Page 18: of Marine Technology Magazine (April 2005)

Read this page in Pdf, Flash or Html5 edition of April 2005 Marine Technology Magazine

18 MTR April 2009

By Adam Westwood

Both the wave power and tidal current stream energy sectors are emerging industries. While development activ- ities run back some 30 years, commercialization of leading technologies in both sectors is only just beginning. The sectors are characterized by high numbers of prototype technologies. Over 200 are known of and tracked by

Douglas-Westwood. Of these technologies, only a handful is now approaching full-scale commercial deployment.

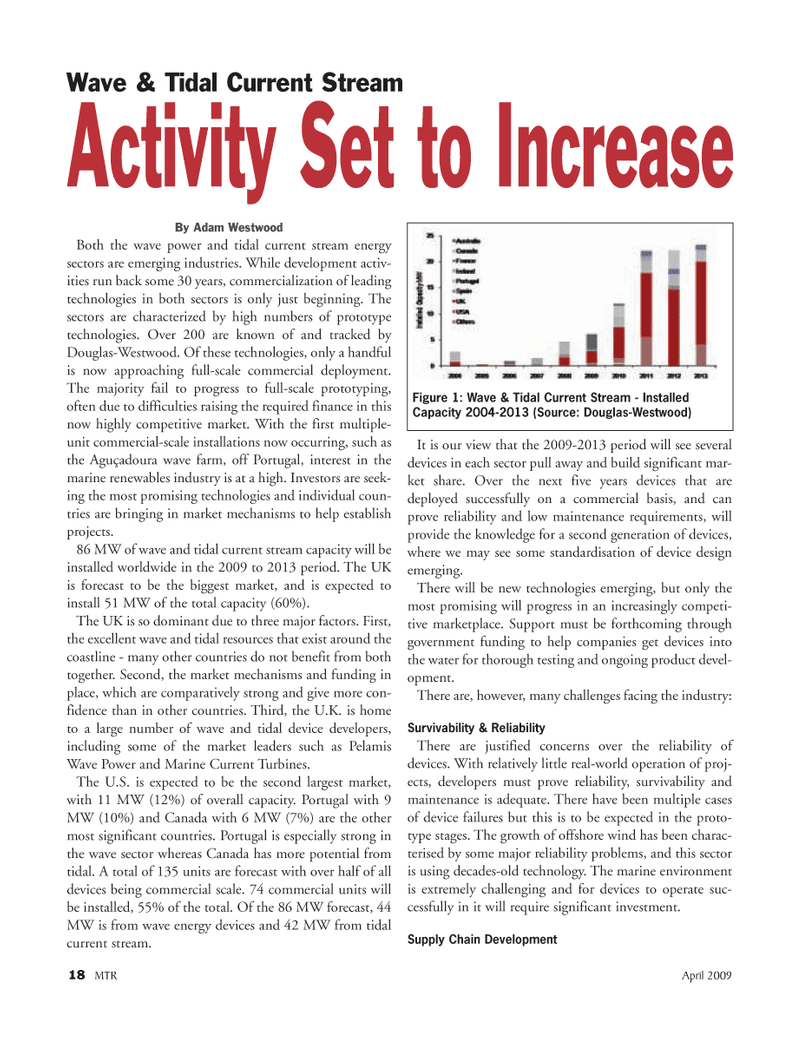

The majority fail to progress to full-scale prototyping, often due to difficulties raising the required finance in this now highly competitive market. With the first multiple- unit commercial-scale installations now occurring, such as the Aguçadoura wave farm, off Portugal, interest in the marine renewables industry is at a high. Investors are seek- ing the most promising technologies and individual coun- tries are bringing in market mechanisms to help establish projects. 86 MW of wave and tidal current stream capacity will be installed worldwide in the 2009 to 2013 period. The UK is forecast to be the biggest market, and is expected to install 51 MW of the total capacity (60%).

The UK is so dominant due to three major factors. First, the excellent wave and tidal resources that exist around the coastline - many other countries do not benefit from both together. Second, the market mechanisms and funding in place, which are comparatively strong and give more con- fidence than in other countries. Third, the U.K. is home to a large number of wave and tidal device developers, including some of the market leaders such as Pelamis

Wave Power and Marine Current Turbines.

The U.S. is expected to be the second largest market, with 11 MW (12%) of overall capacity. Portugal with 9

MW (10%) and Canada with 6 MW (7%) are the other most significant countries. Portugal is especially strong in the wave sector whereas Canada has more potential from tidal. A total of 135 units are forecast with over half of all devices being commercial scale. 74 commercial units will be installed, 55% of the total. Of the 86 MW forecast, 44

MW is from wave energy devices and 42 MW from tidal current stream.

It is our view that the 2009-2013 period will see several devices in each sector pull away and build significant mar- ket share. Over the next five years devices that are deployed successfully on a commercial basis, and can prove reliability and low maintenance requirements, will provide the knowledge for a second generation of devices, where we may see some standardisation of device design emerging.

There will be new technologies emerging, but only the most promising will progress in an increasingly competi- tive marketplace. Support must be forthcoming through government funding to help companies get devices into the water for thorough testing and ongoing product devel- opment.

There are, however, many challenges facing the industry:

Survivability & Reliability

There are justified concerns over the reliability of devices. With relatively little real-world operation of proj- ects, developers must prove reliability, survivability and maintenance is adequate. There have been multiple cases of device failures but this is to be expected in the proto- type stages. The growth of offshore wind has been charac- terised by some major reliability problems, and this sector is using decades-old technology. The marine environment is extremely challenging and for devices to operate suc- cessfully in it will require significant investment.

Supply Chain Development

Wave & Tidal Current Stream

Activity Set to Increase

Figure 1: Wave & Tidal Current Stream - Installed

Capacity 2004-2013 (Source: Douglas-Westwood)

MTR#3 (18-33).qxd 3/27/2009 1:55 PM Page 18

17

17

19

19