Page 41: of Maritime Reporter Magazine (April 2014)

Offshore Edition

Read this page in Pdf, Flash or Html5 edition of April 2014 Maritime Reporter Magazine

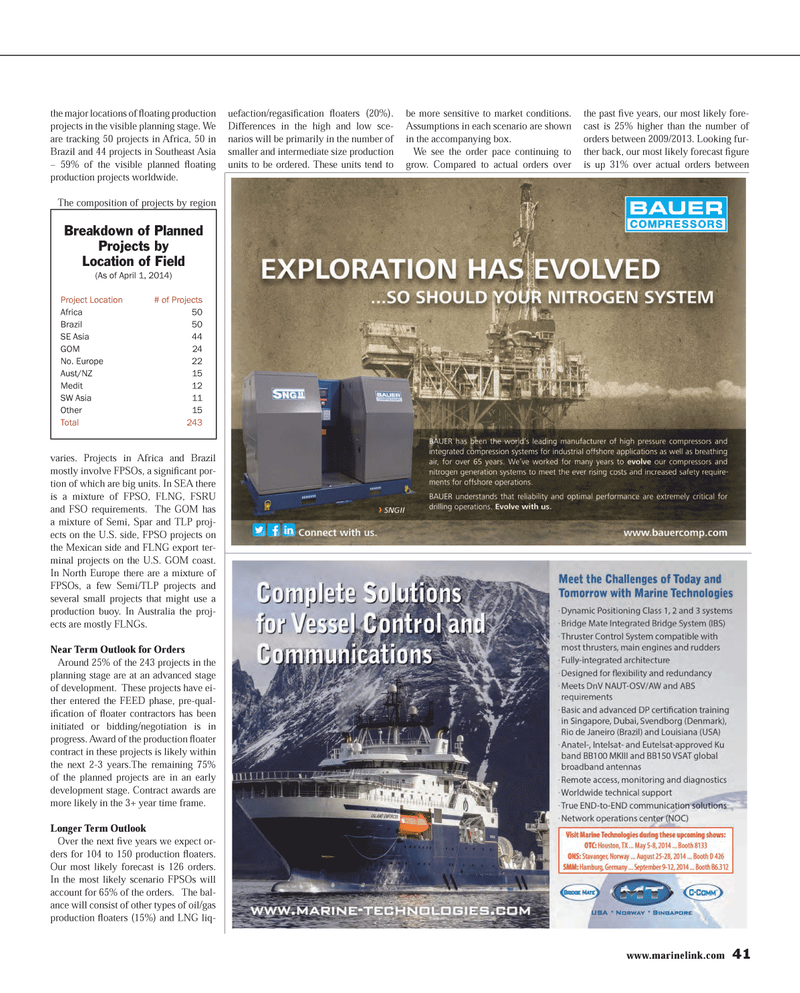

www.marinelink.com 41the major locations of ß oating production projects in the visible planning stage. We are tracking 50 projects in Africa, 50 in Brazil and 44 projects in Southeast Asia ? 59% of the visible planned ß oating production projects worldwide.The composition of projects by region varies. Projects in Africa and Brazil mostly involve FPSOs, a signiÞ cant por- tion of which are big units. In SEA there is a mixture of FPSO, FLNG, FSRU and FSO requirements. The GOM has a mixture of Semi, Spar and TLP proj- ects on the U.S. side, FPSO projects on the Mexican side and FLNG export ter- minal projects on the U.S. GOM coast. In North Europe there are a mixture of FPSOs, a few Semi/TLP projects and several small projects that might use a production buoy. In Australia the proj- ects are mostly FLNGs.Near Term Outlook for Orders Around 25% of the 243 projects in the planning stage are at an advanced stage of development. These projects have ei- ther entered the FEED phase, pre-qual-iÞ cation of ß oater contractors has been initiated or bidding/negotiation is in progress. Award of the production ß oater contract in these projects is likely within the next 2-3 years.The remaining 75% of the planned projects are in an early development stage. Contract awards are more likely in the 3+ year time frame.Longer Term Outlook Over the next Þ ve years we expect or- ders for 104 to 150 production ß oaters. Our most likely forecast is 126 orders. In the most likely scenario FPSOs will account for 65% of the orders. The bal- ance will consist of other types of oil/gas production ß oaters (15%) and LNG liq- uefaction/regasiÞ cation ß oaters (20%). Differences in the high and low sce- narios will be primarily in the number of smaller and intermediate size production units to be ordered. These units tend to be more sensitive to market conditions. Assumptions in each scenario are shown in the accompanying box.We see the order pace continuing to grow. Compared to actual orders over the past Þ ve years, our most likely fore- cast is 25% higher than the number of orders between 2009/2013. Looking fur- ther back, our most likely forecast Þ gure is up 31% over actual orders between Breakdown of Planned Projects by Location of Field(As of April 1, 2014) Project Location # of Projects Africa 50Brazil 50SE Asia 44 GOM 24 No. Europe 22Aust/NZ 15 Medit 12SW Asia 11 Other 15 Total 243 MR #4 (34-41).indd 41MR #4 (34-41).indd 414/4/2014 11:17:05 AM4/4/2014 11:17:05 AM

40

40

42

42