Page 40: of Marine Technology Magazine (July 2006)

Underwater Defense: Port & Harbor Security

Read this page in Pdf, Flash or Html5 edition of July 2006 Marine Technology Magazine

personnel needed to design, build, and operate drilling and production equipment will also command a growing premium".

However, it is noted that "new rigs have already begun to enter the market and are now serving to moderate day rate growth. These restraints are reinforced by limits on opportunities in offshore regions available to private oil & gas companies." "The offshore market forces directing the industry towards new cost-cutting technology and other commer- cial innovations are strengthening. In this sphere the greatest challenges faced by technology developers remain problems related to the conversion of new products into proven hardware, in particular the reticence by oil com- panies to introducing unproven equipment into a high technology project.

New low-risk ways of product introduction are needed for both technology developers and oil companies to field-prove new technology."

In the light of growing offshore expenditure another challenge that both the oil companies and their contrac- tors is facing is that of accessing human resources. "The 'skills shortage' may in time be addressed as new people enter the industry attracted by higher salaries. But the 'experience shortage' is far more challenging and there exists a growing potential for both technical and strategic mistakes to be made by inexperienced personnel acting in an environment of rapid technology advances" said

Westwood.

Low Cost Plays Disappeared

On the other hand resource-limited growth is also of increasing concern said Dr. Smith. "Besides the portfolios of a few NOCs operating in the Persian Gulf, the low marginal cost oil plays have virtually disappeared.

Opportunities for finding and developing large offshore oil fields with relatively benign sub-surface and reservoir conditions are now rare. Only the most demanding envi- ronments in ultra-deep waters and Arctic regions are expected to offer new large scale opportunities by the end of the period." "Conversely, offshore gas still has opportunities related to the advent of new gas production and conversion tech- nologies, the growth of gas markets in the developing world, and pressures by all governments to eradicate gas flaring.

LNG projects and the beginnings of a GTL industry are kick-starting the development of stranded gas fields that have been lying fallow for many years and are also encour- aging new exploration drilling in gas-prone areas." 40 MTR July 2006

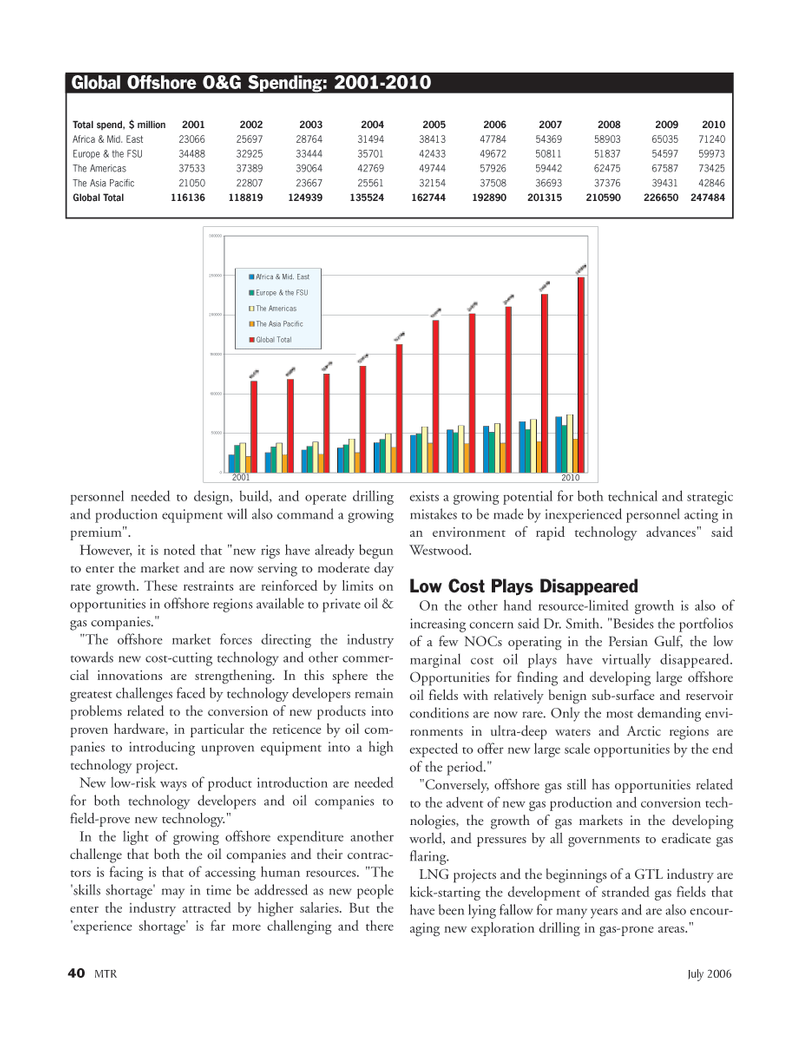

Total spend, $ million 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Africa & Mid. East 23066 25697 28764 31494 38413 47784 54369 58903 65035 71240

Europe & the FSU 34488 32925 33444 35701 42433 49672 50811 51837 54597 59973

The Americas 37533 37389 39064 42769 49744 57926 59442 62475 67587 73425

The Asia Pacific 21050 22807 23667 25561 32154 37508 36693 37376 39431 42846

Global Total 116136 118819 124939 135524 162744 192890 201315 210590 226650 247484 0 50000 100000 150000 200000 250000 300000

Africa & Mid. East

Europe & the FSU

The Americas

The Asia Pacific

Global Total

Global Offshore O&G Spending: 2001-2010 2001 2010

MTR#6 (33-48).qxd 7/11/2006 11:27 AM Page 40

39

39

41

41