Page 38: of Marine Technology Magazine (September 2011)

Ocean Observation

Read this page in Pdf, Flash or Html5 edition of September 2011 Marine Technology Magazine

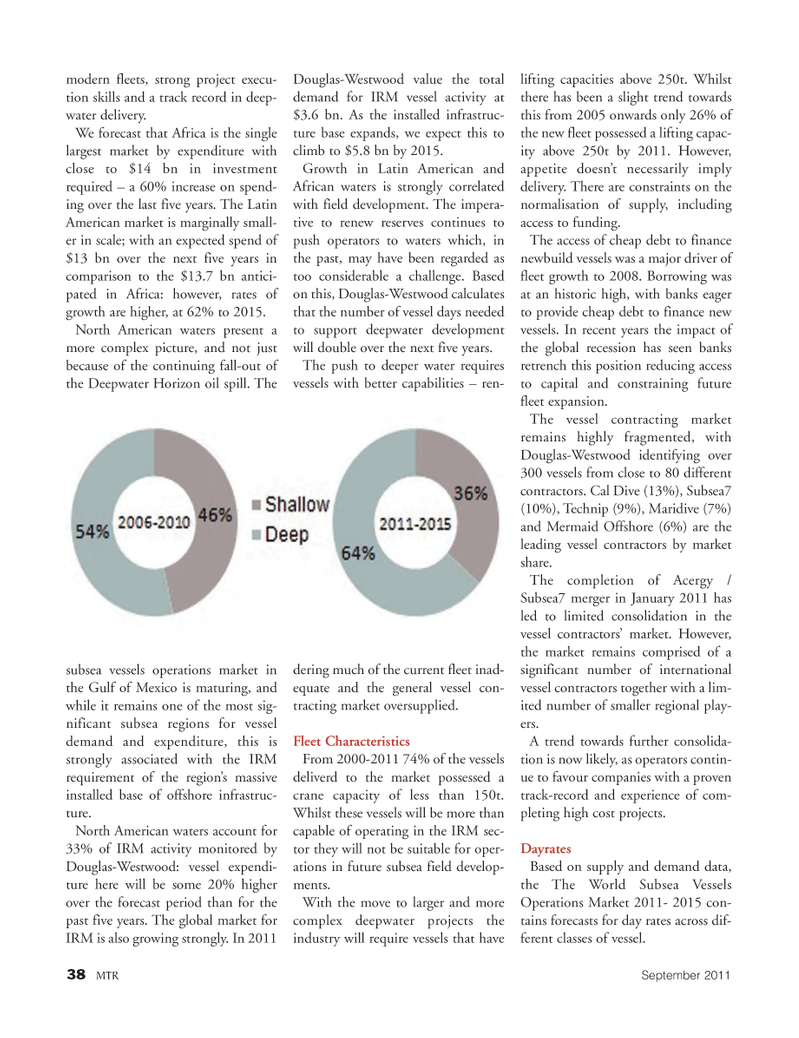

38MTRSeptember 2011modern fleets, strong project execu- tion skills and a track record in deep- water delivery. We forecast that Africa is the single largest market by expenditure with close to $14 bn in investment required ? a 60% increase on spend- ing over the last five years. The Latin American market is marginally small- er in scale; with an expected spend of$13 bn over the next five years in comparison to the $13.7 bn antici-pated in Africa: however, rates of growth are higher, at 62% to 2015. North American waters present a more complex picture, and not just because of the continuing fall-out ofthe Deepwater Horizon oil spill. The subsea vessels operations market in the Gulf of Mexico is maturing, and while it remains one of the most sig- nificant subsea regions for vessel demand and expenditure, this is strongly associated with the IRM requirement of the region?s massive installed base of offshore infrastruc- ture. North American waters account for 33% of IRM activity monitored by Douglas-Westwood: vessel expendi- ture here will be some 20% higher over the forecast period than for the past five years. The global market for IRM is also growing strongly. In 2011 Douglas-Westwood value the total demand for IRM vessel activity at $3.6 bn. As the installed infrastruc- ture base expands, we expect this to climb to $5.8 bn by 2015. Growth in Latin American and African waters is strongly correlated with field development. The impera- tive to renew reserves continues to push operators to waters which, inthe past, may have been regarded as too considerable a challenge. Based on this, Douglas-Westwood calculates that the number of vessel days needed to support deepwater development will double over the next five years. The push to deeper water requires vessels with better capabilities ? ren- dering much of the current fleet inad- equate and the general vessel con- tracting market oversupplied. Fleet Characteristics From 2000-2011 74% of the vessels deliverd to the market possessed a crane capacity of less than 150t.Whilst these vessels will be more than capable of operating in the IRM sec-tor they will not be suitable for oper-ations in future subsea field develop- ments. With the move to larger and more complex deepwater projects the industry will require vessels that have lifting capacities above 250t. Whilst there has been a slight trend towards this from 2005 onwards only 26% of the new fleet possessed a lifting capac- ity above 250t by 2011. However, appetite doesn?t necessarily imply delivery. There are constraints on the normalisation of supply, including access to funding. The access of cheap debt to financenewbuild vessels was a major driver of fleet growth to 2008. Borrowing was at an historic high, with banks eagerto provide cheap debt to finance new vessels. In recent years the impact of the global recession has seen banks retrench this position reducing access to capital and constraining future fleet expansion. The vessel contracting market remains highly fragmented, with Douglas-Westwood identifying over 300 vessels from close to 80 different contractors. Cal Dive (13%), Subsea7 (10%), Technip (9%), Maridive (7%) and Mermaid Offshore (6%) are the leading vessel contractors by market share. The completion of Acergy / Subsea7 merger in January 2011 has led to limited consolidation in thevessel contractors? market. However, the market remains comprised of a significant number of internationalvessel contractors together with a lim- ited number of smaller regional play- ers. A trend towards further consolida- tion is now likely, as operators contin- ue to favour companies with a proven track-record and experience of com- pleting high cost projects. Dayrates Based on supply and demand data, the The World Subsea Vessels Operations Market 2011- 2015 con- tains forecasts for day rates across dif- ferent classes of vessel. MTR#7 (34-48):MTR Layouts 8/29/2011 10:18 AM Page 38

37

37

39

39