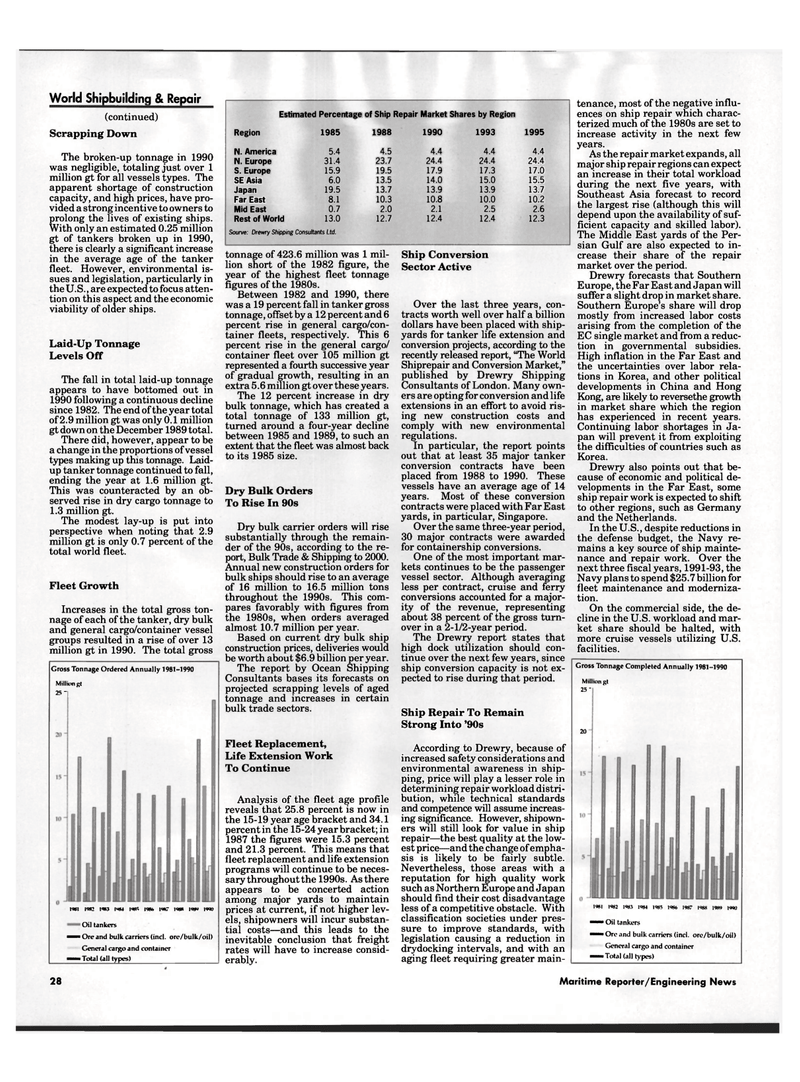

Estimated Percentage of Ship Repair Market Shares by Region

Region 1985 1988 1990 1993 1995

N. America 5.4 4.5 4.4 4.4 4.4

N. Europe 31.4 23.7 24.4 24.4 24.4

S. Europe 15.9 19.5 17.9 17.3 17.0

SE Asia 6.0 13.5 14.0 15.0 15.5

Japan 19.5 13.7 13.9 13.9 13.7

Far East 8.1 10.3 10.8 10.0 10.2

Mid East 0.7 2.0 2.1 2.5 2.6

Rest of World 13.0 12.7 12.4 12.4 12.3

Sourve: Drewry Shipping Consultants Ltd.

!»! I9S2 1**3 1«M MB I9S6 ! Oil tankers

•"""« Ore and bulk carriers (incl. ore/bulk/oil)

General cargo and container

— Total (all types)

tonnage of 423.6 million was 1 mil-

lion short of the 1982 figure, the

year of the highest fleet tonnage

figures of the 1980s.

Between 1982 and 1990, there

was a 19 percent fall in tanker gross

tonnage, offset by a 12 percent and 6

percent rise in general cargo/con-

tainer fleets, respectively. This 6

percent rise in the general cargo/

container fleet over 105 million gt

represented a fourth successive year

of gradual growth, resulting in an

extra 5.6 million gt over these years.

The 12 percent increase in dry

bulk tonnage, which has created a

total tonnage of 133 million gt,

turned around a four-year decline

between 1985 and 1989, to such an

extent that the fleet was almost back

to its 1985 size.

Dry Bulk Orders

To Rise In 90s

Dry bulk carrier orders will rise

substantially through the remain-

der of the 90s, according to the re-

port, Bulk Trade & Shipping to 2000.

Annual new construction orders for

bulk ships should rise to an average

of 16 million to 16.5 million tons

throughout the 1990s. This com-

pares favorably with figures from

the 1980s, when orders averaged

almost 10.7 million per year.

Based on current dry bulk ship

construction prices, deliveries would

be worth about $6.9 billion per year.

The report by Ocean Shipping

Consultants bases its forecasts on

projected scrapping levels of aged

tonnage and increases in certain

bulk trade sectors.

Fleet Replacement,

Life Extension Work

To Continue

Analysis of the fleet age profile

reveals that 25.8 percent is now in

the 15-19 year age bracket and 34.1

percent in the 15-24 year bracket; in

1987 the figures were 15.3 percent

and 21.3 percent. This means that

fleet replacement and life extension

programs will continue to be neces-

sary throughout the 1990s. As there

appears to be concerted action

among major yards to maintain

prices at current, if not higher lev-

els, shipowners will incur substan-

tial costs—and this leads to the

inevitable conclusion that freight

rates will have to increase consid-

erably.

Ship Conversion

Sector Active

Over the last three years, con-

tracts worth well over half a billion

dollars have been placed with ship-

yards for tanker life extension and

conversion projects, according to the

recently released report, "The World

Shiprepair and Conversion Market,"

published by Drewry Shipping

Consultants of London. Many own-

ers are opting for conversion and life

extensions in an effort to avoid ris-

ing new construction costs and

comply with new environmental

regulations.

In particular, the report points

out that at least 35 major tanker

conversion contracts have been

placed from 1988 to 1990. These

vessels have an average age of 14

years. Most of these conversion

contracts were placed with Far East

yards, in particular, Singapore.

Over the same three-year period,

30 major contracts were awarded

for containership conversions.

One of the most important mar-

kets continues to be the passenger

vessel sector. Although averaging

less per contract, cruise and ferry

conversions accounted for a major-

ity of the revenue, representing

about 38 percent of the gross turn-

over in a 2-1/2-year period.

The Drewry report states that

high dock utilization should con-

tinue over the next few years, since

ship conversion capacity is not ex-

pected to rise during that period.

Ship Repair To Remain

Strong Into '90s

According to Drewry, because of

increased safety considerations and

environmental awareness in ship-

ping, price will play a lesser role in

determining repair workload distri-

bution, while technical standards

and competence will assume increas-

ing significance. However, shipown-

ers will still look for value in ship

repair—the best quality at the low-

est price—and the change of empha-

sis is likely to be fairly subtle.

Nevertheless, those areas with a

reputation for high quality work

such as Northern Europe and Japan

should find their cost disadvantage

less of a competitive obstacle. With

classification societies under pres-

sure to improve standards, with

legislation causing a reduction in

drydocking intervals, and with an

aging fleet requiring greater main-

tenance, most of the negative influ-

ences on ship repair which charac-

terized much of the 1980s are set to

increase activity in the next few

years.

As the repair market expands, all

major ship repair regions can expect

an increase in their total workload

during the next five years, with

Southeast Asia forecast to record

the largest rise (although this will

depend upon the availability of suf-

ficient capacity and skilled labor).

The Middle East yards of the Per-

sian Gulf are also expected to in-

crease their share of the repair

market over the period.

Drewry forecasts that Southern

Europe, the Far East and Japan will

suffer a slight drop in market share.

Southern Europe's share will drop

mostly from increased labor costs

arising from the completion of the

EC single market and from a reduc-

tion in governmental subsidies.

High inflation in the Far East and

the uncertainties over labor rela-

tions in Korea, and other political

developments in China and Hong

Kong, are likely to reversethe growth

in market share which the region

has experienced in recent years.

Continuing labor shortages in Ja-

pan will prevent it from exploiting

the difficulties of countries such as

Korea.

Drewry also points out that be-

cause of economic and political de-

velopments in the Far East, some

ship repair work is expected to shift

to other regions, such as Germany

and the Netherlands.

In the U.S., despite reductions in

the defense budget, the Navy re-

mains a key source of ship mainte-

nance and repair work. Over the

next three fiscal years, 1991-93, the

Navy plans to spend $25.7 billion for

fleet maintenance and moderniza-

tion.

On the commercial side, the de-

cline in the U.S. workload and mar-

ket share should be halted, with

more cruise vessels utilizing U.S.

facilities.

Gross Tonnage Completed Annually 1981-1990

Million gt

25"

20

NSI 1982 1183 1984 1985 1186 1987 1988 1989 1990

mmm Oil tankers

— Ore and bulk carriers (incl. ore/bulk/oil)

General cargo and container

— Total (all types)

28 Maritime Reporter/Engineering News

25

25

27

27