Page 10: of Marine Technology Magazine (June 2011)

Hydrographic Survey

Read this page in Pdf, Flash or Html5 edition of June 2011 Marine Technology Magazine

news 10 MTR June 2011

Nautilus Minerals' plan to open a new frontier of seafloor resource production has taken a step forward, with the formation of a strategic partnership with German shipping company Harren & Partner. A joint venture company is to be formed to own and operate a production support vessel which will serve as the operational base for

Nautilus to produce high grade copper and gold ore at its first development project, Solwara 1, in the Bismarck Sea of Papua New Guinea (PNG).

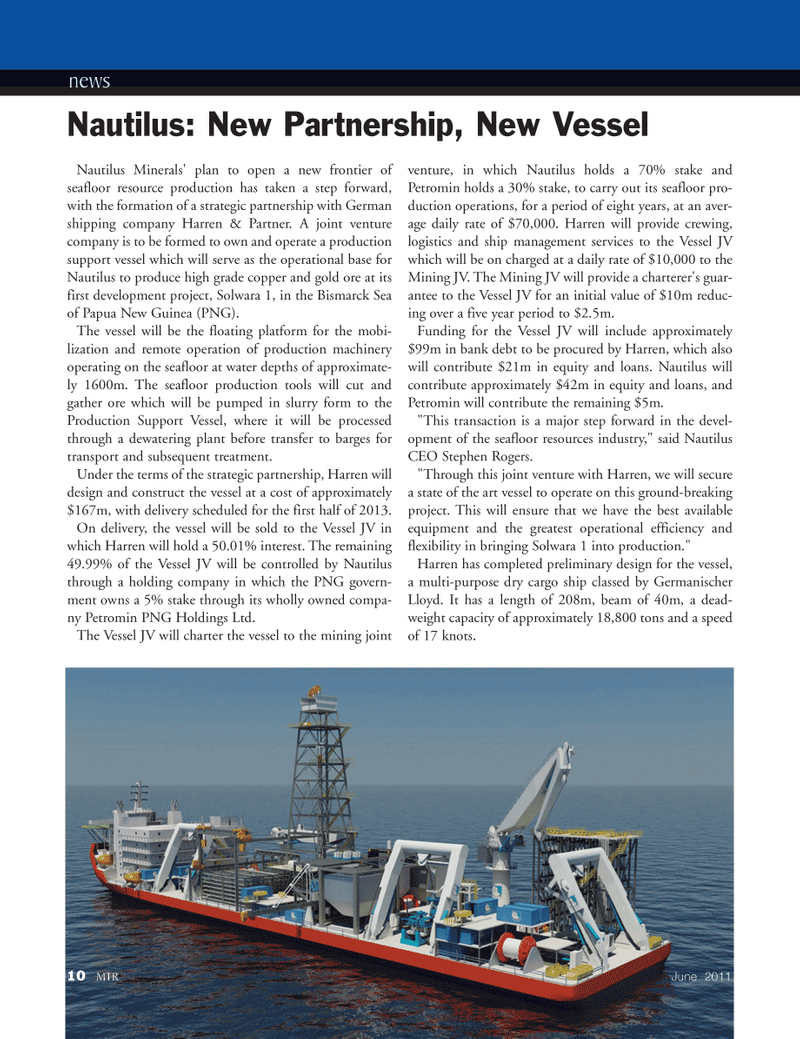

The vessel will be the floating platform for the mobi- lization and remote operation of production machinery operating on the seafloor at water depths of approximate- ly 1600m. The seafloor production tools will cut and gather ore which will be pumped in slurry form to the

Production Support Vessel, where it will be processed through a dewatering plant before transfer to barges for transport and subsequent treatment.

Under the terms of the strategic partnership, Harren will design and construct the vessel at a cost of approximately $167m, with delivery scheduled for the first half of 2013.

On delivery, the vessel will be sold to the Vessel JV in which Harren will hold a 50.01% interest. The remaining 49.99% of the Vessel JV will be controlled by Nautilus through a holding company in which the PNG govern- ment owns a 5% stake through its wholly owned compa- ny Petromin PNG Holdings Ltd.

The Vessel JV will charter the vessel to the mining joint venture, in which Nautilus holds a 70% stake and

Petromin holds a 30% stake, to carry out its seafloor pro- duction operations, for a period of eight years, at an aver- age daily rate of $70,000. Harren will provide crewing, logistics and ship management services to the Vessel JV which will be on charged at a daily rate of $10,000 to the

Mining JV. The Mining JV will provide a charterer's guar- antee to the Vessel JV for an initial value of $10m reduc- ing over a five year period to $2.5m.

Funding for the Vessel JV will include approximately $99m in bank debt to be procured by Harren, which also will contribute $21m in equity and loans. Nautilus will contribute approximately $42m in equity and loans, and

Petromin will contribute the remaining $5m. "This transaction is a major step forward in the devel- opment of the seafloor resources industry," said Nautilus

CEO Stephen Rogers. "Through this joint venture with Harren, we will secure a state of the art vessel to operate on this ground-breaking project. This will ensure that we have the best available equipment and the greatest operational efficiency and flexibility in bringing Solwara 1 into production."

Harren has completed preliminary design for the vessel, a multi-purpose dry cargo ship classed by Germanischer

Lloyd. It has a length of 208m, beam of 40m, a dead- weight capacity of approximately 18,800 tons and a speed of 17 knots.

Nautilus: New Partnership, New Vessel

9

9

11

11