Page 32: of Marine Technology Magazine (September 2013)

Ocean Observation: Gliders, Buoys & Sub-Surface monitoring Networks

Read this page in Pdf, Flash or Html5 edition of September 2013 Marine Technology Magazine

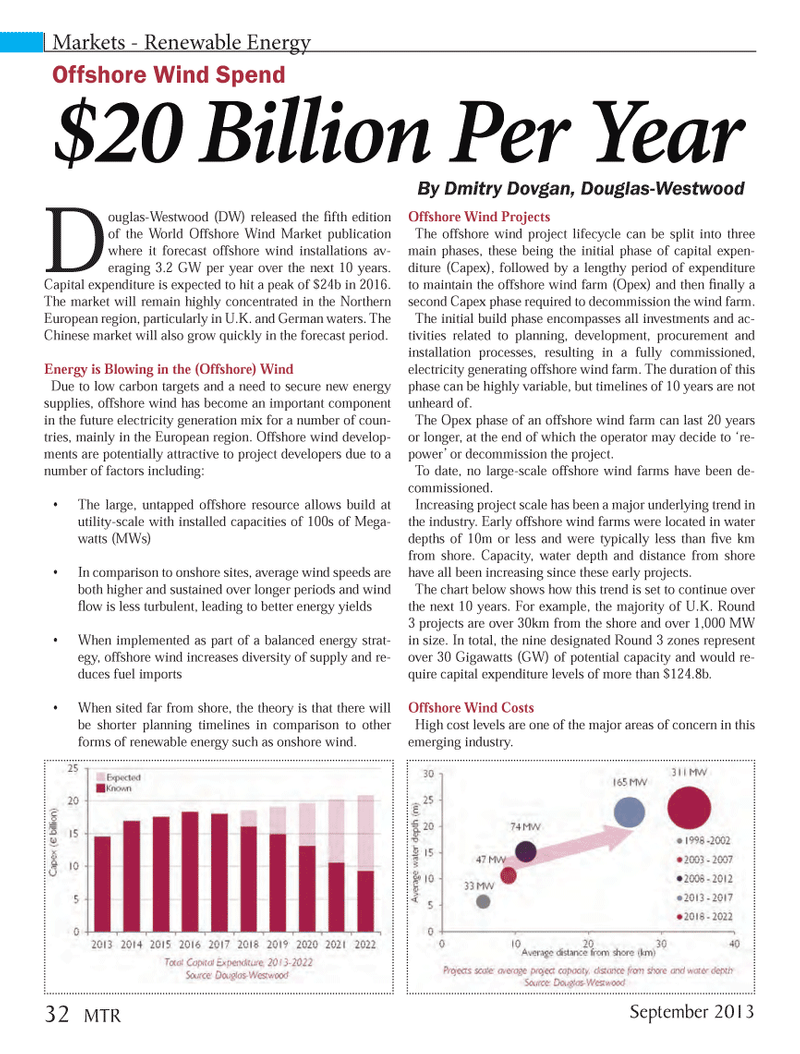

Douglas-Westwood (DW) released the Þ fth edition of the World Offshore Wind Market publication where it forecast offshore wind installations av- eraging 3.2 GW per year over the next 10 years. Capital expenditure is expected to hit a peak of $24b in 2016. The market will remain highly concentrated in the Northern European region, particularly in U.K. and German waters. The Chinese market will also grow quickly in the forecast period. Energy is Blowing in the (Offshore) Wind Due to low carbon targets and a need to secure new energy supplies, offshore wind has become an important component in the future electricity generation mix for a number of coun-tries, mainly in the European region. Offshore wind develop- ments are potentially attractive to project developers due to a number of factors including: ¥ The large, untapped offshore resource allows build at utility-scale with installed capacities of 100s of Mega- watts (MWs) ¥ In comparison to onshore sites, average wind speeds are both higher and sustained over longer periods and wind ß ow is less turbulent, leading to better energy yields ¥ When implemented as part of a balanced energy strat- egy, offshore wind increases diversity of supply and re- duces fuel imports¥ When sited far from shore, the theory is that there will be shorter planning timelines in comparison to other forms of renewable energy such as onshore wind. Offshore Wind Projects The offshore wind project lifecycle can be split into three main phases, these being the initial phase of capital expen-diture (Capex), followed by a lengthy period of expenditure to maintain the offshore wind farm (Opex) and then Þ nally a second Capex phase required to decommission the wind farm. The initial build phase encompasses all investments and ac- tivities related to planning, development, procurement and installation processes, resulting in a fully commissioned, electricity generating offshore wind farm. The duration of this phase can be highly variable, but timelines of 10 years are not unheard of.The Opex phase of an offshore wind farm can last 20 years or longer, at the end of which the operator may decide to Ôre- powerÕ or decommission the project. To date, no large-scale offshore wind farms have been de- commissioned. Increasing project scale has been a major underlying trend in the industry. Early offshore wind farms were located in water depths of 10m or less and were typically less than Þ ve km from shore. Capacity, water depth and distance from shore have all been increasing since these early projects. The chart below shows how this trend is set to continue over the next 10 years. For example, the majority of U.K. Round 3 projects are over 30km from the shore and over 1,000 MW in size. In total, the nine designated Round 3 zones represent over 30 Gigawatts (GW) of potential capacity and would re- quire capital expenditure levels of more than $124.8b. Offshore Wind Costs High cost levels are one of the major areas of concern in this emerging industry. Markets - Renewable Energy Offshore Wind Spend $20 Billion Per Year By Dmitry Dovgan, Douglas-Westwood 32 MTRSeptember 2013MTR #7 (18-33).indd 32MTR #7 (18-33).indd 328/22/2013 10:35:20 AM8/22/2013 10:35:20 AM

31

31

33

33