Page 52: of Maritime Reporter Magazine (June 2014)

Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2014 Maritime Reporter Magazine

52 Maritime Reporter & Engineering News • JUNE 2014

THE 2014 YEARBOOK: OFFSHORE

C urrently, 320 oil/gas ? oating production units are now in service, on order or available for reuse on another ? eld.

FPSOs account for 65% of the exist- ing systems, 76% of systems on order.

Production semis, barges, spars and

TLPs comprise the balance. Total oil/ gas inventory is down two units since last month – two off-? eld FPSOs have been scrapped. Another 27 ? oating LNG processing systems are in service or on order. Liquefaction ? oaters account for 15%, regasi? cation ? oaters 85%. No liquefaction ? oaters are yet in service – all four are on order. Total LNG inven- tory is down one unit since last month.

A regas carrier used as an interim FSRU in Brazil has resumed trading following delivery of the permanent FSRU. In ad- dition, 102 ? oating storage units are in service, on order or available. There has been a decrease of one unit since last month. An LNG carrier used in Chile as an interim storage unit has been replaced by permanent land storage tanks.

Production Floater Order Backlog

Sixty eight production ? oaters are cur- rently on order. The ? gure includes 41

FPSOs, 13 other oil/gas production units and 14 LNG processing units. In the lat- er are 4 ? oating liquefaction plants and 10 regasi? cation terminals.

Current backlog includes an FPSO or- der placed in May.

TH Heavy Engineering received an

EPCI contract + 7 year lease with 3 year option from JX Nippon to supply an FPSO for the Layang gas/condensate

Floating Production

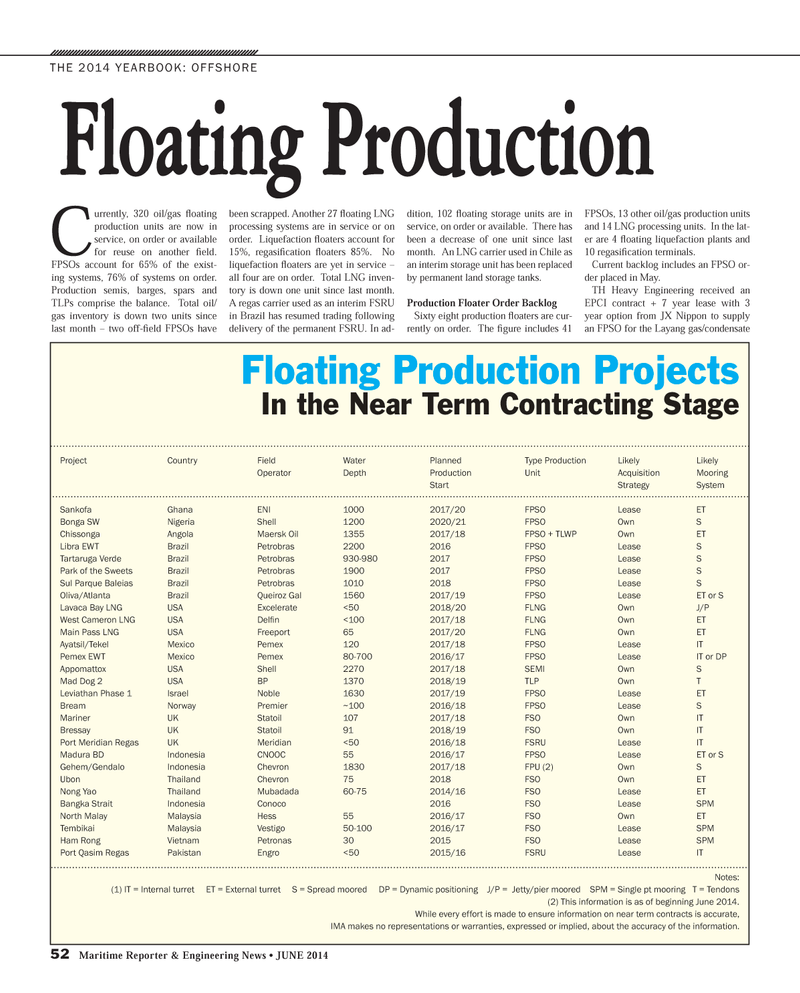

Floating Production Projects

In the Near Term Contracting Stage

Project Country Field Water Planned Type Production Likely Likely Operator Depth Production Unit Acquisition Mooring Start Strategy System

Sankofa Ghana ENI 1000 2017/20 FPSO Lease ET

Bonga SW Nigeria Shell 1200 2020/21 FPSO Own S

Chissonga Angola Maersk Oil 1355 2017/18 FPSO + TLWP Own ET

Libra EWT Brazil Petrobras 2200 2016 FPSO Lease S

Tartaruga Verde Brazil Petrobras 930-980 2017 FPSO Lease S

Park of the Sweets Brazil Petrobras 1900 2017 FPSO Lease S

Sul Parque Baleias Brazil Petrobras 1010 2018 FPSO Lease S

Oliva/Atlanta Brazil Queiroz Gal 1560 2017/19 FPSO Lease ET or S

Lavaca Bay LNG USA Excelerate <50 2018/20 FLNG Own J/P

West Cameron LNG USA Delfi n <100 2017/18 FLNG Own ET

Main Pass LNG USA Freeport 65 2017/20 FLNG Own ET

Ayatsil/Tekel Mexico Pemex 120 2017/18 FPSO Lease IT

Pemex EWT Mexico Pemex 80-700 2016/17 FPSO Lease IT or DP

Appomattox USA Shell 2270 2017/18 SEMI Own S

Mad Dog 2 USA BP 1370 2018/19 TLP Own T

Leviathan Phase 1 Israel Noble 1630 2017/19 FPSO Lease ET

Bream Norway Premier ~100 2016/18 FPSO Lease S

Mariner UK Statoil 107 2017/18 FSO Own IT

Bressay UK Statoil 91 2018/19 FSO Own IT

Port Meridian Regas UK Meridian <50 2016/18 FSRU Lease IT

Madura BD Indonesia CNOOC 55 2016/17 FPSO Lease ET or S

Gehem/Gendalo Indonesia Chevron 1830 2017/18 FPU (2) Own S

Ubon Thailand Chevron 75 2018 FSO Own ET

Nong Yao Thailand Mubadada 60-75 2014/16 FSO Lease ET

Bangka Strait Indonesia Conoco 2016 FSO Lease SPM

North Malay Malaysia Hess 55 2016/17 FSO Own ET

Tembikai Malaysia Vestigo 50-100 2016/17 FSO Lease SPM

Ham Rong Vietnam Petronas 30 2015 FSO Lease SPM

Port Qasim Regas Pakistan Engro <50 2015/16 FSRU Lease IT

Notes: (1) IT = Internal turret ET = External turret S = Spread moored DP = Dynamic positioning J/P = Jetty/pier moored SPM = Single pt mooring T = Tendons (2) This information is as of beginning June 2014.

While every effort is made to ensure information on near term contracts is accurate,

IMA makes no representations or warranties, expressed or implied, about the accuracy of the information.

MR #6 (50-57).indd 52 6/9/2014 11:24:25 AM

51

51

53

53