Page 42: of Maritime Reporter Magazine (May 2020)

Fleet Management

Read this page in Pdf, Flash or Html5 edition of May 2020 Maritime Reporter Magazine

OFFSHORE WIND turnover, was reported at $2.9B, for 2018. dwarfed by traditional supply, subsea and seismic categories.

With bigger ticket items comes more risk; utilization in Q4 Early 2019 saw strong performance for Fred Olsen’s fleet of 2019 for the Shipping/Offshore wind segment vessels was seven “Bayard Class” CTV’s, integrated the previous year into 46% (compared to 79% in Q4 2018), as Fred Olsen was in- Northern Offshore Services business and sold in Q3, saw a uti- tegrating an investment in Hamburg based United Wind Lo- lization rate of 97% in Q2. Northern Offshore operates a fleet gistics- which transports offshore wind turbine components, of nearly three dozen crew transfer and multi-purpose vessels. such as blades, nacelles and towers from manufacturing sites to In early 2020, Northern Offshore entered into a Memorandum pre-assembly ports with chartered vessels (four owned vessels of Understanding (MOU) with NYK Line to study and presum- are under construction). ably cooperate as the offshore wind market expands to Japan.

Traditional OSVs – whether purpose built or converted from Another northern European outfit, Windea, a multi-company the oil trades, have an important , albeit still growing role to cooperation spearheaded by Bernhard Schulte Offshore, offers play. In Europe, the trendsetter in offshore wind, offshore wind both service vessels and CTVs, serving windfarms throughout is part of a diversified portfolio approach for OSV owners. Ei- the North Sea. As European expertise spreads outward, Bern- desvik, the Norwegian listed owner, whose OSVs Viking Nep- hard Schulte Offshore is looking at the U.S. market. Importantly, tune, Viking Poseidon and Acergy Viking have been chartered it entered into a partnership with the financial packager Mid- into wind energy projects in the North Sea for deep pocketed ocean Wind (tied to the Clean Marine group mentioned previ- developers such as Merkur Offshore and Siemens Gamesea. ously, involved with the structured finance underpinning the

While precise revenues are not broken out, Eidesvik’s 2019 Q4 LNG barges). financial results by segments reveal that revenues in its “other” Look to the structured finance behind the LNG bunkering category were 6.4 million Kroner (roughly US $0.7 million), deals, for an offshore wind template, with the caution that Coro-

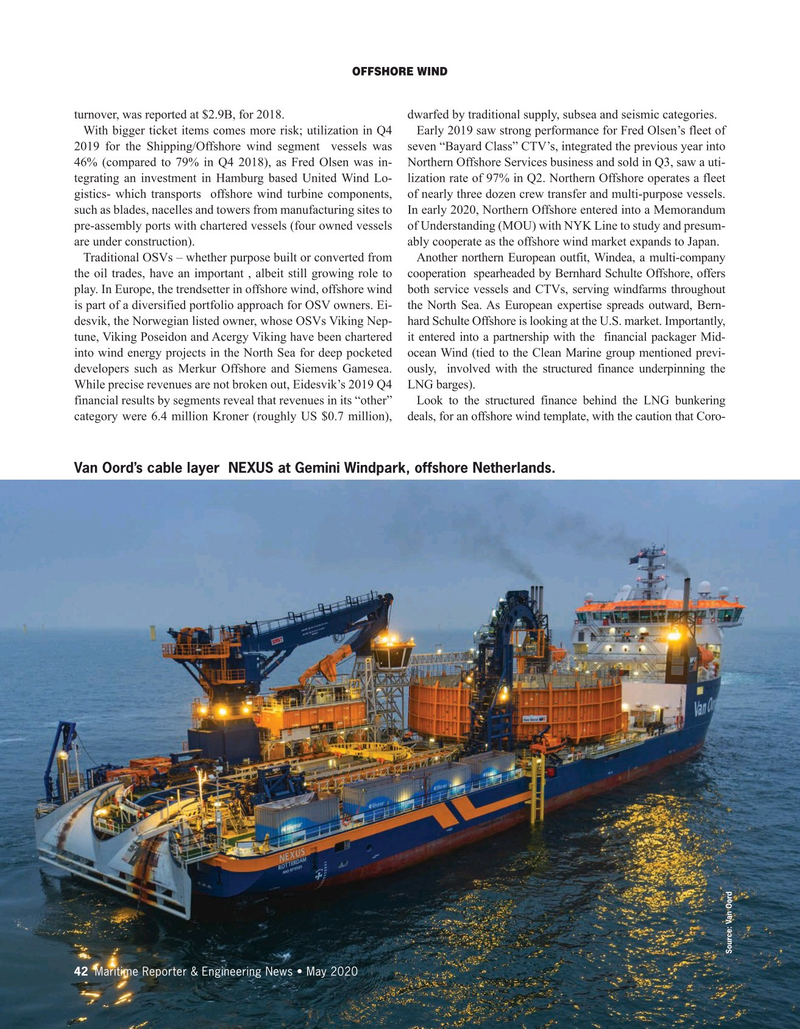

Van Oord’s cable layer NEXUS at Gemini Windpark, offshore Netherlands.

Source: Van Oord 42 Maritime Reporter & Engineering News • May 2020

41

41

43

43