Page 21: of Marine Technology Magazine (October 2014)

Subsea Defense

Read this page in Pdf, Flash or Html5 edition of October 2014 Marine Technology Magazine

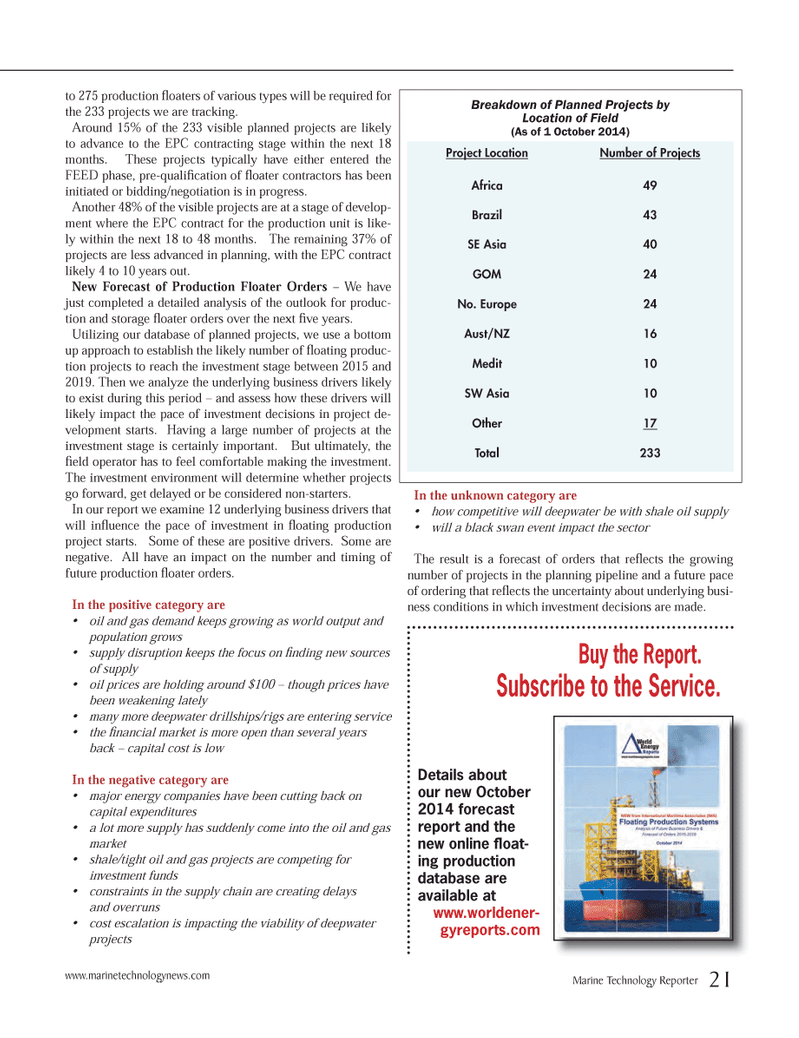

to 275 production ß oaters of various types will be required for the 233 projects we are tracking.Around 15% of the 233 visible planned projects are likely to advance to the EPC contracting stage within the next 18 months. These projects typically have either entered the FEED phase, pre-qualiÞ cation of ß oater contractors has been initiated or bidding/negotiation is in progress. Another 48% of the visible projects are at a stage of develop- ment where the EPC contract for the production unit is like- ly within the next 18 to 48 months. The remaining 37% of projects are less advanced in planning, with the EPC contract likely 4 to 10 years out. New Forecast of Production Floater Orders ? We have just completed a detailed analysis of the outlook for produc-tion and storage ß oater orders over the next Þ ve years. Utilizing our database of planned projects, we use a bottom up approach to establish the likely number of ß oating produc- tion projects to reach the investment stage between 2015 and 2019. Then we analyze the underlying business drivers likely to exist during this period Ð and assess how these drivers will likely impact the pace of investment decisions in project de- velopment starts. Having a large number of projects at the investment stage is certainly important. But ultimately, the Þ eld operator has to feel comfortable making the investment. The investment environment will determine whether projects go forward, get delayed or be considered non-starters. In our report we examine 12 underlying business drivers that will inß uence the pace of investment in ß oating production project starts. Some of these are positive drivers. Some are negative. All have an impact on the number and timing of future production ß oater orders. In the positive category are oil and gas demand keeps growing as world output and population grows supply disruption keeps the focus on nding new sources of supply oil prices are holding around $100 ? though prices have been weakening lately many more deepwater drillships/rigs are entering service the nancial market is more open than several years back ? capital cost is low In the negative category are major energy companies have been cutting back on capital expenditures a lot more supply has suddenly come into the oil and gas market shale/tight oil and gas projects are competing for investment funds constraints in the supply chain are creating delays and overruns cost escalation is impacting the viability of deepwater projects In the unknown category are how competitive will deepwater be with shale oil supply will a black swan event impact the sector The result is a forecast of orders that reß ects the growing number of projects in the planning pipeline and a future pace of ordering that reß ects the uncertainty about underlying busi- ness conditions in which investment decisions are made. Project LocationNumber of ProjectsAfrica49Brazil43SE Asia40GOM24No. Europe24Aust/NZ16Medit10SW Asia10Other17Total233 Breakdown of Planned Projects by Location of Field(As of 1 October 2014) Buy the Report. Subscribe to the Service. Details about our new October 2014 forecast report and the new online ß oat-ing production database are available at www.worldener- gyreports.com Marine Technology Reporter 21www.marinetechnologynews.com MTR #8 (18-33).indd 21MTR #8 (18-33).indd 2110/10/2014 1:48:18 PM10/10/2014 1:48:18 PM

20

20

22

22