Page 16: of Maritime Reporter Magazine (April 2019)

Navies of the World

Read this page in Pdf, Flash or Html5 edition of April 2019 Maritime Reporter Magazine

M

MARKETS: OSVs ? nancial structuring that saw SMHI put- semi-submersibles) working offshore in ting up only $5 million of its own capi- early March, 2019- little changed from

IN LATE 2014, THE BAKER HUGHES DATA tal), acquired three Fast Support Vessels levels of September/October 2018 (but from a onetime pool partner, paying with up from the 17 logged at the beginning

SHOWS 57 DEEPWATER RIGS WORKING,

SMHI shares, and, most recently, bought of 2018). Unstacking boats requires a

MORE THAN DOUBLE THE PRESENT NUM- three 2018 built PSVs from a company judgement that upticks in day rates (and

BER, WHICH, IN RETROSPECT PROVIDES A within the COSCO group. For others, boats working) are not merely temporary it’s more about cost savings and staying spikes, and, importantly, a commitment

BENCHMARK FOR FULL OSV UTILIZATION. power. Tidewater (TDW), restructured for owners to pay for drydock costs. after its 2017 bankruptcy ? ling, and Matthew M Rigdon, Executive Vice now the world’s largest OSV operator tation market, a second derivative of that $2.66 million, on average, would President and Chief Operating Of? cer of after having acquired Gulfmark Interna- offshore exploration and development have been required to reactivate each OSV owner Jackson Offshore Operators, activity has started to improve albeit at a vessel to trading readiness.

tional in late 2018, talked about “value discussing deepwater OSVs, told Mari- creation in a down market… ” through slower pace as a previous oversupply of Hornbeck Offshore, along with well- time Reporter & Engineering News: vessels begins to work itself out via attri- known owners including Harvey Gulf In- post-merger synergies, in a January con- “Supply is tightening, as I suspected at tion and market consolidation.” ternational Marine and Edison Chouest, ference presentation. SMHI reported av- the time of a presentation I gave in late

TDW, in its presentation, and referring also participate in the Jones Act market, erage 2018 day rates for its ? eet of just November 2018, due to the large number to the OSVs / working rigs, suggested where the constrained supply dynamics above $9,700/day (for those units work- of dry-dock requirements coming due in that “…the market is likely tighter than for PSVs lead to a slightly different vola- ing) but with a disappointing utilization 2019. There is little spot availability and it appears…” citing the high probability tility contour. The big picture, much like of around 60%. our competitors are not willing to of-

A recovery is coming, but its timing, that vessels stacked for more than three the international arena where assets can fer vessels for short term requirements. beyond its frequent characterization as years, or those more than 15 years old, move around, is one of an oversupplied

They are requiring longer term commit- would not return to service. market. For Hornbeck, its 2018 results “eventual,” is unknown. Research ana- Markers can be found in the sale of the show that its “new generation” OSVs ments from charterers to even offer the lysts at Clarksons titled a January, 2019 averaged $19,150/day when working, few vessels that are immediately avail-

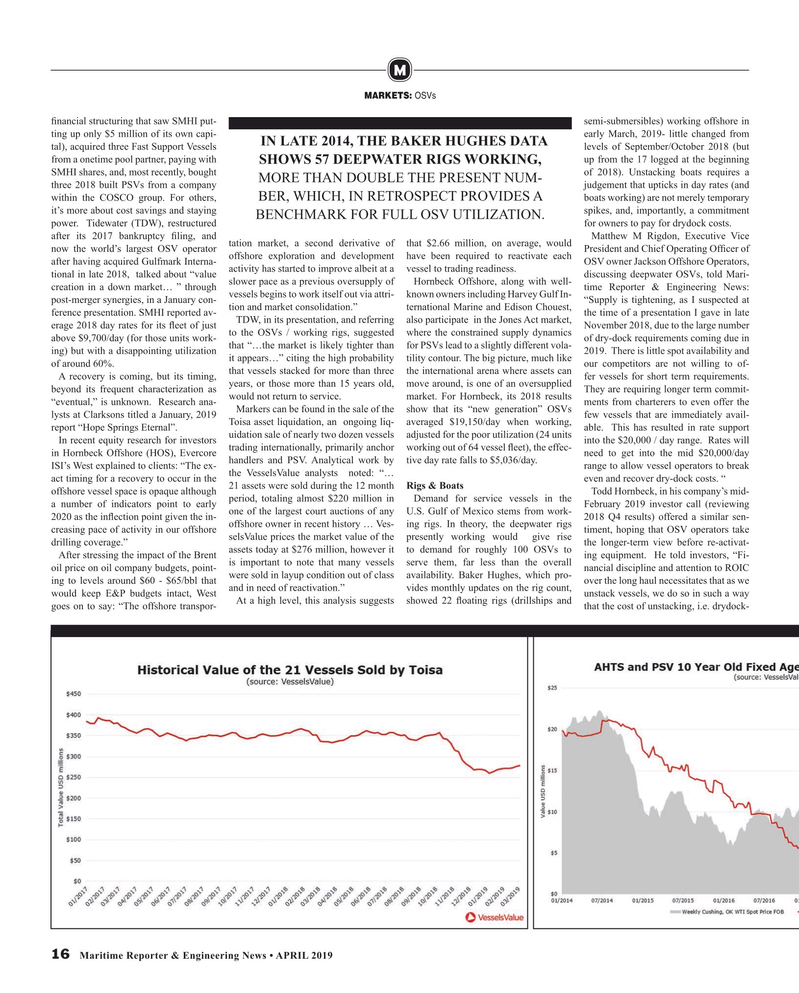

Toisa asset liquidation, an ongoing liq- report “Hope Springs Eternal”. able. This has resulted in rate support uidation sale of nearly two dozen vessels adjusted for the poor utilization (24 units

In recent equity research for investors into the $20,000 / day range. Rates will trading internationally, primarily anchor working out of 64 vessel ? eet), the effec- in Hornbeck Offshore (HOS), Evercore need to get into the mid $20,000/day handlers and PSV. Analytical work by tive day rate falls to $5,036/day.

ISI’s West explained to clients: “The ex- range to allow vessel operators to break the VesselsValue analysts noted: “… act timing for a recovery to occur in the even and recover dry-dock costs. “ 21 assets were sold during the 12 month Rigs & Boats offshore vessel space is opaque although Todd Hornbeck, in his company’s mid-

Demand for service vessels in the February 2019 investor call (reviewing a number of indicators point to early period, totaling almost $220 million in one of the largest court auctions of any U.S. Gulf of Mexico stems from work- 2020 as the in? ection point given the in- 2018 Q4 results) offered a similar sen- offshore owner in recent history … Ves- ing rigs. In theory, the deepwater rigs creasing pace of activity in our offshore selsValue prices the market value of the presently working would give rise timent, hoping that OSV operators take drilling coverage.” assets today at $276 million, however it to demand for roughly 100 OSVs to the longer-term view before re-activat-

After stressing the impact of the Brent is important to note that many vessels serve them, far less than the overall ing equipment. He told investors, “Fi- oil price on oil company budgets, point- nancial discipline and attention to ROIC ing to levels around $60 - $65/bbl that were sold in layup condition out of class availability. Baker Hughes, which pro- over the long haul necessitates that as we would keep E&P budgets intact, West and in need of reactivation.” vides monthly updates on the rig count, unstack vessels, we do so in such a way goes on to say: “The offshore transpor- At a high level, this analysis suggests showed 22 ? oating rigs (drillships and that the cost of unstacking, i.e. drydock- 16 Maritime Reporter & Engineering News • APRIL 2019

MR #4 (10-17).indd 16 4/2/2019 3:19:50 PM

15

15

17

17