Page 81: of Offshore Engineer Magazine (Sep/Oct 2015)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2015 Offshore Engineer Magazine

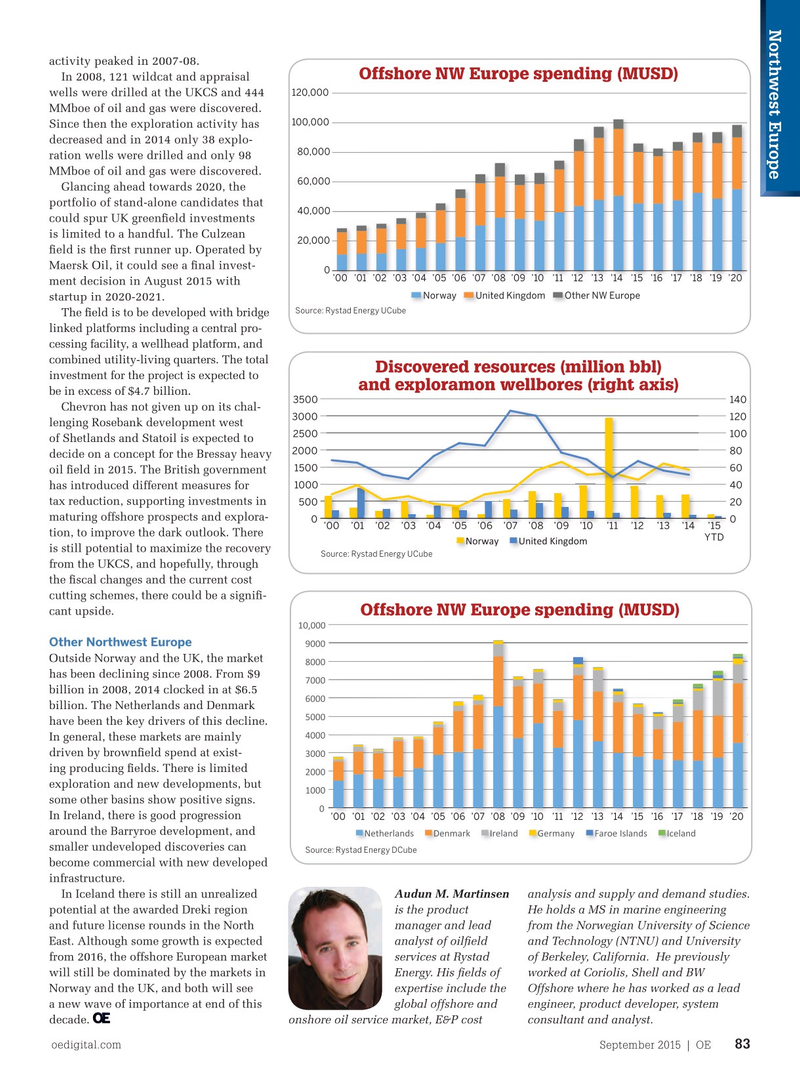

Northwest Europe activity peaked in 2007-08.

Offshore NW Europe spending (MUSD)

In 2008, 121 wildcat and appraisal 120,000 wells were drilled at the UKCS and 444

MMboe of oil and gas were discovered. 100,000

Since then the exploration activity has decreased and in 2014 only 38 explo- 80,000 ration wells were drilled and only 98

MMboe of oil and gas were discovered. 60,000

Glancing ahead towards 2020, the portfolio of stand-alone candidates that 40,000 could spur UK green? eld investments is limited to a handful. The Culzean 20,000 ? eld is the ? rst runner up. Operated by

Maersk Oil, it could see a ? nal invest- 0 ’00’01’02’03’04’05’06’07’08’09’10 ’11’12’13 ’14 ’15 ’16 ’17 ’18’19’20’00’01’02’03’04’05’06’07’08’09’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 ’18 ’19’20 ment decision in August 2015 with

Norway United Kingdom Norway United Kingdom Other NW Europe startup in 2020-2021.

Source: Rystad Energy UCube

The ? eld is to be developed with bridge linked platforms including a central pro- cessing facility, a wellhead platform, and combined utility-living quarters. The total

Discovered resources (million bbl) investment for the project is expected to and exploramon wellbores (right axis) be in excess of $4.7 billion. 3500 140

Chevron has not given up on its chal- 3000 120 lenging Rosebank development west 2500 100 of Shetlands and Statoil is expected to 2000 80 decide on a concept for the Bressay heavy 1500 60 oil ? eld in 2015. The British government 1000 40

UK Continental Shelf has introduced different measures for

The UK Continental Shelf (UKCS) was tax reduction, supporting investments in 500 20 surpassed by the NCS to be the largest oil maturing offshore prospects and explora- 0 ’00 ’01 ’02’03’04’05’06 ’07 ’08’09 ’10 ’11’12’13 ’14 ’15 0 and gas market in 2006. In 2014, the UK tion, to improve the dark outlook. There

YTD

Norway United Kingdom almost closed the gap with $46 billion is still potential to maximize the recovery

Source: Rystad Energy UCube expenditure on upstream activities. from the UKCS, and hopefully, through 2015, on the other hand, will be the ? scal changes and the current cost much more dramatic for the UK than cutting schemes, there could be a signi? - for Norway. The money spent will drop cant upside.

Offshore NW Europe spending (MUSD) 10,000 by more than 20%, and we will see the

Other Northwest Europe spend contract even more in 2016, before 9000 stabilizing at around $35 billion at the Outside Norway and the UK, the market 8000 end of the decade. has been declining since 2008. From $9 7000

The reason for this immense drop is billion in 2008, 2014 clocked in at $6.5 6000 an extreme case of what we observed billion. The Netherlands and Denmark 5000 in Norway – record high oil prices and have been the key drivers of this decline. 4000 in? ation, which led to massive invest- In general, these markets are mainly ments and rejuvenation programs in old driven by brown? eld spend at exist- 3000 discoveries and ? elds. ing producing ? elds. There is limited 2000

Some 58 green? eld investments started exploration and new developments, but 1000 between 2010 and 2013, such as Clair some other basins show positive signs. 0

Ridge, Quad 204 and Mariner. So when In Ireland, there is good progression ’00’01’02’03’04’05’06’07’08’09’10 ’11’12’13 ’14 ’15 ’16 ’17 ’18’19’20 completion simultaneously occurs and around the Barryroe development, and

NetherlandsDenmarkIrelandGermanyFaroe Islands Netherlands Denmark Ireland Germany Faroe Islands Iceland investments stop, there are only a few smaller undeveloped discoveries can

Source: Rystad Energy DCube new discoveries to be developed. become commercial with new developed

The current ? eld development boom infrastructure. observed on the NCS includes a healthy

In Iceland there is still an unrealized Audun M. Martinsen analysis and supply and demand studies. mixture of old discoveries having potential at the awarded Dreki region is the product He holds a MS in marine engineering matured into economical projects and and future license rounds in the North manager and lead from the Norwegian University of Science discoveries made over the last decade.

East. Although some growth is expected analyst of oil? eld and Technology (NTNU) and University

Comparing discovered volumes at the from 2016, the offshore European market services at Rystad of Berkeley, California. He previously

NCS with the UKCS, pinpoints one will still be dominated by the markets in Energy. His ? elds of worked at Coriolis, Shell and BW of the key issues for the UKCS – that

Norway and the UK, and both will see expertise include the Offshore where he has worked as a lead exploration results have been per- a new wave of importance at end of this global offshore and engineer, product developer, system sistently poor and on decline since decade. onshore oil service market, E&P cost consultant and analyst.

oedigital.com September 2015 | OE 83 082_OE0915_Geofocus2_Rystad.indd 83 8/19/15 10:59 PM

80

80

82

82