Page 38: of Marine Technology Magazine (July 2006)

Underwater Defense: Port & Harbor Security

Read this page in Pdf, Flash or Html5 edition of July 2006 Marine Technology Magazine

38 MTR July 2006 "The subsea market has nowhere to go but up" say

Howard Wright, Senior Analyst and Dr Roger Knight,

Data Manger of Infield Systems.

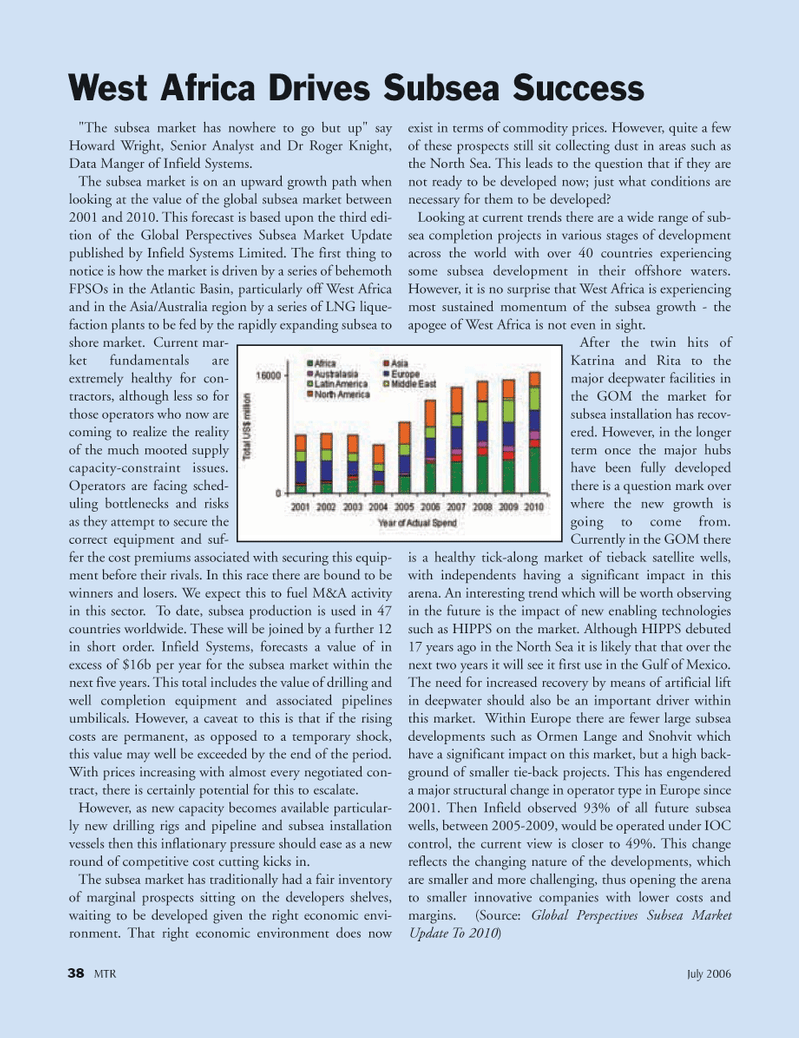

The subsea market is on an upward growth path when looking at the value of the global subsea market between 2001 and 2010. This forecast is based upon the third edi- tion of the Global Perspectives Subsea Market Update published by Infield Systems Limited. The first thing to notice is how the market is driven by a series of behemoth

FPSOs in the Atlantic Basin, particularly off West Africa and in the Asia/Australia region by a series of LNG lique- faction plants to be fed by the rapidly expanding subsea to shore market. Current mar- ket fundamentals are extremely healthy for con- tractors, although less so for those operators who now are coming to realize the reality of the much mooted supply capacity-constraint issues.

Operators are facing sched- uling bottlenecks and risks as they attempt to secure the correct equipment and suf- fer the cost premiums associated with securing this equip- ment before their rivals. In this race there are bound to be winners and losers. We expect this to fuel M&A activity in this sector. To date, subsea production is used in 47 countries worldwide. These will be joined by a further 12 in short order. Infield Systems, forecasts a value of in excess of $16b per year for the subsea market within the next five years. This total includes the value of drilling and well completion equipment and associated pipelines umbilicals. However, a caveat to this is that if the rising costs are permanent, as opposed to a temporary shock, this value may well be exceeded by the end of the period.

With prices increasing with almost every negotiated con- tract, there is certainly potential for this to escalate.

However, as new capacity becomes available particular- ly new drilling rigs and pipeline and subsea installation vessels then this inflationary pressure should ease as a new round of competitive cost cutting kicks in.

The subsea market has traditionally had a fair inventory of marginal prospects sitting on the developers shelves, waiting to be developed given the right economic envi- ronment. That right economic environment does now exist in terms of commodity prices. However, quite a few of these prospects still sit collecting dust in areas such as the North Sea. This leads to the question that if they are not ready to be developed now; just what conditions are necessary for them to be developed?

Looking at current trends there are a wide range of sub- sea completion projects in various stages of development across the world with over 40 countries experiencing some subsea development in their offshore waters.

However, it is no surprise that West Africa is experiencing most sustained momentum of the subsea growth - the apogee of West Africa is not even in sight.

After the twin hits of

Katrina and Rita to the major deepwater facilities in the GOM the market for subsea installation has recov- ered. However, in the longer term once the major hubs have been fully developed there is a question mark over where the new growth is going to come from.

Currently in the GOM there is a healthy tick-along market of tieback satellite wells, with independents having a significant impact in this arena. An interesting trend which will be worth observing in the future is the impact of new enabling technologies such as HIPPS on the market. Although HIPPS debuted 17 years ago in the North Sea it is likely that that over the next two years it will see it first use in the Gulf of Mexico.

The need for increased recovery by means of artificial lift in deepwater should also be an important driver within this market. Within Europe there are fewer large subsea developments such as Ormen Lange and Snohvit which have a significant impact on this market, but a high back- ground of smaller tie-back projects. This has engendered a major structural change in operator type in Europe since 2001. Then Infield observed 93% of all future subsea wells, between 2005-2009, would be operated under IOC control, the current view is closer to 49%. This change reflects the changing nature of the developments, which are smaller and more challenging, thus opening the arena to smaller innovative companies with lower costs and margins. (Source: Global Perspectives Subsea Market

Update To 2010)

West Africa Drives Subsea Success

MTR#6 (33-48).qxd 7/11/2006 9:10 AM Page 38

37

37

39

39