Page 10: of Marine Technology Magazine (November 2020)

Read this page in Pdf, Flash or Html5 edition of November 2020 Marine Technology Magazine

Leading O?

Energy Outlook with BP

International Energy Company, rather costs are estimated at $9/boe. bark gas prospect on the NW Shelf of than an IOC. BP would produce 8 billion barrels of Australia, the Shafag Asimam gas pros-

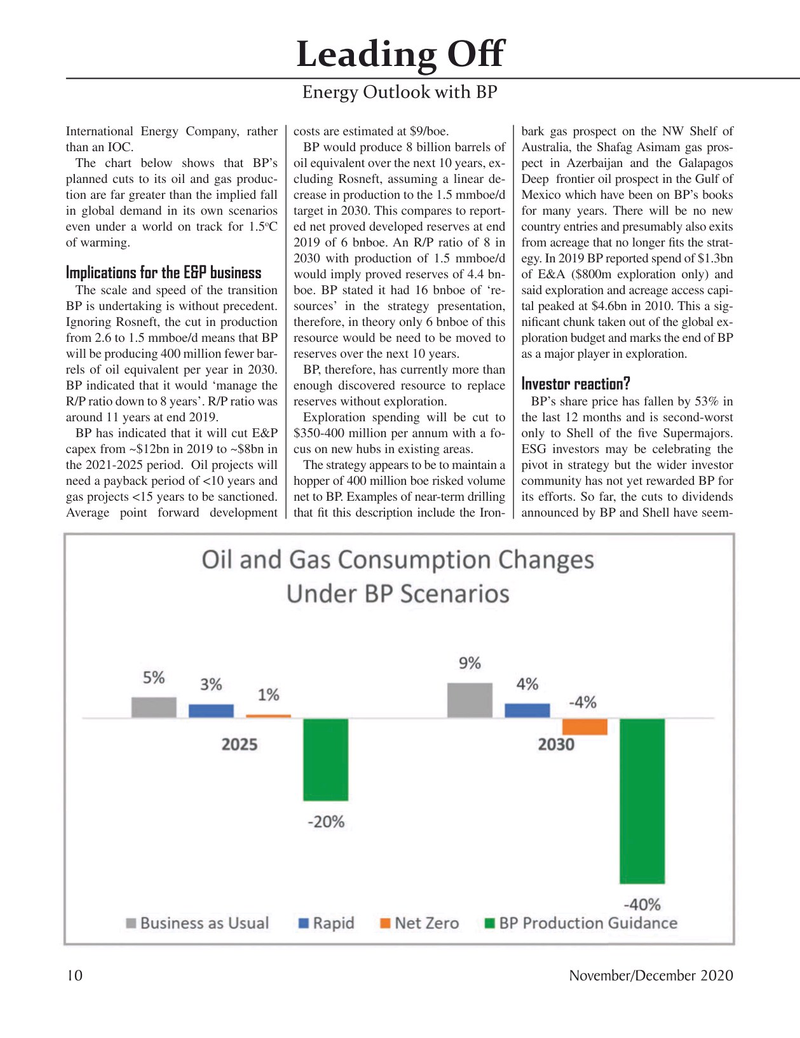

The chart below shows that BP’s oil equivalent over the next 10 years, ex- pect in Azerbaijan and the Galapagos planned cuts to its oil and gas produc- cluding Rosneft, assuming a linear de- Deep frontier oil prospect in the Gulf of tion are far greater than the implied fall crease in production to the 1.5 mmboe/d Mexico which have been on BP’s books in global demand in its own scenarios target in 2030. This compares to report- for many years. There will be no new o even under a world on track for 1.5 C ed net proved developed reserves at end country entries and presumably also exits of warming. 2019 of 6 bnboe. An R/P ratio of 8 in from acreage that no longer ? ts the strat- 2030 with production of 1.5 mmboe/d egy. In 2019 BP reported spend of $1.3bn

Implications for the E&P business would imply proved reserves of 4.4 bn- of E&A ($800m exploration only) and

The scale and speed of the transition boe. BP stated it had 16 bnboe of ‘re- said exploration and acreage access capi-

BP is undertaking is without precedent. sources’ in the strategy presentation, tal peaked at $4.6bn in 2010. This a sig-

Ignoring Rosneft, the cut in production therefore, in theory only 6 bnboe of this ni? cant chunk taken out of the global ex- from 2.6 to 1.5 mmboe/d means that BP resource would be need to be moved to ploration budget and marks the end of BP will be producing 400 million fewer bar- reserves over the next 10 years. as a major player in exploration.

rels of oil equivalent per year in 2030. BP, therefore, has currently more than

BP indicated that it would ‘manage the enough discovered resource to replace Investor reaction?

R/P ratio down to 8 years’. R/P ratio was reserves without exploration. BP’s share price has fallen by 53% in around 11 years at end 2019. Exploration spending will be cut to the last 12 months and is second-worst

BP has indicated that it will cut E&P $350-400 million per annum with a fo- only to Shell of the ? ve Supermajors. capex from ~$12bn in 2019 to ~$8bn in cus on new hubs in existing areas. ESG investors may be celebrating the the 2021-2025 period. Oil projects will The strategy appears to be to maintain a pivot in strategy but the wider investor need a payback period of <10 years and hopper of 400 million boe risked volume community has not yet rewarded BP for gas projects <15 years to be sanctioned. net to BP. Examples of near-term drilling its efforts. So far, the cuts to dividends

Average point forward development that ? t this description include the Iron- announced by BP and Shell have seem- 10 November/December 2020

MTR #9 (1-17).indd 10 11/3/2020 12:04:24 PM

9

9

11

11