Page 54: of Maritime Reporter Magazine (December 1998)

Read this page in Pdf, Flash or Html5 edition of December 1998 Maritime Reporter Magazine

199811 81998 19981998

Consolidation — across the full realm of the maritime industry — could reasonably be called the major theme of 1998, and it appears this trend will continue well into the new millennium.

While it is impossible to provide a catch-all reason for why vessel builders, vessel owners and marine equipment suppliers are numbering fewer but larger, a strong case can be made for the ever evolving globalization of busi- ness. This is not, of course, unique to marine companies, as soda manufacturers, for example, face many of the same operational con- straints and market share con- cerns as makers of bowthrusters.

Simply put, price pressures and politics make it increasingly pro- hibitive for the "little guy" to prof- it. A prime example of this trend was seen with the recent announcement that Mitsui O.S.K.

Lines Ltd. and Navix Line Ltd. will merge next April, effectively creating one of Japan's biggest shipping firms with revenues com- parable to industry leader Nippon

Yusen KK. The two companies were reportedly driven to merge in a bid to survive the increasingly competitive global shipping indus- try. The deals announced or con- summated in 1998 are far too numerous to list here, but some recent notable players include

General Dynamics, headquartered in Falls Church, Va., which offi- cially added San Diego-based

NASSCO to its vast arsenal of shipbuilding and general defense holdings.

But while mega-deals are in vogue, it is worthy to note that size doesn't always matter. Kvaerner

ASA, one of the world's largest engineering and construction firms, had a rough year digesting the sum of its previous year's addi- tions.

The company's steady march down the stock market scales eventually led to the ousting of its chairman and CEO. But through- out, it is interesting to note, the company's shipbuilding arm con- tinued making its mark on the global shipbuilding scene by deliv- ering quality, high-value tonnage, and with the development of | advanced shipbuilding facilities, ] notably in Philadelphia.

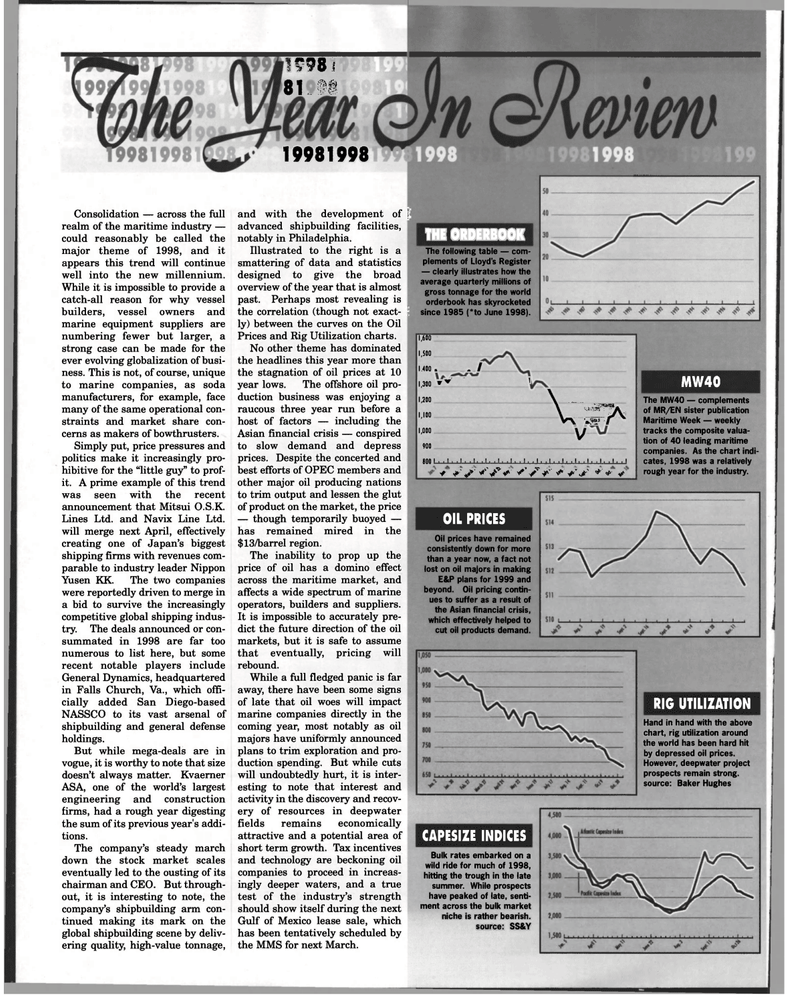

Illustrated to the right is a | smattering of data and statistics 3 designed to give the broad overview of the year that is almost J past. Perhaps most revealing is the correlation (though not exact- j ly) between the curves on the Oil

Prices and Rig Utilization charts.

No other theme has dominated the headlines this year more than the stagnation of oil prices at 10 year lows. The offshore oil pro- duction business was enjoying a raucous three year run before a host of factors — including the

Asian financial crisis — conspired to slow demand and depress prices. Despite the concerted and best efforts of OPEC members and other major oil producing nations to trim output and lessen the glut of product on the market, the price — though temporarily buoyed — has remained mired in the $13/barrel region.

The inability to prop up the price of oil has a domino effect across the maritime market, and affects a wide spectrum of marine operators, builders and suppliers.

It is impossible to accurately pre- dict the future direction of the oil markets, but it is safe to assume that eventually, pricing will rebound.

While a full fledged panic is far away, there have been some signs of late that oil woes will impact marine companies directly in the coming year, most notably as oil majors have uniformly announced plans to trim exploration and pro- duction spending. But while cuts will undoubtedly hurt, it is inter- esting to note that interest and activity in the discovery and recov- ery of resources in deepwater fields remains economically attractive and a potential area of short term growth. Tax incentives and technology are beckoning oil companies to proceed in increas- ingly deeper waters, and a true test of the industry's strength should show itself during the next

Gulf of Mexico lease sale, which has been tentatively scheduled by the MMS for next March.

THE 0RDERB00K

The following table — com- plements of Lloyd's Register — clearly illustrates how the average quarterly millions of gross tonnage for the world orderbook has skyrocketed since 1985 (*to June 1998). 1,600 1,500 1.400 . / 1,300 »* ' 1,200 \ 1,100 • 1,000 \ A \ J\

V\ a. f 900 y

BOO 1 i i 1 i 11 i 111 111 11 > 111 i 11 i 11 11 i 111 111 111 111 111 > 1 + * J * /y ** / * ^ ^

MW40

The MW40 — complements of MR/EN sister publication

Maritime Week — weekly tracks the composite valua- tion of 40 leading maritime companies. As the chart indi- cates, 1998 was a relatively rough year for the industry.

OIL PRICES

Oil prices have remained consistently down for more than a year now, a fact not lost on oil majors in making

E&P plans for 1999 and beyond. Oil pricing contin- ues to suffer as a result of the Asian financial crisis, which effectively helped to cut oil products demand.

RIG UTILIZATION

Hand in hand with the above chart, rig utilization around the world has been hard hit by depressed oil prices.

However, deepwater project prospects remain strong, source: Baker Hughes

CAPESIZE INDICES

Bulk rates embarked on a wild ride for much of 1998, hitting the trough in the late summer. While prospects have peaked of late, senti- ment across the bulk market niche is rather bearish, source: SS&Y

53

53

55

55