Page 42: of Maritime Reporter Magazine (April 2014)

Offshore Edition

Read this page in Pdf, Flash or Html5 edition of April 2014 Maritime Reporter Magazine

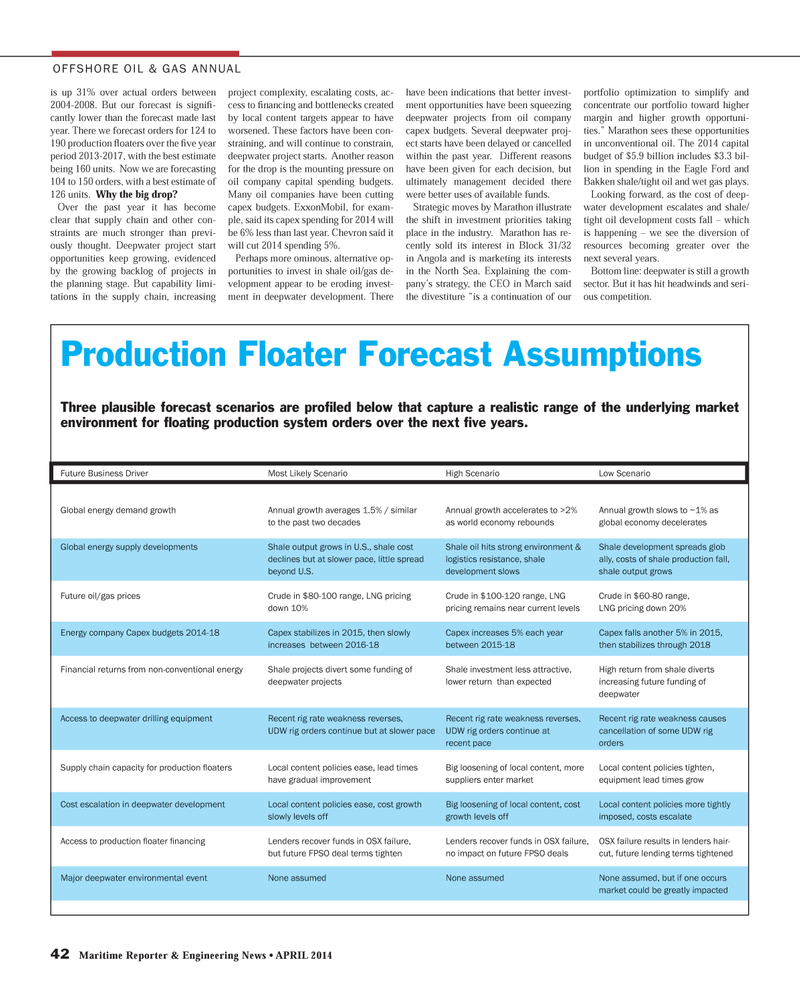

42 Maritime Reporter & Engineering News ? APRIL 2014 OFFSHORE OIL & GAS ANNUAL Production Floater Forecast Assumptions Three plausible forecast scenarios are proÞ led below that capture a realistic range of the underlying market environment for ß oating production system orders over the next Þ ve years. Future Business Driver Most Likely Scenario High Scenario Low Scenario Global energy demand growth Annual growth averages 1.5% / similar Annual growth accelerates to >2% Annual growth slows to ~1% as to the past two decades as world economy rebounds global economy decelerates Global energy supply developments Shale output grows in U.S., shale cost Shale oil hits strong environment & Shale development spreads glob declines but at slower pace, little spread logistics resistance, shale ally, costs of shale production fall, beyond U.S. development slows shale output grows Future oil/gas prices Crude in $80-100 range, LNG pricing Crude in $100-120 range, LNG Crude in $60-80 range, down 10% pricing remains near current levels LNG pricing down 20% Energy company Capex budgets 2014-18 Capex stabilizes in 2015, then slowly Capex increases 5% each year Capex falls another 5% in 2015, increases between 2016-18 between 2015-18 then stabilizes through 2018 Financial returns from non-conventional energy Shale projects divert some funding of Shale investment less attractive, High r eturn from shale diverts deepwater projects lower return than expected increasing future funding of deepwater Access to deepwater drilling equipment Recent rig rate weakness reverses, Recent rig rate weakness reverses, Recent rig rate weakness causes UDW rig orders continue but at slower pace UDW rig orders continue at cancellation of some UDW rig recent pace orders Supply chain capacity for production ß oaters Local content policies ease, lead times Big loosening of local content, more Local content policies tighten, have gradual improvement suppliers enter market equipment lead times grow Cost escalation in deepwater development Local content policies ease, cost growth Big loosening of local content, cost Local content policies more tightly slowly levels off growth levels off imposed, costs escalate Access to production ß oater Þ nancing Lenders recover funds in OSX failure, Lenders recover funds in OSX failure, OSX failure results in lenders hair- but future FPSO deal terms tighten no impact on future FPSO deals cut, future lending terms tightened Major deepwater environmental event None assumed None assumed None assumed, but if one occurs market could be greatly impacted is up 31% over actual orders between 2004-2008. But our forecast is signiÞ -cantly lower than the forecast made last year. There we forecast orders for 124 to 190 production ß oaters over the Þ ve year period 2013-2017, with the best estimate being 160 units. Now we are forecasting 104 to 150 orders, with a best estimate of 126 units. Why the big drop? Over the past year it has become clear that supply chain and other con-straints are much stronger than previ-ously thought. Deepwater project start opportunities keep growing, evidenced by the growing backlog of projects in the planning stage. But capability limi-tations in the supply chain, increasing project complexity, escalating costs, ac- cess to Þ nancing and bottlenecks created by local content targets appear to have worsened. These factors have been con- straining, and will continue to constrain, deepwater project starts. Another reason for the drop is the mounting pressure on oil company capital spending budgets. Many oil companies have been cutting capex budgets. ExxonMobil, for exam-ple, said its capex spending for 2014 will be 6% less than last year. Chevron said it will cut 2014 spending 5%.Perhaps more ominous, alternative op-portunities to invest in shale oil/gas de-velopment appear to be eroding invest-ment in deepwater development. There have been indications that better invest-ment opportunities have been squeezing deepwater projects from oil company capex budgets. Several deepwater proj-ect starts have been delayed or cancelled within the past year. Different reasons have been given for each decision, but ultimately management decided there were better uses of available funds.Strategic moves by Marathon illustrate the shift in investment priorities taking place in the industry. Marathon has re- cently sold its interest in Block 31/32 in Angola and is marketing its interests in the North Sea. Explaining the com-pany?s strategy, the CEO in March said the divestiture ?is a continuation of our portfolio optimization to simplify and concentrate our portfolio toward higher margin and higher growth opportuni- ties.? Marathon sees these opportunities in unconventional oil. The 2014 capital budget of $5.9 billion includes $3.3 bil-lion in spending in the Eagle Ford and Bakken shale/tight oil and wet gas plays.Looking forward, as the cost of deep-water development escalates and shale/tight oil development costs fall ? which is happening ? we see the diversion of resources becoming greater over the next several years. Bottom line: deepwater is still a growth sector. But it has hit headwinds and seri- ous competition.MR #4 (42-49).indd 42MR #4 (42-49).indd 424/7/2014 3:59:44 PM4/7/2014 3:59:44 PM

41

41

43

43