Page 48: of Maritime Reporter Magazine (May 2004)

The Propulsion Technology Yearbook

Read this page in Pdf, Flash or Html5 edition of May 2004 Maritime Reporter Magazine

The Shipbuilding Report

Shipbuilding Future

Steel, Ship Prices Soar as Tankers Stay Firm

Soaring steel prices are now a major concern for leading shipbuilders.

Uncertainty about spiraling material costs is even causing some yards to defer new orders, market reports indi- cate. "The lack of steel in some ship- yards of the three major shipbuilding nations is causing newbuildings for 2007 and 2008 to be delayed." says New

York tanker broker Poten & Partners in a recent market report. "Some shipyards are not accepting any more ship orders beyond late 2007 or 2008 delivery because of the lack of berth availability, insecurity stemming from the dollar's weakness, as well as uncertain steel cost," the broker says.

China may as well build ships, says

Poten, as "they're taking all the steel".

Steel prices have risen by $140 over the last two years, largely on the back of

Chinese demand, Poten declares. And. commenting on current demolition rates, the New York firm explains that "steel needed to build bridges, roads and housing to accommodate the millions of people relocating to China's urban areas from remote rural villages has sent scrap prices above $400 per ldt from the low $l()()s/ldt approx two years ago".

The fact that sophisticated vessels such as LNG carriers and container ships are in heavy demand is further tax- ing shipyard capacity and new ship prices are rocketing. By way of compar- ison. Poten points out that a VLCC cost about $70m to build in 1999. This month, says Poten, the price for a new

VLCC has risen to $86m, based on 2007 delivery. However, current VLCC mar- ket rates, which averaged W97 last month from the Arabian Gulf to the Far

East, equivalent to $61,000 a day, are expected to decline to lower levels, with seasonal change, says Poten. But owners are falling over themselves to get their hands on prompt tonnage. This, says

Poten. has meant that modern second- hand VLCCs now cost just about as much as new ones. Owners don't want to wait until 2007/8 - they want new ton- nage now. Says Poten: "Suezmaxes,

Aframaxes and Panamaxes are seeing the same type of price increases. A

Suezmax newbuilding is quoted at just over $57m this month," the broker reports, the highest price in a decade.

Meanwhile Aframaxes are being quoted at up to S47m, up from $36m in April 2000 and Panamaxes prices are around $37m, up from $27m two years ago.

In this latest bull market run. tanker companies continue to report record earnings. Most recently Teekay has declared record profits, with first quarter net income of $189m. up 253% from $53.6m in the corresponding period last year.

The company explained that high spot rates were partly the reason for the bet- ter figures, whilst the integration of

Navion was another key factor.

Meanwhile a senior executive at tanker company Stelmar declared a bull- ish view of the future. Peter Goodfel low. chief executive, told Bloomberg news that current strong demand in both the

East and West, led by China and the US, is very unusual and provided the compa- ny with a good opportunity to reposition ships profitably. Historically, it was not easy to find profitable cargoes to reposi- tion ships for repairs in the east,

Goodfellow said, but now Asian growth was far outstripping expansion in the

US, he said.

OMI meanwhile has reported its best ever quarter and anticipates that the strong tanker market will last for sever- al years.

The first quarter profit of $56.41 m was up from $25.73m one year earlier and was not only the company's best ever figure but was actually more than annu- al income in all but two of the years since 1984. According to OMI figures, the world's tanker fleet comprised 295.3m dwt at the end of March. The orderbook of just over 83m dwt repre- sented 28.1% of the fleet.

Tanker Company Guilty

Jo Tankers Fined $19.5M

Jo Tankers B.V. has agreed to plead guilty and pay a $19.5 million criminal fine for participating in an international cartel to allocate customers, rig bids, and fix prices on parcel tanker affreight- ment contracts for shipment of specialty liquids to and from the U.S. and else- where.

On Ice

Ice Class & Large Ships

Pose New Challenges

New challenges lie in store for north- ern shiprepair yards as a new generation of ultra sophisticated ice-class tankers join the fleet. So far. South Korean builders are in the vanguard of these new vessels' construction, built to carry oil from reserves located in some of the world's coldest and most inhospitable places. But ship designers, coastal states with seasonal or year-round ice and classification societies are all preparing for new vessels in the Aframax and

Suezmax categories. Designs are being model-tested and new construction cri- teria are being drawn up by leading class societies such as Lloyd's Register, DNV and ABS. The new vessels will lift car- goes in the North Baltic, the Arctic and

Far Eastern areas of Russia. Exports from the Former Soviet Union have already increased by 50% since 1996.

But Russian oil cargoes, piped to

Primorsk. have expanded from 12m tons in 2002 to a forecast 42m tons this year and some analysts believe volumes could soar to well over 100m tons by 2010. Lloyd's Register believes that new designs of "double-acting" tankers - ships that are built both for convention- al open-sea operation but with ice- breaking capability running full astern - will provide potential for some of the northern-most oil developments. The

Tempera and Master double-acting tankers were delivered to Finnish energy group Fortnum Oil and Gas last year.

The Sumitomo-built 106,000 dwt ves- sels are built to sail forward through light ice. but astern through heavy ice conditions. With azipods and thrusters, the tankers can turn through 180 degrees and will be deployed on a special route around the Turku archipelago off the coast of Finland.

Container Terminal

Project Approved for VA

APM Terminals North America Inc. announced plans to build a container ter- minal located on the Elizabeth Ris er in

Portsmouth, Virginia. Dredging is expected to start later this year, and con- struction of the terminal is expected to be completed in 2007. The facility will feature 4000 ft. of deepwater berth space (four times the current amount), and serve as a Mid-Atlantic platform for future growth.

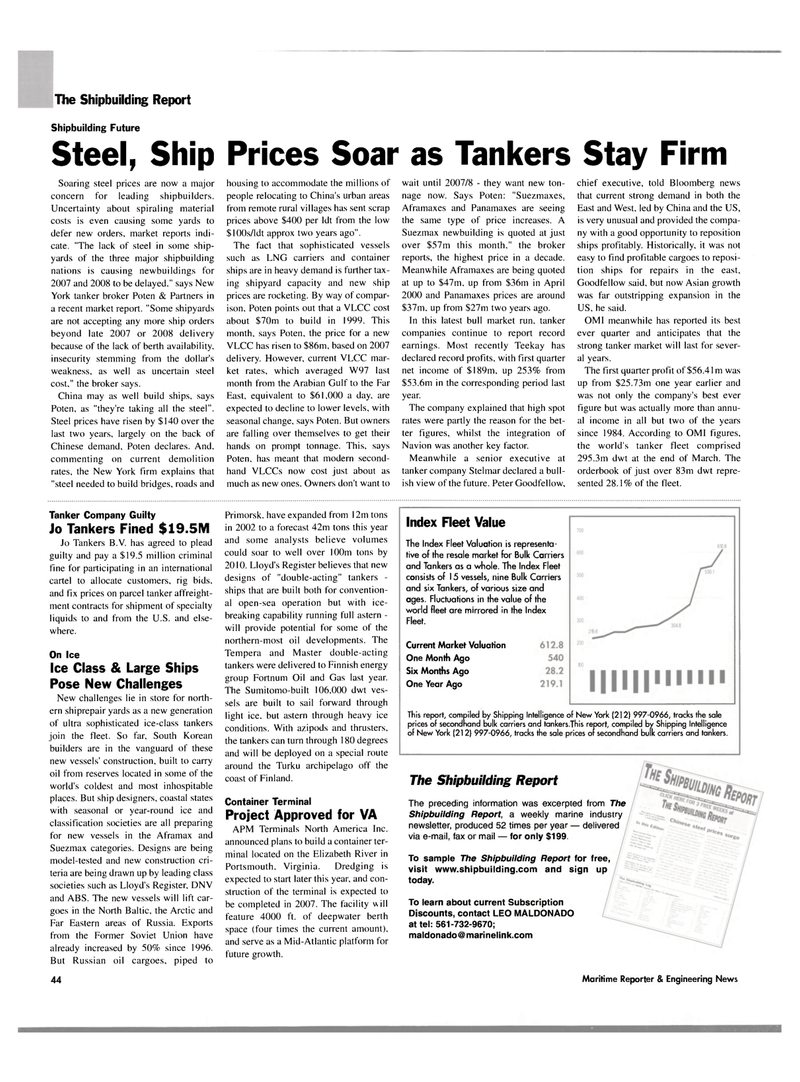

Index Fleet Value

The Index Fleet Valuation is representa- tive of the resale market for Bulk Carriers and Tankers as a whole. The Index Fleet consists of 15 vessels, nine Bulk Carriers and six Tankers, of various size and ages. Fluctuations in the value of the world fleet are mirrored in the Index

Fleet.

Current Market Valuation

One Month Ago

Six Months Ago

One Year Ago

This report, compiled by Shipping Intelligence of New York (212) 997-0966, tracks the sale prices of secondhand bulk carriers and tankers.This report, compiled by Shipping Intelligence of New York (212) 997-0966, tracks the sale prices of secondhand bulk carriers and tankers. 44 Maritime Reporter & Engineering News

The Shipbuilding Report

The preceding information was excerpted from The

Shipbuilding Report, a weekly marine industry newsletter, produced 52 times per year — delivered via e-mail, fax or mail — for only $199.

To sample The Shipbuilding Report for free, visit www.shipbuilding.com and sign up today.

To learn about current Subscription

Discounts, contact LEO MALDONADO at tel: 561-732-9670; [email protected]

47

47

49

49