Page 32: of Marine Technology Magazine (April 2016)

Offshore Energy Annual

Read this page in Pdf, Flash or Html5 edition of April 2016 Marine Technology Magazine

Offshore Market: Decommissioning both surface and subsea, since ? rst production in the 1960’s. deconstruction costs the bene? ts of SLV use far outweigh the

DW forecasts that over 50% of these will need to be removed negatives as this method will be less time consuming, cheaper over the forecast period, with costs being over 50% of the overall and, crucially for operators, safer.

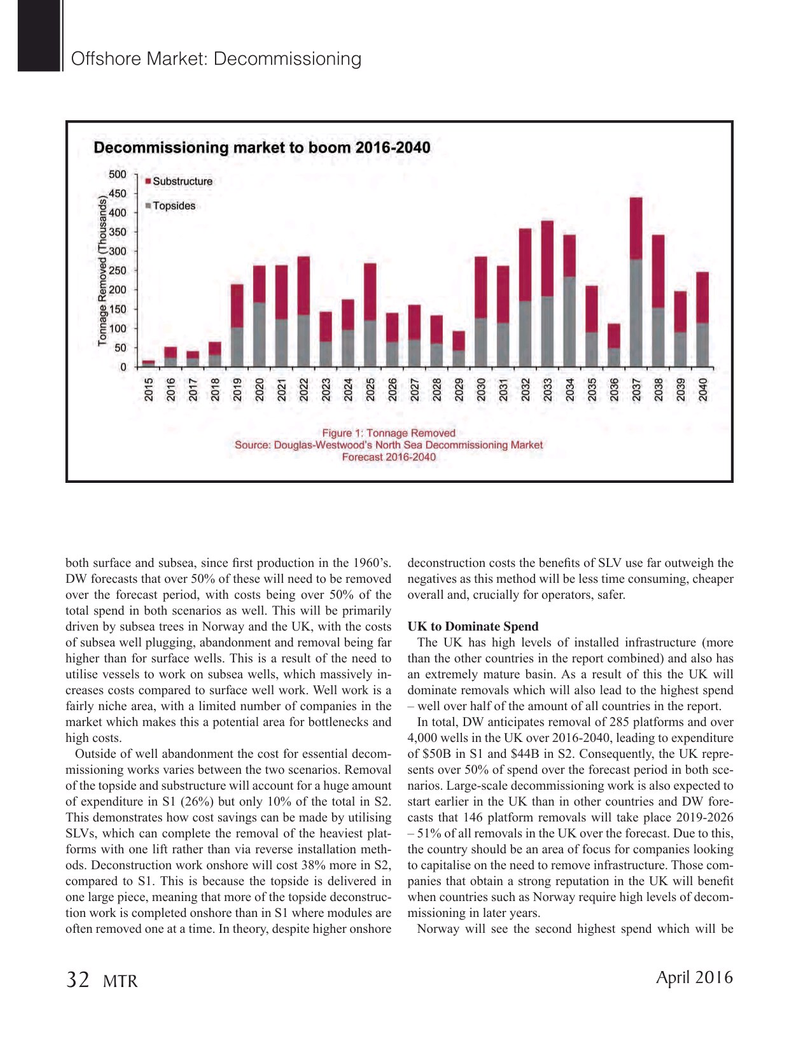

total spend in both scenarios as well. This will be primarily driven by subsea trees in Norway and the UK, with the costs UK to Dominate Spend of subsea well plugging, abandonment and removal being far The UK has high levels of installed infrastructure (more higher than for surface wells. This is a result of the need to than the other countries in the report combined) and also has utilise vessels to work on subsea wells, which massively in- an extremely mature basin. As a result of this the UK will creases costs compared to surface well work. Well work is a dominate removals which will also lead to the highest spend fairly niche area, with a limited number of companies in the – well over half of the amount of all countries in the report. market which makes this a potential area for bottlenecks and In total, DW anticipates removal of 285 platforms and over high costs. 4,000 wells in the UK over 2016-2040, leading to expenditure

Outside of well abandonment the cost for essential decom- of $50B in S1 and $44B in S2. Consequently, the UK repre- missioning works varies between the two scenarios. Removal sents over 50% of spend over the forecast period in both sce- of the topside and substructure will account for a huge amount narios. Large-scale decommissioning work is also expected to of expenditure in S1 (26%) but only 10% of the total in S2. start earlier in the UK than in other countries and DW fore-

This demonstrates how cost savings can be made by utilising casts that 146 platform removals will take place 2019-2026

SLVs, which can complete the removal of the heaviest plat- – 51% of all removals in the UK over the forecast. Due to this, forms with one lift rather than via reverse installation meth- the country should be an area of focus for companies looking ods. Deconstruction work onshore will cost 38% more in S2, to capitalise on the need to remove infrastructure. Those com- compared to S1. This is because the topside is delivered in panies that obtain a strong reputation in the UK will bene? t one large piece, meaning that more of the topside deconstruc- when countries such as Norway require high levels of decom- tion work is completed onshore than in S1 where modules are missioning in later years. often removed one at a time. In theory, despite higher onshore Norway will see the second highest spend which will be

April 2016 32 MTR

MTR #3 (18-33).indd 32 4/4/2016 10:00:57 AM

31

31

33

33