Page 25: of Offshore Engineer Magazine (Aug/Sep 2014)

Read this page in Pdf, Flash or Html5 edition of Aug/Sep 2014 Offshore Engineer Magazine

Analysis decline towards the end of the decade. On the other side of the

North Sea, Statoil will attempt improved recovery from brown-

Rig stats ? eld projects. Along with project startups in the large Johan

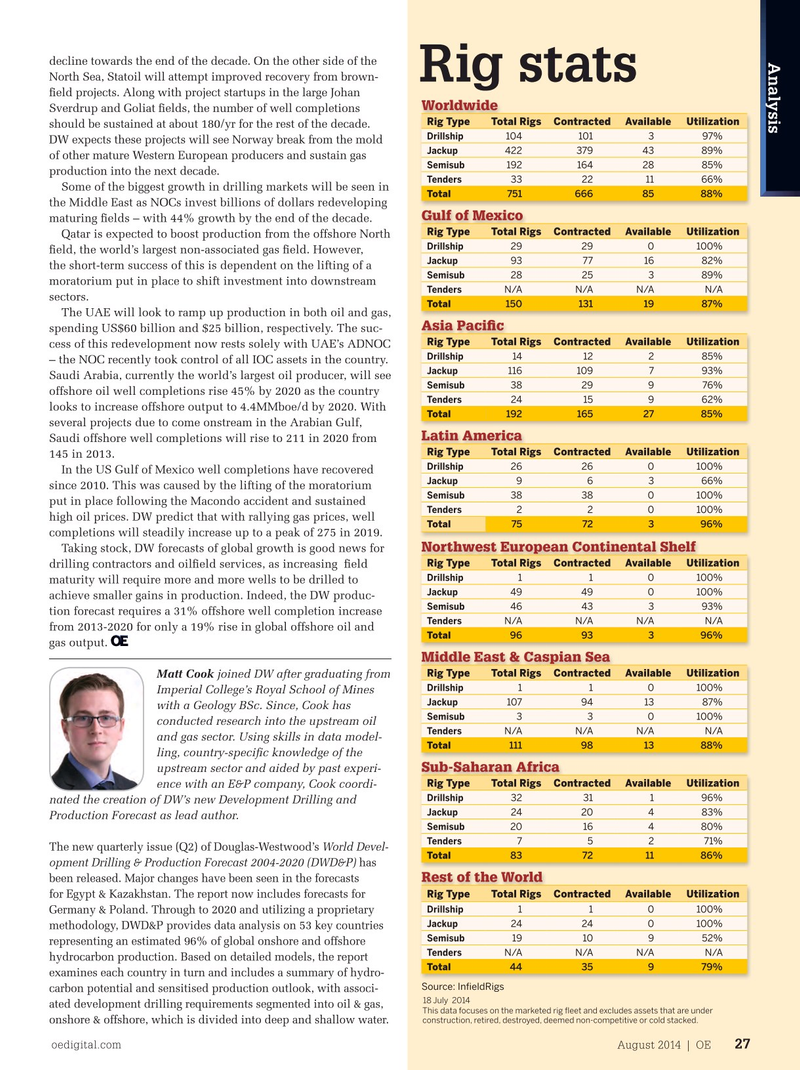

Worldwide

Sverdrup and Goliat ? elds, the number of well completions

Rig Type Total Rigs Contracted Available Utilization should be sustained at about 180/yr for the rest of the decade.

Drillship 104 101 3 97%

DW expects these projects will see Norway break from the mold 422 379 43 89%

Jackup of other mature Western European producers and sustain gas 192 164 28 85%Semisub production into the next decade.

33 22 1166%

Tenders

Some of the biggest growth in drilling markets will be seen in

Total 751 666 85 88% the Middle East as NOCs invest billions of dollars redeveloping

Gulf of Mexico maturing ? elds – with 44% growth by the end of the decade.

Rig Type Total Rigs Contracted Available Utilization

Qatar is expected to boost production from the offshore North

Drillship 29 29 0100% ? eld, the world’s largest non-associated gas ? eld. However, 93 77 16 82%

Jackup the short-term success of this is dependent on the lifting of a 28 25 3 89%

Semisub moratorium put in place to shift investment into downstream

N/A N/AN/A N/A

Tenders sectors. 150 131 19 87%Total

The UAE will look to ramp up production in both oil and gas,

Asia Paci? c spending US$60 billion and $25 billion, respectively. The suc-

Rig Type Total Rigs Contracted Available Utilization cess of this redevelopment now rests solely with UAE’s ADNOC

Drillship 14 12 2 85% – the NOC recently took control of all IOC assets in the country.

Jackup 116 109 7 93%

Saudi Arabia, currently the world’s largest oil producer, will see 38 29 9 76%

Semisub offshore oil well completions rise 45% by 2020 as the country

Tenders 24 15 962% looks to increase offshore output to 4.4MMboe/d by 2020. With

Total 192 165 27 85% several projects due to come onstream in the Arabian Gulf,

Latin America

Saudi offshore well completions will rise to 211 in 2020 from

Rig Type Total Rigs Contracted Available Utilization 145 in 2013.

Drillship 26 26 0100%

In the US Gulf of Mexico well completions have recovered

Jackup 9 6 366% since 2010. This was caused by the lifting of the moratorium 38 38 0100%

Semisub put in place following the Macondo accident and sustained

Tenders 2 2 0100% high oil prices. DW predict that with rallying gas prices, well

Total 75 72 396% completions will steadily increase up to a peak of 275 in 2019.

Northwest European Continental Shelf

Taking stock, DW forecasts of global growth is good news for

Rig Type Total Rigs Contracted Available Utilization drilling contractors and oil? eld services, as increasing ? eld

Drillship 1 1 0100% maturity will require more and more wells to be drilled to

Jackup 49 49 0100% achieve smaller gains in production. Indeed, the DW produc-

Semisub 46 43 3 93% tion forecast requires a 31% offshore well completion increase

N/A N/AN/A N/A

Tenders from 2013-2020 for only a 19% rise in global offshore oil and 96 93 396%

Total gas output.

Middle East & Caspian Sea

Rig Type Total Rigs Contracted Available Utilization

Matt Cook joined DW after graduating from

Drillship 1 1 0100%

Imperial College’s Royal School of Mines 107 94 13 87%

Jackup with a Geology BSc. Since, Cook has

Semisub 3 3 0100% conducted research into the upstream oil

N/A N/AN/A N/A

Tenders and gas sector. Using skills in data model-

Total 111 98 13 88% ling, country-speci? c knowledge of the

Sub-Saharan Africa upstream sector and aided by past experi-

Rig Type Total Rigs Contracted Available Utilization ence with an E&P company, Cook coordi-

Drillship 32 31 196% nated the creation of DW’s new Development Drilling and

Jackup 24 20 483%

Production Forecast as lead author.

Semisub 20 16 480% 7 5 2 71%

Tenders

The new quarterly issue (Q2) of Douglas-Westwood’s

24

24

26

26