Page 63: of Maritime Reporter Magazine (February 1997)

Read this page in Pdf, Flash or Html5 edition of February 1997 Maritime Reporter Magazine

n The Rebound?

Questions surrounding the resurgence of naval business focus on when, not if

With navy budgets seemingly heacft for the sea floor^ many traditional defense sup- pliers have sought to expand their markets within and out- side of the maritime industry.

However, while navy business is depressed around the globe, it is far from dormant. In fact, several long-awaited contracts and new designs have been recently announced, sending a charge into a long-believed moribund market segment.

LPD-17

Followed closely by MR/EN since early last year, the con- tract to build the next-genera- tion of U.S. Navy warships,

LPD-17, was won by a consor- tium of builders and suppliers led by Avondale Industries.

While the Ingalls-led team has started official action to protest the award, it appears that Avondale Industries, Inc. and team members Bath Iron

Works, Hughes Aircraft and

Intergraph Corporation, have the $641 million contract in hand and will be responsible for leading the development and procurement of advanced ships systems and the integra- tion this technology into vessel construction for the ship.

The award provides for )ptions exercisable by the U.S. ivy for two additional ships, ancl the contract price of the three^hips has been estimated to exceed $1.5 billion.

Avondaleuvill reportedly build the first tm ships while Bath

Iron WorksVBIW) will build the third. Hughes Aircraft will be responsible Bor integrating the ships' electronic and weapons systems into the con- struction process.

The contract is uniVue on many fronts, and a pottoitial watershed for Navy construc- tion in America. LPDA7 embodies the U.S. Navy' efforts to procure, produce and maintain a series of vessels in a progressive, economical manner, with a bottom-liru approach to development ^as well as life cycle costs.

To date, the LPD-17 pi ment has bent or brokaft many standard operating proce- dures, evidenced My the fact that the operational core of the project will be^stablished on location at the prime contrac- tor's facilities in Louisiana, not in Washington, D.C.

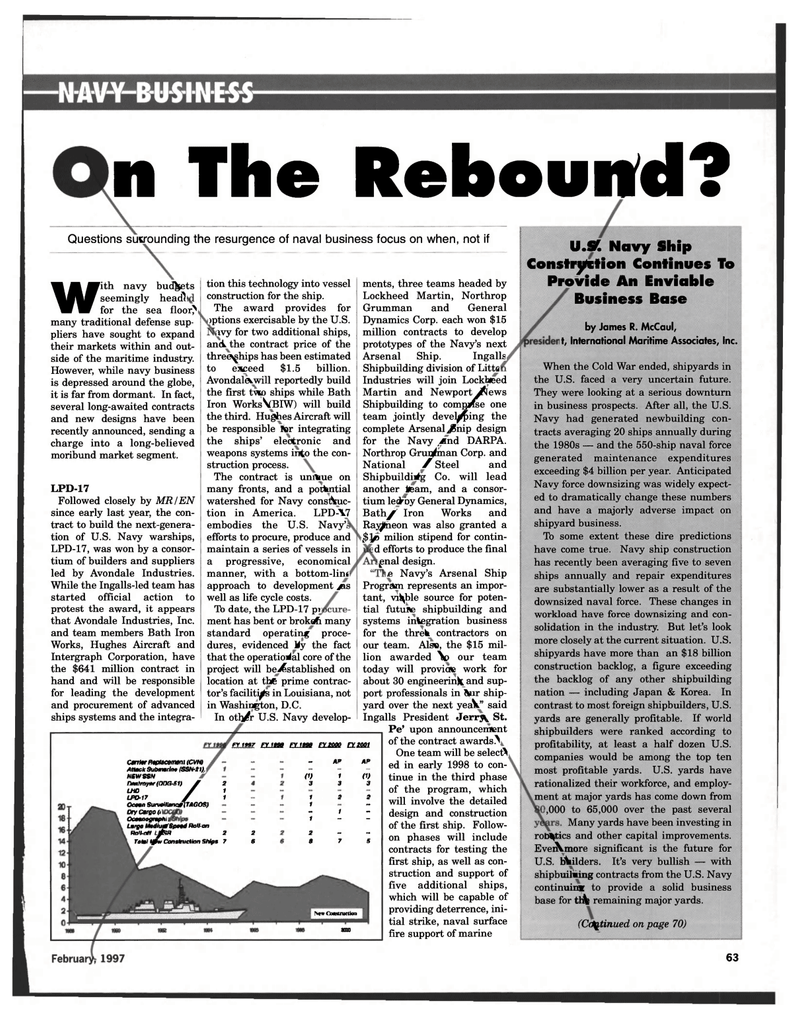

In oth/r U.S. Navy develop- er rwr mm mm txxm ami

Canter Replacement (Cvm Attack Submarine ISSN-H).

NBV/SSH rumlmyor (OOG-S1) f 2

LHO / 1 LPD-17 /

Ocean Surveilltnae(TAGOS) Dry Cargo o

Oceanegraphi Largo Medium Speed Roll-on

Ftotl-nft IyS» 2 2 Total t0w Construction Ships 7 6

- AP AP

S

NrvOMHUwthn

20Q0

ments, three teams headed by

Lockheed Martin, Northrop

Grumman and General

Dynamics Corp. each won $15

million contracts to develop

prototypes of the Navy's next

Arsenal Ship. Ingalls

Shipbuilding division of Litta

Industries will join Lockbfeed

Martin and Newport^Jews

Shipbuilding to compulse one

team jointly devel^ing the

complete Arsenal jSnip design

for the Navy And DARPA.

Northrop Grun^man Corp. and

National / Steel and

Shipbuilding Co. will lead

another ieam, and a consor-

tium ledmy General Dynamics,

Bathyr Iron Works and

Ray^neon was also granted a

k$J(D milion stipend for contin-

d efforts to produce the final

f nal design.

s Navy's Arsenal Ship

Progrstoi represents an impor-

tant, viable source for poten-

tial future shipbuilding and

systems integration business

for the threk contractors on

our team. Also, the $15 mil-

lion awarded \> our team

today will proviofe work for

about 30 engineering and sup-

port professionals in Anr ship-

yard over the next yeaV' said

Ingalls President Jerry St.

Pe' upon announcement

of the contract awards.^

One team will be select^

ed in early 1998 to con-

tinue in the third phase

of the program, which

will involve the detailed

design and construction

of the first ship. Follow-

on phases will include

contracts for testing the

first ship, as well as con-

struction and support of

five additional ships,

which will be capable of

providing deterrence, ini-

tial strike, naval surface

fire support of marine

U.SC Navy Ship

Construction Continues To

Provide An Enviable

Business Base

by James R. McCaul,

t, International Maritime Associates, Inc.

When the Cold War ended, shipyards in

the U.S. faced a very uncertain future.

They were looking at a serious downturn

in business prospects. After all, the U.S.

Navy had generated newbuilding con-

tracts averaging 20 ships annually during

the 1980s — and the 550-ship naval force

generated maintenance expenditures

exceeding $4 billion per year. Anticipated

Navy force downsizing was widely expect-

ed to dramatically change these numbers

and have a majorly adverse impact on

shipyard business.

To some extent these dire predictions

have come true. Navy ship construction

has recently been averaging five to seven

ships annually and repair expenditures

are substantially lower as a result of the

downsized naval force. These changes in

workload have force downsizing and con-

solidation in the industry. But let's look

more closely at the current situation. U.S.

shipyards have more than an $18 billion

construction backlog, a figure exceeding

the backlog of any other shipbuilding

nation — including Japan & Korea. In

contrast to most foreign shipbuilders, U.S.

yards are generally profitable. If world

shipbuilders were ranked according to

profitability, at least a half dozen U.S.

companies would be among the top ten

most profitable yards. U.S. yards have

rationalized their workforce, and employ-

ment at major yards has come down from

,000 to 65,000 over the past several

Many yards have been investing in

robotics and other capital improvements.

EveiXmore significant is the future for

U.S. bWilders. It's very bullish — with

shipbuilding contracts from the U.S. Navy

continuing to provide a solid business

base for tb^ remaining major yards.

(Continued on page 70)

63

62

62

64

64