Page 37: of Maritime Reporter Magazine (July 2016)

Marine Communications Edition

Read this page in Pdf, Flash or Html5 edition of July 2016 Maritime Reporter Magazine

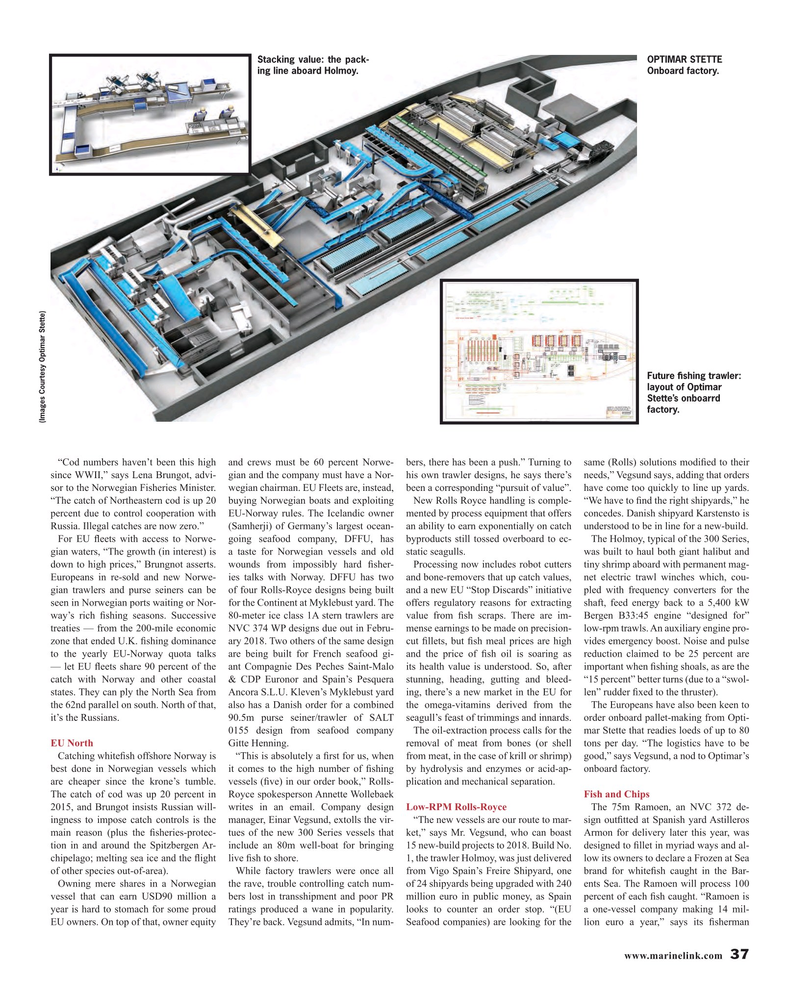

Stacking value: the pack- OPTIMAR STETTE ing line aboard Holmoy. Onboard factory.

Future ? shing trawler: layout of Optimar

Stette’s onboarrd factory. (Images Courtesy Optimar Stette) “Cod numbers haven’t been this high and crews must be 60 percent Norwe- bers, there has been a push.” Turning to same (Rolls) solutions modi? ed to their since WWII,” says Lena Brungot, advi- gian and the company must have a Nor- his own trawler designs, he says there’s needs,” Vegsund says, adding that orders sor to the Norwegian Fisheries Minister. wegian chairman. EU Fleets are, instead, been a corresponding “pursuit of value”. have come too quickly to line up yards. “The catch of Northeastern cod is up 20 buying Norwegian boats and exploiting New Rolls Royce handling is comple- “We have to ? nd the right shipyards,” he percent due to control cooperation with EU-Norway rules. The Icelandic owner mented by process equipment that offers concedes. Danish shipyard Karstensto is

Russia. Illegal catches are now zero.” (Samherji) of Germany’s largest ocean- an ability to earn exponentially on catch understood to be in line for a new-build.

For EU ? eets with access to Norwe- going seafood company, DFFU, has byproducts still tossed overboard to ec- The Holmoy, typical of the 300 Series, gian waters, “The growth (in interest) is a taste for Norwegian vessels and old static seagulls. was built to haul both giant halibut and down to high prices,” Brungnot asserts. wounds from impossibly hard ? sher- Processing now includes robot cutters tiny shrimp aboard with permanent mag-

Europeans in re-sold and new Norwe- ies talks with Norway. DFFU has two and bone-removers that up catch values, net electric trawl winches which, cou- gian trawlers and purse seiners can be of four Rolls-Royce designs being built and a new EU “Stop Discards” initiative pled with frequency converters for the seen in Norwegian ports waiting or Nor- for the Continent at Myklebust yard. The offers regulatory reasons for extracting shaft, feed energy back to a 5,400 kW way’s rich ? shing seasons. Successive 80-meter ice class 1A stern trawlers are value from ? sh scraps. There are im- Bergen B33:45 engine “designed for” treaties — from the 200-mile economic NVC 374 WP designs due out in Febru- mense earnings to be made on precision- low-rpm trawls. An auxiliary engine pro- zone that ended U.K. ? shing dominance ary 2018. Two others of the same design cut ? llets, but ? sh meal prices are high vides emergency boost. Noise and pulse to the yearly EU-Norway quota talks are being built for French seafood gi- and the price of ? sh oil is soaring as reduction claimed to be 25 percent are — let EU ? eets share 90 percent of the ant Compagnie Des Peches Saint-Malo its health value is understood. So, after important when ? shing shoals, as are the catch with Norway and other coastal & CDP Euronor and Spain’s Pesquera stunning, heading, gutting and bleed- “15 percent” better turns (due to a “swol- states. They can ply the North Sea from Ancora S.L.U. Kleven’s Myklebust yard ing, there’s a new market in the EU for len” rudder ? xed to the thruster). the 62nd parallel on south. North of that, also has a Danish order for a combined the omega-vitamins derived from the The Europeans have also been keen to it’s the Russians. 90.5m purse seiner/trawler of SALT seagull’s feast of trimmings and innards. order onboard pallet-making from Opti- 0155 design from seafood company The oil-extraction process calls for the mar Stette that readies loeds of up to 80

EU North Gitte Henning. removal of meat from bones (or shell tons per day. “The logistics have to be

Catching white? sh offshore Norway is “This is absolutely a ? rst for us, when from meat, in the case of krill or shrimp) good,” says Vegsund, a nod to Optimar’s best done in Norwegian vessels which it comes to the high number of ? shing by hydrolysis and enzymes or acid-ap- onboard factory.

are cheaper since the krone’s tumble. vessels (? ve) in our order book,” Rolls- plication and mechanical separation.

The catch of cod was up 20 percent in Royce spokesperson Annette Wollebaek Fish and Chips 2015, and Brungot insists Russian will- writes in an email. Company design Low-RPM Rolls-Royce The 75m Ramoen, an NVC 372 de- ingness to impose catch controls is the manager, Einar Vegsund, extolls the vir- “The new vessels are our route to mar- sign out? tted at Spanish yard Astilleros main reason (plus the ? sheries-protec- tues of the new 300 Series vessels that ket,” says Mr. Vegsund, who can boast Armon for delivery later this year, was tion in and around the Spitzbergen Ar- include an 80m well-boat for bringing 15 new-build projects to 2018. Build No. designed to ? llet in myriad ways and al- chipelago; melting sea ice and the ? ight live ? sh to shore. 1, the trawler Holmoy, was just delivered low its owners to declare a Frozen at Sea of other species out-of-area). While factory trawlers were once all from Vigo Spain’s Freire Shipyard, one brand for white? sh caught in the Bar-

Owning mere shares in a Norwegian the rave, trouble controlling catch num- of 24 shipyards being upgraded with 240 ents Sea. The Ramoen will process 100 vessel that can earn USD90 million a bers lost in transshipment and poor PR million euro in public money, as Spain percent of each ? sh caught. “Ramoen is year is hard to stomach for some proud ratings produced a wane in popularity. looks to counter an order stop. “(EU a one-vessel company making 14 mil-

EU owners. On top of that, owner equity They’re back. Vegsund admits, “In num- Seafood companies) are looking for the lion euro a year,” says its ? sherman www.marinelink.com 37

MR #7 (34-41).indd 37 7/6/2016 3:49:09 PM

36

36

38

38