Page 85: of Maritime Reporter Magazine (March 1994)

Read this page in Pdf, Flash or Html5 edition of March 1994 Maritime Reporter Magazine

Portuaria '94 Preps For

May Date

Scheduled for May 23 to 28,

Portuaria '94, an international port exhibition, will focus on commer- cial relations and technological de- velopments. Included among the participating institutions are: all of the port authorities of Spain; the

Ports Authority of Andalusia; the

Dept. of Ports and Coasts of the

Government of Catalonia; and more.

Portuaria '94 will also feature tech- nical seminars—scheduled to be held in the World Trade Center,

Seville—covering topics from ports and docks paving and surfacing; wave forecasting and ship route consultancy; and combined trans- port, port and dock logistics. For more information on Portuaria '94, contact: MARGE. Avda. Diagonal, 541, 3 . 08029, Barcelona, Spain; tel: + 34 3 419 6941; fax: + 34 3 405 2258.

Engineers Detail Pros Of

Fiber Optic Technology

New techniques are being pio- neered to make the installation and maintenance of underwater fiber optic cable systems more affordable and accessible for developing coun- tries. Details of these methods were presented in a paper by two leading engineers from B.T. Marine at the

Pacific Telecommunications Coun- cil (PTC) 16th Annual Conference.

The paper, entitled "Cost Effec- tive Installation and Maintenance of Subsea Links for Developing

Economies," was presented by Roy

C. May and Andrew R. Cannell.

In the paper the duo call for a to- tally new concept of undersea in- stallation and maintenance to be considered. One way developing countries can lower installation costs include using what Mr. May and Mr. Cannell call the "ship of opportunity" concept, which calls for selecting a suitable local vessel which can be adapted for cable han- dling. Among the types of vessels which can be used are supply ships, fishing boats, barges and others which can effectively be adapted for undersea cable installation, the au- thors claim.

AMSEA Awards TSA Project

Tracking On Two Ships

Tracking Systems of America

TSA) was recently awarded a con- tact by AMSEA on the MarAd- )wned S/SCape Jacob and S/SCape

John, currently undergoing Sealift

Enhancement contracts in a Texas shipyard. TSA is providing

VMSEA's port engineer and onsite nspectors with graphic reports de- ailing manhour productivity, per- ormance and completion rates lased on data received from the >ort engineer and the contractor. tape Jacob and Cape John are the inth and tenth MarAd ships to tilize TSA's advanced reporting ystem during the past year.

TSA utilizes a custom-designed

March, 1994 87 comparative analysis software sys- tem to evaluate the contractor's plan, as prescribed by the CPM and Gantt charts, and compares them to the current progress as reported. A com- plete planning service to ship own- ers is also offered so that maximum impact is achieved through its ex- clusive tracking system. The output provides a snapshot of the progress of each ship by item, with Critical

Path items more closely monitored since the completion of each report rests on those items coming in on time. The report is then sent over- night to the on-site management team for review and corrective ac- tion. TSA's complement of services has expanded during this time to also include preparation of charts and graphs utilized in settlement of post-contract disputes. For more information on TSA's products and services,

Circle 93 on Reader Service Card

SPD Teams With Henschel To

Win Sealift Contract

SPD and Henschel were awarded a contract from Newport News for two shipsets of equipment for its

Sealift Conversion Program, cover- ing switchgear and circuit break- ers, as well as machinery control systems, and more. For additional information on SPD Technologies,

Circle 89 on Reader Service Card

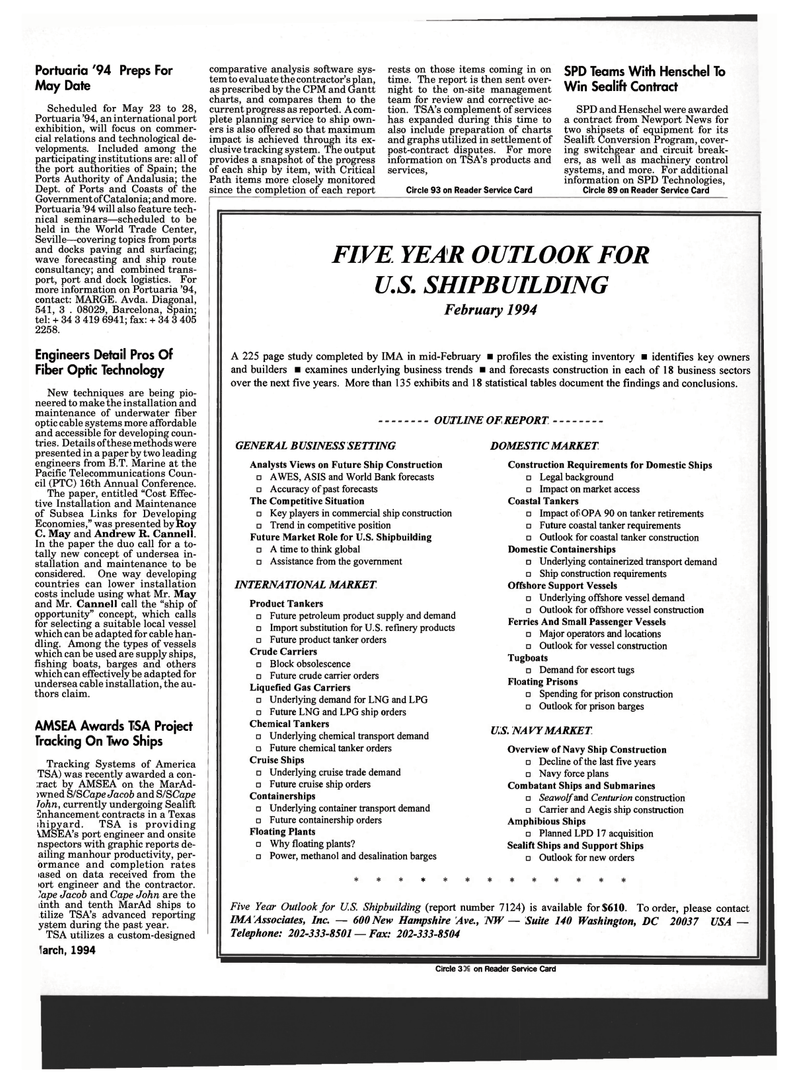

FIVE YEAR OUTLOOK FOR

U.S. SHIPBUILDING

February 1994

A 225 page study completed by IMA in mid-February • profiles the existing inventory • identifies key owners and builders • examines underlying business trends • and forecasts construction in each of 18 business sectors over the next five years. More than 135 exhibits and 18 statistical tables document the findings and conclusions.

OUTLINE OF REPORT

GENERAL BUSINESS SETTING

Analysts Views on Future Ship Construction • AWES, ASIS and World Bank forecasts • Accuracy of past forecasts

The Competitive Situation • Key players in commercial ship construction • Trend in competitive position

Future Market Role for U.S. Shipbuilding • A time to think global • Assistance from the government

INTERNATIONAL MARKET

Product Tankers • Future petroleum product supply and demand • Import substitution for U.S. refinery products • Future product tanker orders

Crude Carriers • Block obsolescence • Future crude carrier orders

Liquefied Gas Carriers • Underlying demand for LNG and LPG • Future LNG and LPG ship orders

Chemical Tankers • Underlying chemical transport demand • Future chemical tanker orders

Cruise Ships • Underlying cruise trade demand • Future cruise ship orders

Containerships • Underlying container transport demand • Future containership orders

Floating Plants • Why floating plants? • Power, methanol and desalination barges *

DOMESTIC MARKET

Construction Requirements for Domestic Ships • Legal background • Impact on market access

Coastal Tankers • Impact of OPA 90 on tanker retirements • Future coastal tanker requirements • Outlook for coastal tanker construction

Domestic Containerships o Underlying containerized transport demand • Ship construction requirements

Offshore Support Vessels • Underlying offshore vessel demand • Outlook for offshore vessel construction

Ferries And Small Passenger Vessels • Major operators and locations • Outlook for vessel construction

Tugboats • Demand for escort tugs

Floating Prisons • Spending for prison construction • Outlook for prison barges

U.S. NAVY MARKET

Overview of Navy Ship Construction • Decline of the last five years • Navy force plans

Combatant Ships and Submarines a Seawolf and Centurion construction • Carrier and Aegis ship construction

Amphibious Ships • Planned LPD 17 acquisition

Sealift Ships and Support Ships • Outlook for new orders

Five Year Outlook for U.S. Shipbuilding (report number 7124) is available for $610. To order, please contact

IMA Associates, Inc. — 600 New Hampshire Ave., NW— Suite 140 Washington, DC 20037 USA —

Telephone: 202-333-8501 — Fax: 202-333-8504

Circle 318 on Reader Service Card

84

84

86

86