Page 38: of Maritime Reporter Magazine (July 2014)

Offshore Energy Structures & Systems

Read this page in Pdf, Flash or Html5 edition of July 2014 Maritime Reporter Magazine

38 Maritime Reporter & Engineering News • JULY 2014

T he fl oating production business continues to be very strong, particularly in the LNG gas processing sector. Last month saw a speculatively ordered fl oating liq- uefaction plant – a $1.2 billion contract – as well as several regasifi cation vessel contracts. Here’s a snapshot of what’s happening in the business.

Current Inventory

In total, 320 oil/gas fl oating produc- tion units are now in service, on order or available for reuse on another fi eld.

FPSOs account for 65% of the existing systems, 78% of systems on order. Pro- duction semis, barges, spars and TLPs comprise the balance. Total oil/gas in- ventory is the same as last month – but three units on order were completed and are now in the active inventory.

Another 29 fl oating LNG process- ing systems are in service or on order.

Liquefaction fl oaters account for 17%, regasifi cation fl oaters 83%. No lique- faction fl oaters are yet in service – all 5 are on order. Total LNG inventory has increased by two units since last month.

In addition, 102 fl oating storage units are in service, on order or available.

Production Floater Order Backlog

Sixty-fi ve production fl oaters are cur- rently on order, a reduction of three units since last month. The fi gure includes 38

FPSOs, 11 other oil/gas production units and 16 LNG processing units. In the lat- er are 5 fl oating liquefaction plants and 11 regasifi cation terminals.

The backlog includes a speculatively ordered liquefaction fl oater – the fi rst such order since the ill-fated FlexLNG multiple FLNG contract with Samsung in 2007. In late May Golar LNG con- tracted with Keppel Shipyard to convert the 39 year old LNG carrier Hille to an

FLNG. The converted unit will have capability to produce 2.2 to 2.8 million tonnes of LNG per year and have stor- age for 125,000 m3 of LNG. Keppel has subcontracted with Black and Veatch to design and engineer the topsides plant utilizing B&V’s PRICO technology.

Capex for the FLNG, including con- version and site commissioning, is ex- pected to be in the range of $1.2 billion.

This works out to an initial cost of $430 to $545 per tonne of annual LNG capac- ity. Given the estimated capex, Golar expects to realize an EBITDA payback of 3 to 5 years on a 5 to 8 year contract.

Funding of initial milestone payments will be from the proceeds of a June 2014 public offering of 12.7 million shares of common stock. For the overall project

Golar plans to raise 10 percent of the project capex from vendor participation.

The Golar FLNG is scheduled for deliv- ery within 31 months from contract sign- ing – which would be at end 2016.

Golar has been looking at various projects for the new unit. The fi rm is fo- cusing on offshore fi elds with relatively small reserves of clean natural gas and sites that enable use of the unit with rela- tively small infrastructure investment.

According to Golar, multiple MOUs for the unit have been executed and defi ni- tive agreements are under discussion in

North America and Africa. But the fi rm says the “execution model remains rela- tively complex.”

Also now in backlog are two new fl oating regasifi cation projects. One of these involves use of an LNG regas car- rier as a terminal in Egypt. The unit will be positioned at a jetty in Ain Sukhna, an industrial port on the Red Sea. Hoegh

LNG will lease the newly built Hoegh

Gallant to EGAS for 5 years for the proj- ect. Finalization of the deal is still pend- ing as of beginning July.

The second regas fl oater is being sup- plied to Petrobangla for use as a regasifi - cation terminal in Bangladesh. It will be moored offshore Moheshkhali Island in the Bay of Bengal. Excelerate will de- sign and construct the facility and supply the FSRU under a 15 year charter.

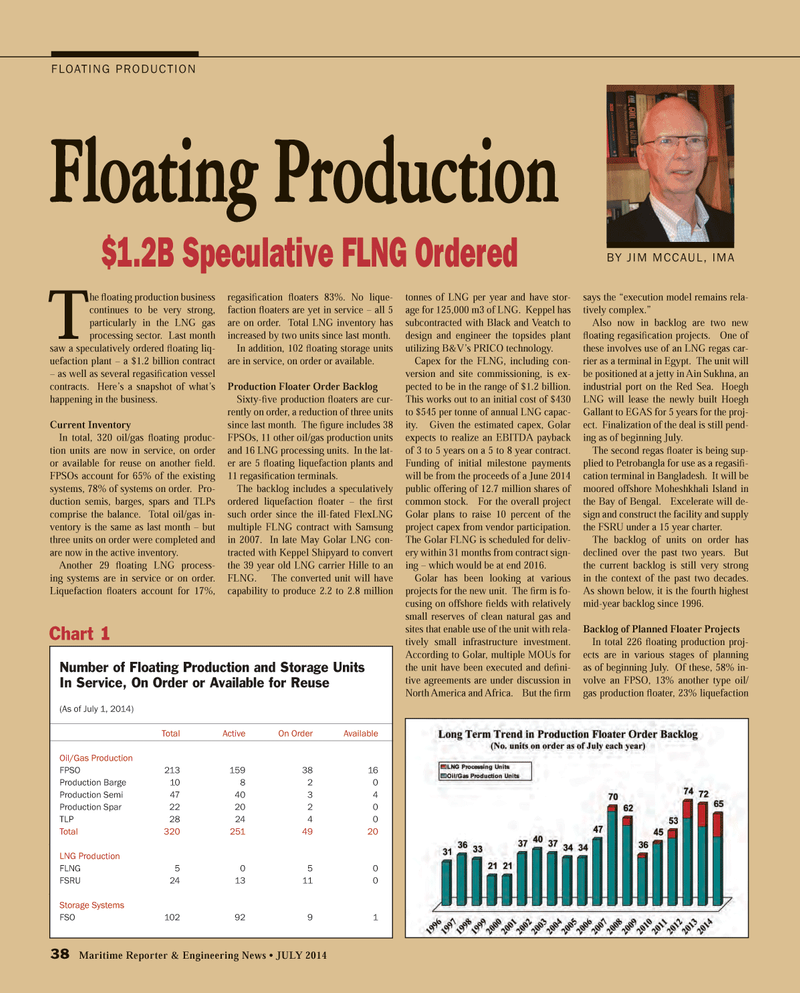

The backlog of units on order has declined over the past two years. But the current backlog is still very strong in the context of the past two decades.

As shown below, it is the fourth highest mid-year backlog since 1996.

Backlog of Planned Floater Projects

In total 226 fl oating production proj- ects are in various stages of planning as of beginning July. Of these, 58% in- volve an FPSO, 13% another type oil/ gas production fl oater, 23% liquefaction

FLOATING PRODUCTION

BY JIM MCCAUL, IMA

Floating Production $1.2B Speculative FLNG Ordered

Number of Floating Production and Storage Units

In Service, On Order or Available for Reuse (As of July 1, 2014) Total Active On Order Available

Oil/Gas Production

FPSO 213 159 38 16

Production Barge 10 8 2 0

Production Semi 47 40 3 4

Production Spar 22 20 2 0

TLP 28 24 4 0

Total 320 251 49 20

LNG Production

FLNG 5 0 5 0

FSRU 24 13 11 0

Storage Systems

FSO 102 92 9 1

Chart 1

MR #7 (32-41).indd 38 7/2/2014 2:00:25 PM

37

37

39

39